- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Amazon Synchrony $2100 to $4000 CLI

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amazon Synchrony $2100 to $4000 CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

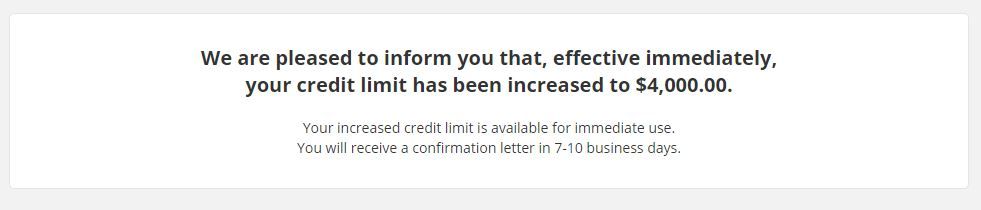

Amazon Synchrony $2100 to $4000 CLI

I've had this account for a year and some weeks now. Started with $2100 limit. Always on time payments. Average $400 per month in spending. Carry $0-300 balances. Rebuilding my credit with average age of accounts 2.5 years. No new cards in last year. No more than 1 new card in last 2 years. No recent hard pulls.

Went online to pay bill and noticed the request more option, people online said soft pull, so I debated how much to ask for. Would they give counter if I request too much? Saw suggestion of $250 for every $1000. So that is like $550 to $600 more or $2700. Felt good about my score increases and payment history, so got aggressive and thought about $3000. Then thought about having $3k limit already so go higher, just went straight for $4k. Approved in about 2 seconds. I was a bit suprised. Can't wait to see the new total limit reports! Should be about $9300 total now.

I have a 6 years ago charge off that I just paid off, but it's not yet been reported. Creditor sending me a letter showing I paid. Then in two weeks original creditor will report the credit. I'm thinking to update report as soon as I get the letter saying I paid. Why wait?

Credit Karma 717/697

FICO 651

Highest unsecured Limit $1000 (now $4000)

Highest secured $3000

4 credit cards

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Congratulations on your increase. Looks like Sync has a little more wiggle room now to give credit line increases to some customers after closing other customers accounts!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Oh, balance was $418 when I applied. I was not sure if I should pay to zero first. Now we know the answer...

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Congratulations on your Amazon CLI!

Current FICO 8 | 9 (April 2024):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Congrats on the CLI. Happy New Year 🎊

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Grats on your Amazon card increase!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

Congrats on your Sync Amazon CLI ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

@visualfxpro wrote:Just thought I'd share conversation with live agent at Amazon about credit limit increases. Based on this, I'm going to try to get the maximum limit. I mean, she said "any time" right? lolQuestion about credit limit increases>May I know your question?What significance is the amount I ask for? Could I ask for too much and get denied BECAUSE I asked for too much? Would you ever giver counter offer if I asked for $20k, would you counter with the maxI qualify for?>You can ask for any amount. If you are not eligible for the amount that you asked we will review it for a lower account.>I'm sorry however if you were denied that means that you did not qualify for any amount>We apologize our decision could not be more favorableHow often can you ask for increases?>Thank you for your patience. Thank you for allowing me to assist you today. Were there any other concerns I may help you with today?>There is no time limit required since your credit score may change at ay time.>You can request a credit limit increase at any time.

So I went all in. Asked for $10k. Denied. No COUNTER! So this is interesting. Does this mean I coincidently requested the max they will give me yesturday? Because they should counter with a lower amount unless they are unable to increase at all. Unless there is a penalty for asking for too much or too close to another request. So I just did 4 requests and all denied, no counter:

$10k

$9k

$8k

$4500 (so not even $500 more)

Request a Credit Limit Increase

Account ending in XXXX

Your request for an increase has been denied.

You will receive a letter in 7-10 business days explaining the reason for the decision. If you

find we based the decision on incorrect information, please contact the credit bureau

indicated on the letter and call us when the information has been corrected.

NFCU Flagship Rewards $25,000 | Capitol One $750 | TD Bank $1000 | Bank of America $3000 | Wells Fargo $500 | Amazon $4000

Charge Off from 2015: Municipal Credit Union $5300 ($6500 limit)[PAID IN FULL]

Credit Age: 4 years | Inquiries (6/12/24 month): 12 mo | Debt to Income ratio: 10%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony $2100 to $4000 CLI

@pauldc73 wrote:Congratulations on your increase. Looks like Sync has a little more wiggle room now to give credit line increases to some customers after closing other customers accounts!

For now, yes.

But with the Fed trimming it's easing in the months to follow (and then raising rates), I would strike now before their mood changes.

Current scores (EQ, EX, TU): 787, 788, 796