- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- A little Cap1 QS1 CLI love

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

A little Cap1 QS1 CLI love

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

@Anonymous wrote:Thanks everyone

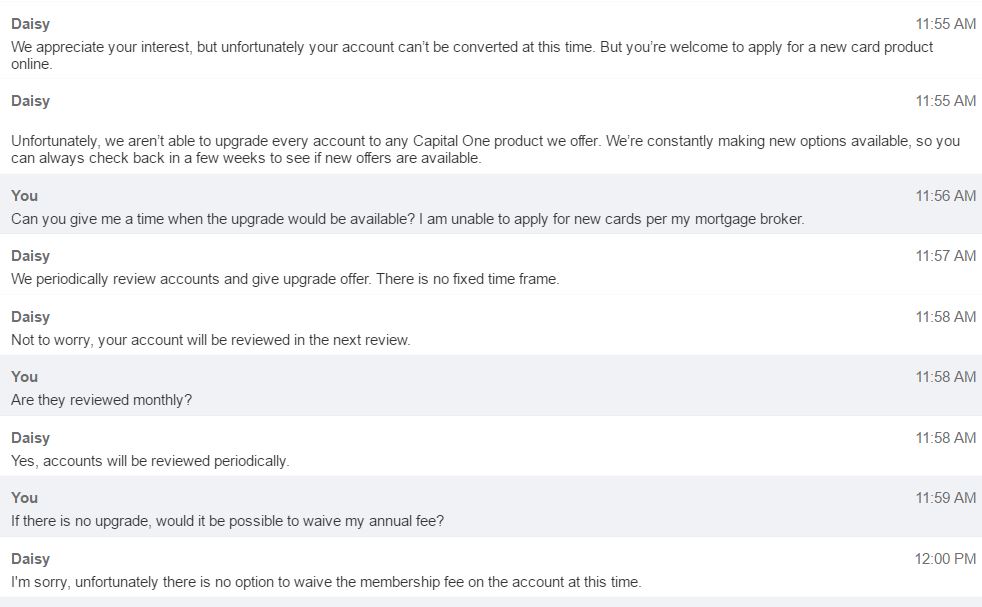

So.....I hopped on chat and the upgrade was a big NO. It's frustrating because I run a lot of money through this card. Current UTI is about 10%. I will try again at the end of November....

Sorry to hear this. That sucks! I've only been approved for like two months and was hoping that I can PC in the next few months. As for waiving the annual fee, I have seen posts where others have contacted the EO or facebook to have them help with that. They may also be able to help with the PC. I'm not sure if these are still viable options, but it is worth a shot.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

@Anonymous wrote:Thanks everyone

So.....I hopped on chat and the upgrade was a big NO. It's frustrating because I run a lot of money through this card. Current UTI is about 10%. I will try again at the end of November....

First of all... huge congrats on the CLI! ![]()

I know you're annoyed about the lack of a PC offer, but I have some data points for you on that... I had been trying to get my QS1 upgraded for nearly three years... each time I was told "there's no offer on the account at this time; please try again later on..." ![]()

Since my card had a $79 (!) annual fee I was quite discouraged by this, and I eventually even opened a QS Visa Signature, with the intention of closing the old QS1. That's the thing, though... it was (is) old - it will be 10 years on the next anniversary - and it's also my oldest bankcard. Long story short, the last couple of years I was able to get them to waive half the fee, however both times I had to let the fee hit the account before they would help me out with it. In my case even with them waiving half, I was still paying 50¢ more than a brand-new QS1 cardholder which really got on my last nerve (half came to $39.50; the current AF for a new QS1 is only $39). ![]()

I tried to get a PC right after the holidays only to be shot down, and the chat rep told me that they review the accounts every three weeks and he encouraged me to keep trying, and to try often. (Note that I'm not sure about the every three week part, but I was encouraged that he indicated that it wasn't a problem on their end if I tried often).

Out of boredom I tried in the middle of Feb, and while I was really just going through the motions I was astonished to see on the screen that I had an "offer" to PC either to a QS or a no-AF Venture (which I'm sure was really a Venture One, but since I wanted the QS anyway there was no reason to bust their chops on mixing up the Venture cards). So in my case it took a few years, but I eventually got my PC. ![]()

Don't give up on your own PC... and if you have an AF to hit before you get the upgrade give them a call and see about having it waived (in my case I always asked for a waiver, and they countered with half... I never asked for half first). Also, note that they won't be able to do anything about the AF until it actually posts to your account (been there, done that... you can't be proactive, unfortunately.) That will at least make it more reasonable until you get the PC you're looking for! ![]()

Hang in there, and again congrats on the CLI! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

Wow 3 years, Uncle B, you have patience!

I have the same issue, it is my oldest open card. I will keep trying, but, I don't understand their logic when some people get an upgrade after only a few statements!

And thanks for the congrats on the CLI everyone ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

OP did you use the card heavily if you dont mind sharing.

because i too started at 500 and got 1000 CLI at 3 month mark and tiny 500 after i completed step putting me to 2000.

i was actually pissed when they gave me 500 after i completed step because ive been putting 2~3k a month and 4k right before my steps were completed

im hoping they will give me decent CLI when my 12th statement cuts which is like 27 days away and put my credit limit to at least 5k.

so i can apply for chase sapphire preffered

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

First off, CONGRATS on your CLI!

Just ask for a PC every now and then. Eventually they may offer it, but it seems like data points show that PCing a Plat to a QS is easier than PCing a QS1 to a QS (maybe because of the annual fee they're raking in on those of us that carry one? hehe who knows).

I ask for a PC on mine about once a month or so. My anniversary is in December and I don't really mind the annual fee (I mean hey, I'm rebuilding, it's par for the course and it isn't something terrible with a leech company so NBD), but I still hope for the PC one day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: A little Cap1 QS1 CLI love

@Anonymous wrote:Wow 3 years, Uncle B, you have patience!

I have the same issue, it is my oldest open card. I will keep trying, but, I don't understand their logic when some people get an upgrade after only a few statements!

And thanks for the congrats on the CLI everyone

Yep, it had been a Capital One account for three years but it's actually been opened since 2007 (and reports as such). Back when I was getting turned down for the PC several people speculated that the reason I was having such difficulties was because the card started off as HSBC/Orchard, but I still continued to check every few months. This is one time I can say my stubbornness paid off. ![]()

Ironically, had they started combining accounts just a little earlier I probably would have combined it with my QS Visa just to be done with it (which would have been "OK", but I much prefer having an almost 10 year-old tradeline still reporting as open).

Again, hang in there and just keep checking in with them... it will happen! ![]()