- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- $10K CLI on Apple Card to $30K

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

$10K CLI on Apple Card to $30K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

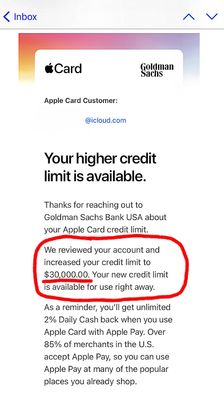

$10K CLI on Apple Card to $30K

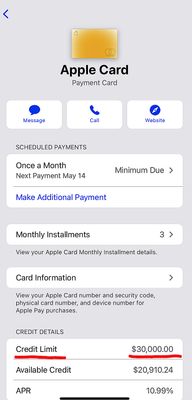

My Apple card was opened in August 2019 with SL of $20K.

I've been denied other increases but TBH had not put much spending on it until recently.

Requested my increase after heavier and regular usage.

Approved for $10K increase to $30K. ![]()

Now for the data points for anyone following Apple card CLI trends. ![]()

Some of you know I took it on myself to put together some reported community CLI data starting in the fall of 2019. In conclusion, I suggested that, for a successful increase request, it appeared best to put spending equal to at least 25% to 30% of the existing CL in the immediate months before asking for an increase. (In other words, if your limit is $4K, you would need to put at least $1K spend on the card; If your limit is $8K, you would need to put at least $2K of spend on the card; etc.) Also, it appeared that the heavier the relative spend to CL, the larger the potential increase. There were reports of members spending 100% of CL and doubling their limit. However, these were generally for cards with lower existing limits (less than $10K.) There have been fairly limited amount of reports of increases on cards like mine with SL of $20K or above, so I wanted to test it out. I've been gardening for eight months and this seemed a worthwhile diversion. ![]()

Apple was my first 2% or better uncategorized cash rewards card and the first I had used with mobile wallet. It seemed like it had some cool features that were new to credit cards and I was curious about it like many of our members. I had 16 statements starting Aug 19' until Nov 20' where I had put spending on the card every month except three, but the balances were usually under $100. The reason for the low spend was that I had refused to ever swipe the physical card since it only earned 1% rewards, and I became disenchanted with the availability of Apple Pay to get the 2% - 3% back. However, in my test, I swiped the card, used mobile wallet, and used it for online purchases including the 0% Apple installment plans, so I gave it a pretty good workout. And I was pleasantly surprised that the Apple Pay was more widely-available than I had initially thought, although I did run up my fair share of 1% transactions. There are a lot of features I learned more about and was impressed with the card itself, including the security features of no externally-visible numbers. Customer support has also been easy and excellent. The interface with my iPhone makes it very easy to manage and monitor the card as transactions post.

Between the months of December 2020 - mid April 2021, I charged (and repaid-in-full) my entire credit limit, actually 104% of it. ($20,965/$20,000.) The first two months, I paid my balance in full after statement cut but the others I paid either right before statement cut, or in the case of April I paid mid-month. (My monthly balances were approximately: $3950; $5086; $3751; $4454; $3724.) For the icing on the cake, I made a large installment plan purchase in April in addition to the above charges worth 45% of my CL ($9090/$20K.) So my grand total charges were 150% of CL over about 4.5 months, although only 104% of were repaid-in-full due to the installment plan.

I had hoped that amount of spend-and-repay might warrant a doubling of CL but they offered the $10K. If I'm not mistaken, that's also the highest CLI increment I've seen others post on My Fico. After talking to customer service reps, supervisors, and even an underwriter with no success, I think my test is additional confirmation that $10K per CLI may be an upper limit for approvals, regardless of spending and payments. This would make Goldman Sachs similar to some other lenders like Navy FCU or Capital One who have automated SP CLI processes that only allow increases up to a certain preset limit. Everyone I spoke with seemed genuinely unable to tell me more about the algorithms behind the automated system or to override the lending decision, similar to some of those other lenders. They just encouraged me to continue to use the card and reapply after 90 days. I hope this information is helpful to others in pursuit of higher limits on their Apple card accounts!

Edit to Add link to early data collection on Apple card CLIs:

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Congratulations on your CLI!! Thanks for sharing your analysis.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

They should have doubled your limit. Congrats

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Congratulations 🎉 on your CLI and TY for all the DP's and very helpful tidbits about spending. 🙏🏻

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Congratulations on your outstanding Apple Card CLI! Thank you for sharing!

I'm hoping to break five figures on the Apple Card this summer. I am planning to order an M1 iPad Pro so hopefully that will help!

Current FICO 8 | 9 (April 2024):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Nice increase, enjoy ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Congratulations on your Apple CLI !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: $10K CLI on Apple Card to $30K

Congrats on massive CLI! Definitely thanks for the data points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content