- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: BACK w/ AMEX! BCE 5 yrs post BK7

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BACK w/ AMEX! BCE 5 yrs post BK7

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BACK w/ AMEX! BCE 5 yrs post BK7

Ok, I should be happy, right? I mean I am, but I also have this sense of "let down" or something, LOL. Maybe because its been the anticipation for the last 5 yrs, and finally getting approved, because I was super excited throwing out apps to them like every 6 months before yesterday, and then Im like...."sighs", LOL..

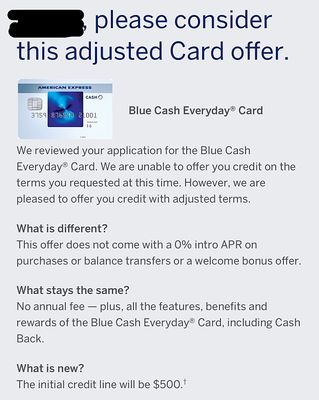

Anyway....here's the details, and Its not a great approval by any means, but its an approval at this point, and that all that matters.....for now, as I will always push the envelope. I did NOT want to apply for the Delta Gold, because its the "easist", I dont even fly Delta, I wanted a card I would use, so I applied for what I wanted.

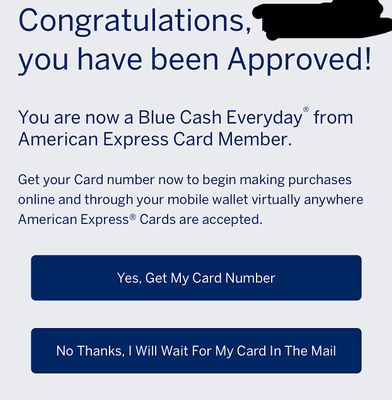

The goal was just to get back in, and thats been accomplished now. The approval to me was a very borderline approval since I was countered offered the card, but with no introductory offerings as you can see, and a $500 sl, so, ok big deal. Have no idea if this card is in their "credit steps" program or not, or if Ill be able to get the CL up in 61 days...we shall see, LOL.

- Had no pre-quals online, cold apped.

- BK file date 5/15/13

- Pulled EX - 662 (14-20 pts lower that the other two)

- Inq - 100+ (yes, you read that right, lol..dont ask)

- Last new acct was literally 4 days shy of 6 months, but have lots of new accts, like I always do.

- $300k+ in overall CL( Im shedding a lot of credit over the next year, as I start to wind down in my last 5 yrs of BK)

- Overall util reporting was 1%

- They were NOT IIB, but were defaulted on in 2008, but PIF. Was a member since 2003 (too bad they dont BD now)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

Congrats Pizza! Finally back in with Amex now you just need USAA and Citi ![]() ..

..

Agree borederline approval due to terms and no bonus, etc.. None the less the door has been opened again though and better things will come with time and shedding some of those inquiries ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

Now go and get some $500 worth of Pizzas!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

Look at it like this, this will start reestablishing a history which in turn will open other products for you in future. I also would believe because you didnt get a bonus, you would still be eligble for one on this very card in future so that's great

I'll take a 5 yr post bk entrance than my 10 year hiatus snyday

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

@AverageJoesCredit wrote:

Awesome job Pizza

Look at it like this, this will start reestablishing a history which in turn will open other products for you in future. I also would believe because you didnt get a bonus, you would still be eligble for one on this very card in future so that's great

I'll take a 5 yr post bk entrance than my 10 year hiatus snyday

Thats was my thoughts exactly AJ! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

I too just got “in” for the first time and came to share too — I had major private student loans issues so AmEx has never touched me. Well I was able to negotiate a pay for delete in those after saving for a number of years.

Because of the student loan issues, I had been stuck with a Cap One Quicksilver that had went to a grand over the course of 10 years from 300 (it was an old HSBC Card), I had a Continental Finance Card that was at a grand also for 10 years, a grand Target card and a 600 WalMart and 800 Amazon Card Plus a Fingerhut I had started in 2014 with their “Fresh Step” program at 200 and had worked its way up over 2 grand... I just couldn’t get much movement so I piled on applications until I was over 42 inquiries — mainly because CreditKarma would tell me I was a good match for something and I’d get declined anyway. 16 months ago I got a secured Discover card with $2500 because I needed to get a credit card with some sort of spending power for travel and was surprised Discover would even give me a secured card... so I went with them. I got an Avant Card with a grand limit last year.

In addition, about 18 months ago, my partner, who has awesome high 700s credit, added me as an authorized user to his AmEx SPG, Citi Simplicity and Disney Chase to give me about 40k in “authorized user available credit” which did help some — it got my scores back up into the low 600s — but I really had to get the student loans paid off which I finally was able to do.

Well over the last 6 months of paying and erasing the student loans (January of this year), my FICO went from the 600 range to the mid 600s. It’s been bouncing between 640 and 680 and seems very sensitive to balances. I held off applying for things because I wanted some of those inquiries to fall off, but I did ask for some CLIs. Last month Discover unsecured my card which was awesome... I asked for a CLI on the Walmart and Amazon in Feb after the student loan collections came off — Synchrony gave me 6 and 5 *grand* respectively, and then TD jumped my Target up to 2600 from the 1k it had sat at forever. Fingerhut bumped me to 3150. Credit Karma started saying I could get an AmEx Card, but the prequalificatin site was down and I’ve learned not to trust them. Just the other day Discover shot me up to 5 grand!

Well — this morning I got an email from AmEx that I was invited to apply for a card. I went to the pre-qualification site and for the first time in my life it actually had options! BCE, Everyday and the Gold Preferred charge card.

I opted for the BCE and **bleep** near cried that they offered me a $500 limit with all the bonuses — and a relatively reasonable interest of 18% when the application said between 15 and 26% — I’d figured if it was anything it would be on the high end of that.

As stupid as it sounds, this felt amazingly good... Even better than Discover unsecuring my card and doubling my limit. Even though it’s only $500 — and AmEx shot me their email of what they want to see over the next 5 months so they will increase it — it feels like a recognition of sorts that the hard work I’ve been putting into my credit it actually starting to pay off! At least in my mind AmEx and and Chase have always seemed like the most skittish ones. I thought it was funny that they offered me the $150 bonus for 1k in spending with that limit — I definitely will get it, but I’ll do it in $200 chunks and immediately send them a payment each time

As of today they did a hard pull on Experian which was sitting at 671 with 26 outstanding inquiries.

So that’s where I’m at and am feeling good... I’m going to manage what I have for a while and let the inquries fall off. The ultimate goal I’m working toward is to get a Chase Sapphire Reserve. I know Chase has a 5 inquiry limit though so I can’t keep adding to the tons I already have and just need to kick back for a while

N

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

@NGeorge wrote:

Congrats! As the others have mentioned, this will help you build credit with them so you’re “back in”!

I too just got “in” for the first time and came to share too — I had major private student loans issues so AmEx has never touched me. Well I was able to negotiate a pay for delete in those after saving for a number of years.

Because of the student loan issues, I had been stuck with a Cap One Quicksilver that had went to a grand over the course of 10 years from 300 (it was an old HSBC Card), I had a Continental Finance Card that was at a grand also for 10 years, a grand Target card and a 600 WalMart and 800 Amazon Card Plus a Fingerhut I had started in 2014 with their “Fresh Step” program at 200 and had worked its way up over 2 grand... I just couldn’t get much movement so I piled on applications until I was over 42 inquiries — mainly because CreditKarma would tell me I was a good match for something and I’d get declined anyway. 16 months ago I got a secured Discover card with $2500 because I needed to get a credit card with some sort of spending power for travel and was surprised Discover would even give me a secured card... so I went with them. I got an Avant Card with a grand limit last year.

In addition, about 18 months ago, my partner, who has awesome high 700s credit, added me as an authorized user to his AmEx SPG, Citi Simplicity and Disney Chase to give me about 40k in “authorized user available credit” which did help some — it got my scores back up into the low 600s — but I really had to get the student loans paid off which I finally was able to do.

Well over the last 6 months of paying and erasing the student loans (January of this year), my FICO went from the 600 range to the mid 600s. It’s been bouncing between 640 and 680 and seems very sensitive to balances. I held off applying for things because I wanted some of those inquiries to fall off, but I did ask for some CLIs. Last month Discover unsecured my card which was awesome... I asked for a CLI on the Walmart and Amazon in Feb after the student loan collections came off — Synchrony gave me 6 and 5 *grand* respectively, and then TD jumped my Target up to 2600 from the 1k it had sat at forever. Fingerhut bumped me to 3150. Credit Karma started saying I could get an AmEx Card, but the prequalificatin site was down and I’ve learned not to trust them. Just the other day Discover shot me up to 5 grand!

Well — this morning I got an email from AmEx that I was invited to apply for a card. I went to the pre-qualification site and for the first time in my life it actually had options! BCE, Everyday and the Gold Preferred charge card.

I opted for the BCE and **bleep** near cried that they offered me a $500 limit with all the bonuses — and a relatively reasonable interest of 18% when the application said between 15 and 26% — I’d figured if it was anything it would be on the high end of that.

As stupid as it sounds, this felt amazingly good... Even better than Discover unsecuring my card and doubling my limit. Even though it’s only $500 — and AmEx shot me their email of what they want to see over the next 5 months so they will increase it — it feels like a recognition of sorts that the hard work I’ve been putting into my credit it actually starting to pay off! At least in my mind AmEx and and Chase have always seemed like the most skittish ones. I thought it was funny that they offered me the $150 bonus for 1k in spending with that limit — I definitely will get it, but I’ll do it in $200 chunks and immediately send them a payment each timethey say that they want to see me carry a small balance to get an increase so I’ll keep a rolling $40 or $50 on it and keep it paid down to that much.

As of today they did a hard pull on Experian which was sitting at 671 with 26 outstanding inquiries.

So that’s where I’m at and am feeling good... I’m going to manage what I have for a while and let the inquries fall off. The ultimate goal I’m working toward is to get a Chase Sapphire Reserve. I know Chase has a 5 inquiry limit though so I can’t keep adding to the tons I already have and just need to kick back for a while

N

Oh wow, thats quite a story!! Thank you for sharing that, and its awlays good to see other's rebuilds with a certain lender, as it helps with the data points provided.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

My gut tells me that what triggered it was a combination of Synchrony giving me huge increases on the Amazon and Walmart... not sure if being in their system as an authorized user helped as well because they regularly email me things and my invite came in a similar format.

So aside from sitting out applying for new things and letting the inquires fall off and get some CLIs, I want to try and CapitalOne to switch the QuickSilver One to a regular Quicksilver or VentureOne that has no annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BACK w/ AMEX! BCE 5 yrs post BK7

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content