- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Bam. Another BoA CLI!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bam. Another BoA CLI!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@barca wrote:@Anonymous btw - if you want to come back to BOA -

I suggest you open checking and savings with them , then app for a credit card after few months

I have not tried anything with them in the last 5 yrs...but last time when I tried opening a checking account with them, I'm told that I am blacklisted....since then I didn't bother....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

That's hugee. Congrats on your CLI!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

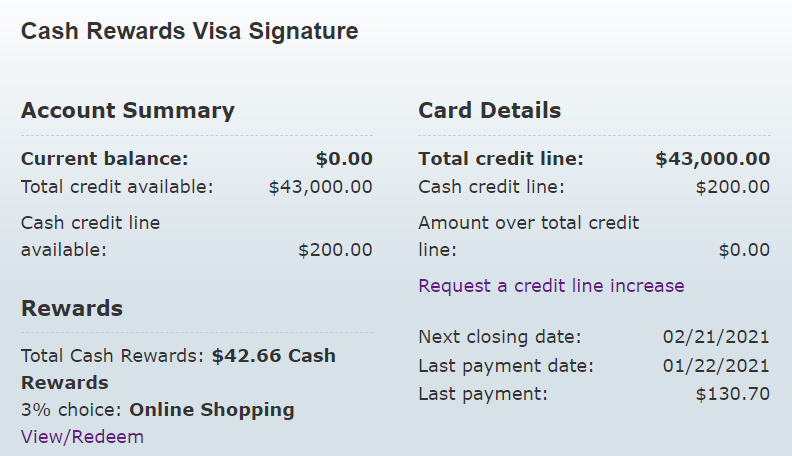

Man, from $3k to $43k in 10 months time? Very impressive growth!

Has your profile changed much over those 10 months? I guess what I find most surprising is the $3k SL on a profile capable of $43k inside of a year, unless your profile has dramatically improved. Awesome results nonetheless!

I'll be curious to see what sort of CLI you get next time around in (say) 3 months or so if you request $60k again. With your income being near 6 figures, it sounds like the $43k limit you're at now is approaching on 50% of that and there might be only enough left for a smaller CLI next time around to bring you to your exposure ceiling.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@2ski wrote:

@CBrow wrote:

Well here we go again. 3 months after my last increase with Bank of America, they decide to keep going. Same financial details as the last request, but only a 8.7k bump this time (asked for $60k). I'll take it. Anyone have any idea what their threshold is regarding credit limit as a ratio of total yearly income?

This has been my go to online card, so it doesn't see a huge amount of charges on it, but apparently enough.

Since 3/2020: 3k > 6k > 18k > 34.3k > 43k

Congradulations on the CLI ! It looks like it's been a great year with BOFA for you.

I am just days away from pushing for a large CLI.

One of the best members for BOFA knowledge is @FinStar, and he might be able to shed some light on the maximum CL vs. yearly Income ratio for BOFA.

I could have sworn in the BOFA 99k thread someone had said they thought it was 50% of yearly income was the max CLI they would give you. Please don't quote me on that. I tried to find it but was unable to locate it in the thread. That's an impressive CL congradulations again!

Thanks for the tag @2ski 😁 There's a few members who have reached the infamous $99.9K threshold (whether on a single or multiple CCs). @K-in-Boston and @coldfusion are also very familiar with BoA and @simplynoir was just recently approved for a CLI in November that took his Premium Rewards to $120K. My personal CC exposure with BoA is north of $200K (excluding biz CCs). There's @Mahraja who also has pretty high BoA exposure as well, IIRC.

I'm not sure there's a specific income ratio per se, and I know there's some information floating around with a figure of ~50%, but that's just a theory because I've seen higher limits on ML Wealth Management CCs that dwarf most of what we see. They do take into consideration quite a few things once you reach >$100K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Congratulations!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@Anonymous wrote:Man, from $3k to $43k in 10 months time? Very impressive growth!

Has your profile changed much over those 10 months? I guess what I find most surprising is the $3k SL on a profile capable of $43k inside of a year, unless your profile has dramatically improved. Awesome results nonetheless!

I'll be curious to see what sort of CLI you get next time around in (say) 3 months or so if you request $60k again. With your income being near 6 figures, it sounds like the $43k limit you're at now is approaching on 50% of that and there might be only enough left for a smaller CLI next time around to bring you to your exposure ceiling.

@Anonymous that $3k starting limit was back from 2016. The only reason I started the heavy CLIs was because I finally found out BoA was doing soft pull CLIs. So I don't know if the previous spend I've done on the card (it was anywhere from $1-2k a month in college) that influenced the decisions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

Ah, gotcha... so you more or less sat on that SL for a handful of years and have taken advantage of frequent SP CLIs since then. Still very good growth inside the last year when you've pressed on the gas. Perhaps the length of time you've had your account has aided a bit in your CLI potential.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

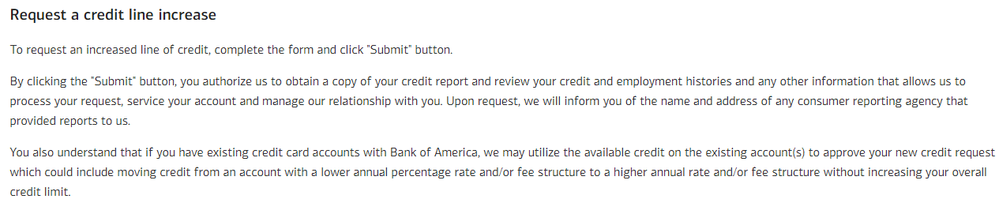

I am so glad to have found this message thread. I have a question for all of you. I truly want to ask for a CLI from BoA, for my Cash Rewards card. But everytime I click on the link that pops up to ask for a CLI, a screen pops up that I need to fill in some questions plus a statement that by submitting the info, I am authorizing the to pull my credit report. I have always exited the screen, simply because I don't want an another HP. So my question is, even with the language, is BoA granting increased based on a SP? TIA. And, if I have posted this in the worng place, please advise me where I should post the inquiry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

@IncrsCreditScore wrote:I am so glad to have found this message thread. I have a question for all of you. I truly want to ask for a CLI from BoA, for my Cash Rewards card. But everytime I click on the link that pops up to ask for a CLI, a screen pops up that I need to fill in some questions plus a statement that by submitting the info, I am authorizing the to pull my credit report. I have always exited the screen, simply because I don't want an another HP. So my question is, even with the language, is BoA granting increased based on a SP? TIA. And, if I have posted this in the worng place, please advise me where I should post the inquiry.

@IncrsCreditScore They've been SP. Feel free to freeze your 3B reports if unsure. Then give it a shot.

For your reading pleasure BoA to stop HPs for CLI’s

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bam. Another BoA CLI!

All my CLI in the past has been SP.

However, @IncrsCreditScore might have a point. I am a bit nervous myself..

becuase thier language and placement of this disclosure is quite explicit and strong.

I don't think they had a language like that before or maybe I am just imagining things.