- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Bam. Another BoA CLI!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bam. Another BoA CLI!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bam. Another BoA CLI!

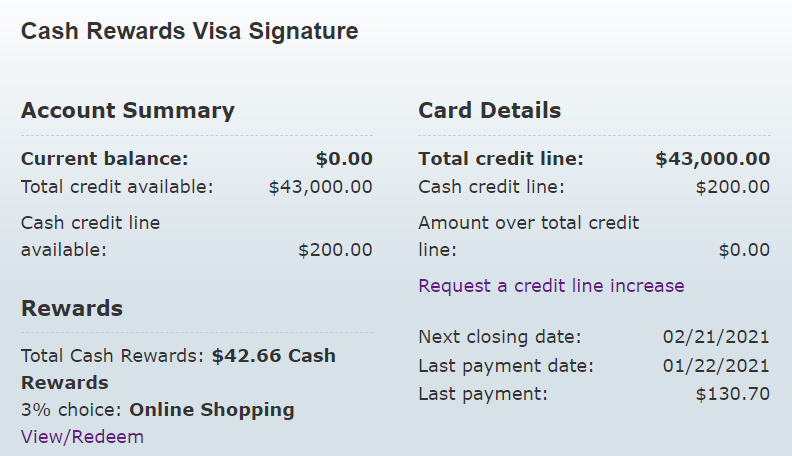

Well here we go again. 3 months after my last increase with Bank of America, they decide to keep going. Same financial details as the last request, but only a 8.7k bump this time (asked for $60k). I'll take it. Anyone have any idea what their threshold is regarding credit limit as a ratio of total yearly income?

This has been my go to online card, so it doesn't see a huge amount of charges on it, but apparently enough.

Since 3/2020: 3k > 9k > 18k > 34.3k > 43k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

That is just about a $9K CLI, Congratulations on robbing the bank!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

That's terrific!! Congratulations on your approval!

I have read that the max is $99,000 but I don't recall if that's a "card" limit or a "POI" limit. I know we have some BofA gurus that can help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Bam sham-a-lam! Miss my BofA card accounts. They were steady performers and APR reducers too.

Big Congratulations on maintaining them and your CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Congratulations for your CLI @CBrow !!!

If you don't mind, could you please tell us if you regularly use your card and which average monthly value you expend on your card? Also, do you have a checking account and use it regularly?

I'm asking because I've a BofA Cashback Rewards since 11/2018 and can't go pass the 8k CL. The CLI button is gone since March/2020, but I almost never use the card, even though I occasionally use my checking account (opened in 07/2018).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@CBrow wrote:

Well here we go again. 3 months after my last increase with Bank of America, they decide to keep going. Same financial details as the last request, but only a 8.7k bump this time (asked for $60k). I'll take it. Anyone have any idea what their threshold is regarding credit limit as a ratio of total yearly income?

This has been my go to online card, so it doesn't see a huge amount of charges on it, but apparently enough.

Since 3/2020: 3k > 6k > 18k > 34.3k > 43k

Congradulations on the CLI ! It looks like it's been a great year with BOFA for you.

I am just days away from pushing for a large CLI.

One of the best members for BOFA knowledge is @FinStar, and he might be able to shed some light on the maximum CL vs. yearly Income ratio for BOFA.

I could have sworn in the BOFA 99k thread someone had said they thought it was 50% of yearly income was the max CLI they would give you. Please don't quote me on that. I tried to find it but was unable to locate it in the thread. That's an impressive CL congradulations again!

Current FICO 8:

Current FICO 9:

Inquires :

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@wowzera wrote:Congratulations for your CLI @CBrow !!!

If you don't mind, could you please tell us if you regularly use your card and which average monthly value you expend on your card? Also, do you have a checking account and use it regularly?

I'm asking because I've a BofA Cashback Rewards since 11/2018 and can't go pass the 8k CL. The CLI button is gone since March/2020, but I almost never use the card, even though I occasionally use my checking account (opened in 07/2018).

@wowzera Gym membership is auto charged to this card, so at minimum $40/month. I would say the card gets used a couple times a month. Average spend is usually around $50-250 depending on what online expenses come up for the month (i.e. vehicle licensing, Amazon, etc.). I used to use this credit card back in college for paying rent, so my spend was over $1000/month (but this was a few years ago), always PIF the day the statement cuts.

I don't have a relationship with BoA besides the credit card. All of my banking is done with different financial institutions. The income I report to them is close to 6 figures.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Congrats on your CLI!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Congrats on your CLI!