- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Approved: Chase Ritz Carlton Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Approved: Chase Ritz Carlton Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Approved: Chase Ritz Carlton Card

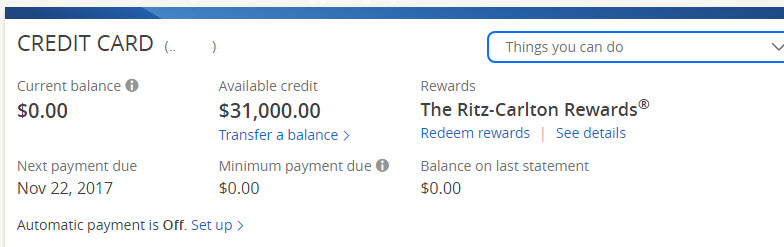

@BronzeTrader wrote:Applied over the weekend. Found the card in my account this morning. No call from Chase. Starting credit line is $31,000. No request to move credit from other card. It is still lower than my $50,000 line with CSR.

Have more spending to do, holiday shopping is coming.

Now thats how you tame the beast! Congrats on the monster approval Bronze!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Approved: Chase Ritz Carlton Card

@BronzeTrader wrote:

@K-in-Boston wrote:Congrats! That is indeed a beautiful SL. I can't really justify the card to myself right now having others that overlap, but depending on how the SPG/Marriott thing goes, it may be something I consider for a daily driver in 2019.

Understand. I'm still light with some of your cards. I'm not sure if I'll get the AmEx Plat card, at least not a keeper. This is still my 3rd card of the year. The $300 travel credit and the $100/trip airline are expected to back up this card....

As you said, the Ritz-Carlton's perks easily pays for itself, even if you ignore the signup bonus. I am an Amex loyalist, so that leans me toward the Platinum card, but honestly unless you need the very specific perks of Platinum, there's no reason to get it (unless for a signup bonus as you alluded to) when you have a Ritz-Carlton or other premium travel card. Since it's not subject to 5/24, I'm still mulling over it anyway, but moving $75k of spend (which would essentially be every purchase every day for me) to get Marriott Platinum status doesn't make sense for me since the card earns fewer Marriott points than the SPG/Platinum combination does at the moment. Sorry, don't mean to derail this into R-C vs Amex combo... again, fantastic card with a fantastic starting line. Enjoy it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Approved: Chase Ritz Carlton Card

Congrats on the approval BronzeTrader!

I've already come up with a list of ways to use the card in the upcoming year, chief among them securing cheap domestic flights to visit my friends in other cities. The travel credit is useful and the priority pass access is going to help me get through a 15-hour layover in Korea this December. I'll probably save the free nights for a time when I can really make good use of them, but I will be staying at the Ritz Boston for a few nights in January so I'll be able to use my club upgrade and gold status at that time.

Just adding it all up you've got...

2 free night stays (anywhere from $700 to nearly $2000 in total value)

$100 x as many times as you fly domestically with a friend or partner

$399 yearly value for Priority Pass membership

$300 travel credit (if you use it)

$100 Global Entry credit

$100 incidental credit on paid multi-night stays (this is specific to those who want stay at the Ritz and pay the regular member rate for their stays)

Plus the intangible benefits like:

Free AUs. 10,000 bonus points for adding one in the first three months

Easy Gold status for as long as you keep spending $10k a year on the card (some of these benefits are seriously good, such as a complimentary upgrade and guaranteed late check out)

3 Club-level upgrades yearly

Plus the standard point redemption per dollars spent (probably the worst thing about the card)

Some things are specific to Ritz guests, many are not. I may find myself keeping the card perpetually. Something I wonder, however, is how easy it is to get CLIs with this card versus other Chase products.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Approved: Chase Ritz Carlton Card

@K-in-Boston wrote:

As you said, the Ritz-Carlton's perks easily pays for itself, even if you ignore the signup bonus. I am an Amex loyalist, so that leans me toward the Platinum card, but honestly unless you need the very specific perks of Platinum, there's no reason to get it (unless for a signup bonus as you alluded to) when you have a Ritz-Carlton or other premium travel card. Since it's not subject to 5/24, I'm still mulling over it anyway, but moving $75k of spend (which would essentially be every purchase every day for me) to get Marriott Platinum status doesn't make sense for me since the card earns fewer Marriott points than the SPG/Platinum combination does at the moment. Sorry, don't mean to derail this into R-C vs Amex combo... again, fantastic card with a fantastic starting line. Enjoy it!

Agreed. With both CSR and Ritz cards, the AmEx Plat would be just overlapping. I may apply for it if I see 100k or 75k bonus, but I won't keep all 3 cards. Very likely AmEx Plat will be out. For me, it is just hard to use all the perks. The $200 Uber is nice, but it is actually like $15/month, not yearly and this makes it close to useless. Then other things....

I'm going to slow down, only apply for 1-2 new card per year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Approved: Chase Ritz Carlton Card

@K-in-Boston wrote:Since it's not subject to 5/24, I'm still mulling over it anyway, but moving $75k of spend (which would essentially be every purchase every day for me) to get Marriott Platinum status doesn't make sense for me since the card earns fewer Marriott points than the SPG/Platinum combination does at the moment. Sorry, don't mean to derail this into R-C vs Amex combo... again, fantastic card with a fantastic starting line. Enjoy it!

This really only works if you value M/SPG/RC Platinum over the opportunity cost OR you have enough other spend that the opportunity cost is minimal in the grand scheme. I fall in the camp of valuing the SPG Platinum status very highly, and consider the opportunity cost covered.

I'm still keeping my AMEX Platinum for other highly valued benefits, though!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content