- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- 5/5 on App Spree w/ thin & young profile!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

5/5 on App Spree w/ thin & young profile!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

5/5 on App Spree w/ thin & young profile!

So I spent the last month getting my accounts lined up to get the most out of my scores and the last 6 going all in to build a relationship with Navy Federal. I'm pumped especially with my work with Navy Federal, it paid off and I'm ecstatic about it!

I'll share as many data points as I can, I hope it helps other people building their credit for the first time too! ![]()

Fico Score 8:

- Equifax - 774

- Transunion - 773

- Experian - 783

Fico Score 9:

- Equifax - 781

- Transunion - 771

- Experian - 780

HPs in last 12 months:

- Equifax - 2

- Transunion - 5

- Experian - 1

Accounts/Utilization/Age:

- NFCU Secured nRewards CC - $0/$200 - 6 mos

- CSE FCU Auto Loan - $16,412/$18,047 - 8 mos

- CSE FCU Platinum Rewards CC - $0/$15,000 - 8 mos

- NFCU Shared Pledge Loan - $239/$3,001 - 8 mos

- Capital One Platinum CC (PC'd to Quicksilver) - $10/$500 - 1 yr, 1 month

- (AU) KeyBank Key2More Rewards CC - $150/$7,500 - 6 yrs, 6 mos

DTI/AAoA/AoYA/AoOA/UTIL/Reported Income:

- DTI - 5.5%

- AAoA - 9 mos

- AoYA - 6 mos

- AoOA - 1yr, 1 month

- UTIL - 1%

- Reported Income: $70,000 a yr - $5,800 a month

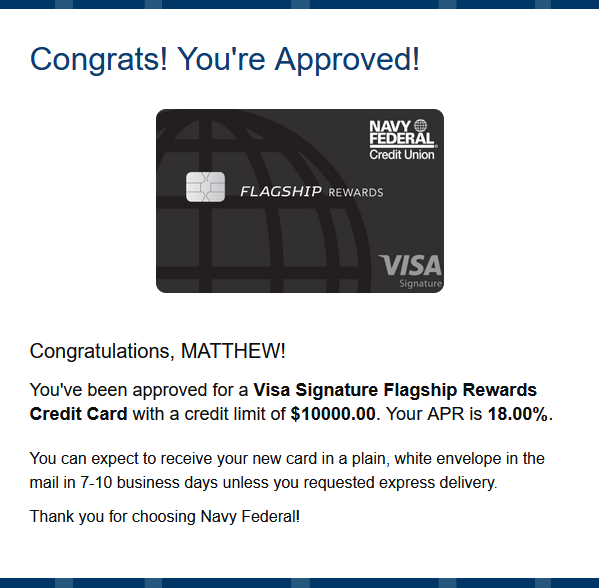

NFCU:

1.)

I went with Navy first. I think these approvals are the most important because of how much work I put into them.

I opened a checking/savings account in Febuary and have been using them very heavy for everything I do since. Both DW and I have our pays direct deposited into a joint account.

I also opened a Shared Pledge Loan and paid it down to < 8.9% in March, then opened an nRewards Secured CC for $200 in May, which is my youngest account and just turned 6 mos old.

All that is important, but I also have been putting $1,200 to $1,600 a month on spend on the nRewards Secured CC and PIF, only once reporting a balance of a few dollars and only once spending less than 1k in charges (the 1st month I had the card). That's a lot of swipes and payments.

Applied for the Visa Signature Flagship Rewards, I liked the SUB and I will PC before the AF probably.

Was approved for 10k instantly!

I was incredibly nervous, because this one I really wanted! It's nice to have a rewards card I can get some real use out of now!

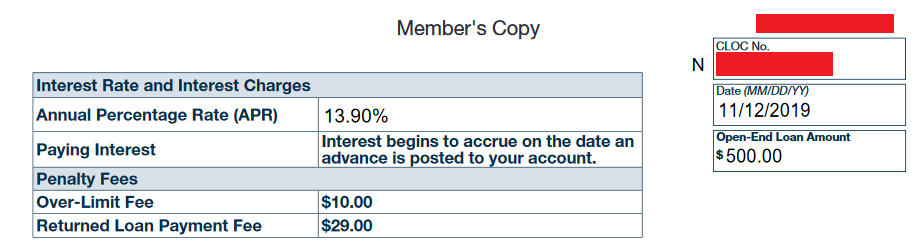

Next I went for the CLOC and I requested $15k, really not sure what would happen now because I felt like I was pushing my luck. But if anyone was going to give it to me, it'd be Navy.

Got told it'd take 1 to 3 hours before I'd get a response, got one the next day with a counter offer of $500 @ 13.9%. I took it because it's the best APR they'd give on it and I know it'll grow with more time with NFCU!

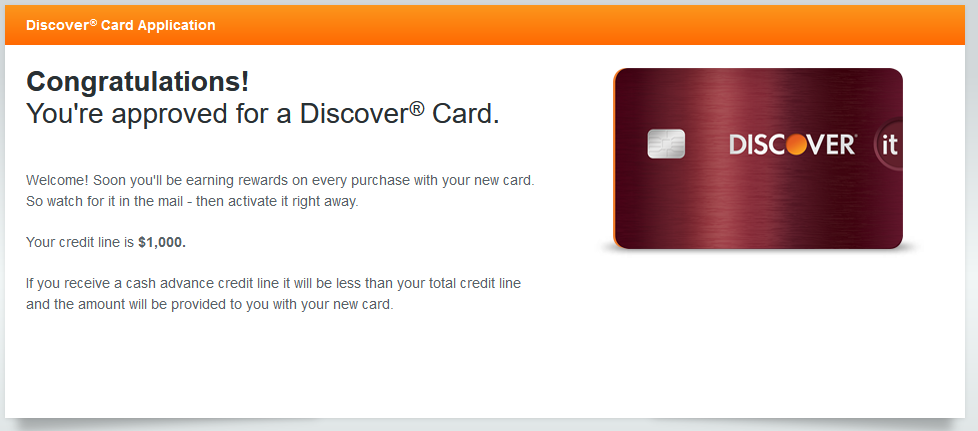

Discover:

I did Discover next and went for the Discover it Credit Card because was pre-approved via their SP pre-approval page and you get a 0% intro APR for 14 months on purchases. More importantly, it'll grow and didn't have a AF.

I really liked the intro APR for 14 months. I have a few expenses coming up due to a recent move but with having the Flagship CC, I don't see me using my Discover it Credit Card except for the few categories it beats my Flagship.

Since I don't anticipate using it, I'm going to make some of those purchases with my Discover and let the balance sit month to month while making payments a bit more than the minimum. Will absolutely PIF before 14 months is up, I just wanna not have to use the card but still look appealing enough to get CLIs.

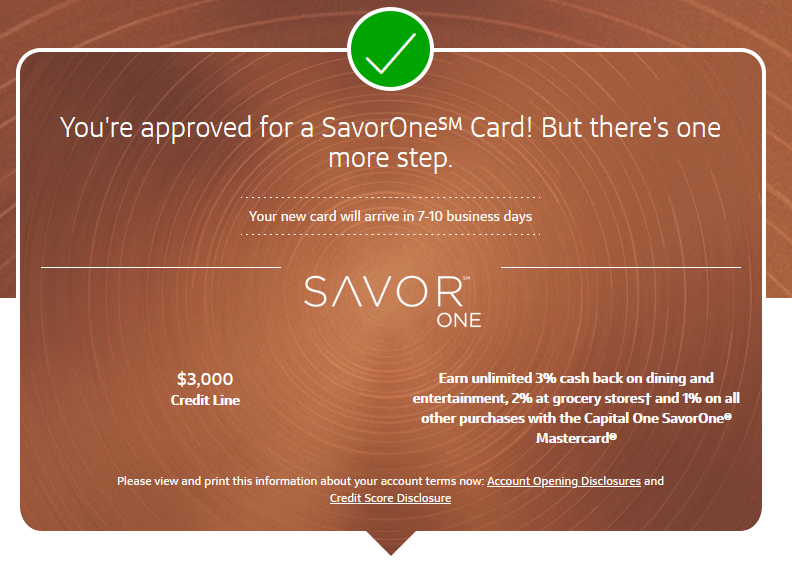

Capital One:

1.)

I went through Capital One's pre-qualify page to see what was available and they offered their SavorOne CC with the exact same thing Discover did in regards 0% intro APR for 14 months on purchases!

You can earn a one-time $150 cash bonus once you spend $500 on purchases within the first 3 months, so will put a balance on it and get that SUB and also do the very exact same thing with this one too, pay a little more than minimum payments month to month to manufacture what seems like use to work on CLIs until just before the intro APR expires, then PIF.

2.)

Lastly I requested a CLI on my bucketed Capital One Quicksilver, got a $100 to bring it up to $600 CLI.

Ending the Saturday 5/5 if you want to count the CLI ;-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

My take away from all this is Navy likes me. I have a very young profile and just one single account of my own barely over a yr old but they still extended me a nice SL on their Flagship.

I got the 10k Flagship at their highest APR, 18%. Then I got the CLOC at their lowest SL but their best APR rate on it at 13.9%. Very yin & yang.

The way I interpret that is they're still apprehensive with me, but they're significantly closer to comfortable than uncomfortable which makes me feel good!

The Discover and Capital One cards are both good cards for someone with my credit profile. They're low limits and high APRs, but they're cards that grow with use and they're good rewards cards at that for me. I get the same feeling with them two that I do with Navy.

They like the idea of my profile but want to see some time and use with their cards before extending me higher CLs.

I have $650 in SUBs to work on now and I'll look forward to the SP CLIs from Discover and Capital One in time!

While working hard at showing Navy love for those hefty HP CLIs down the road ![]()

It's been a d' good day credit building wise for me, can you tell I'm pumped??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

CARDS: Discover It | Kohl’s | Truist Spectrum Cash Rewards | Truist Bright | CITI Custom Cash | Chase Freedom Flex | Chase Amazon Prime Visa | VACU Cash Rewards Mastercard | Sam’s Club Mastercard | PenFed Gold Visa | NFCU CashRewards | NFCU More Rewards | NFCU Platinum Visa | AMEX BCE | Verizon Visa | Wells Fargo Active Cash | Amazon Prime | NFCU Auto Loan

Starting Scores 05/2019: EQ:519, EX:525, TU:574

CLOSED : Capital One Quicksilver One | OpenSky |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

Congratulations on your credit build!!! Nice work !!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

That's a nice bunch of approvals, congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

I'd also like to add that what you posted doesnt seem to be that unusual for NFCU. From what I've read about NFCU, they seem to be very generous to all of their members regardless of how thin their profiles are.

I am very happy for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 5/5 on App Spree w/ thin & young profile!

Congrats on yer approvals!!