- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Blaze MC Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Blaze MC Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Blaze MC Approval

$500 initial SL, with $75 AF.

I know people are going to trash this card, but I'm stil in rebuilding mode and got a Pre-Qualify mailer, I've done some research on the card and yes it has a $75 AF, yes it racks no rewards, etc etc etc - I'm well aware, but I wanted to pull the trigger because my SL's on my other cards are still so small and I'm running my life through my AMEX Green Card right now. I applied online, was approved, 5 days later the card was in the mailbox and I found out I got a $500 SL which was very nice. I've seen posts on the forums that First Savings Bank increases limits up near $2000 - Which would be great for me as I continue my rebuild. I also acquired a Legacy VISA from First Savings Bank, who also issues Blaze, and it started at $350 and quickly grew to $500. I made a committment to myself that this is the last suprime card I will be getting. I'm 6 months into my AMEX Green Card which I got earlier this year. I'm spending roughly $3K a month on it and plan on doing the upgrade to the PRG next year and hopefully getting a revolver once my scores are up in the 680-690 range. But I'm certainly in the garden for now.

Scores right now EX: 650 EQ: 626 TU: 605

Cards are listed in my signature. My total CL is $3,000 now across a variety of cards. I run my life through my AMEX Green card. Light spend on my Capital One QS1 which I'm on the baby steps program for and will soon get a CL increase from $300 to $500 on my next statement. Little by little, it's been quite a rebuild for me. 2012-2014 I was an utter disaster in my early 20's, bunch of utility, cable bills I blew off when I was moving for work. I had a REPO on my car and also was missing payments all over the place on my student loans. I now have 2 years on-time payments on my rehabbed loans, was able to do some Pay and Deletes, but the REPO is there until 2020 in my collections.

I went from not being able to get a secured card at the beginning of 2016 with a Credit Vantage score of 404 to now having my FICO's in the 600's. Looking forward to a brighter future and I'm starting to taste it.

Cheers my fellow Credit Warriors! Rebuilder on the move!

X1 VISA SIG $15,500/ AMEX Gold / Petal 1 $3600 / Wells Fargo Active Cash VISA $3K / VENMO Visa $900 / Verizon Visa $2K / Apple Card $1500 SL / Wyndham Rewards Earner Visa $500 / WALGREENS Store $1K / Amazon Store $5000 SL/ Discover IT Chrome $2500K / BP Prime Rewards VISA $4350 / PayPal MC $3500 / BOA BankAmericard $2K / BOA Cash Rewards $1K / Cap One Savor One $1200 / Cap One QS1 $950 / Blaze MC $2250 / Credit One $850 / Credit One AMEX $1200 / OpenSky $600 / AvantCard $1000 / Discover IT Cash Back (Graduated) $400 / eBay MC $750

FEB '22 EX: 698 EQ: 700 TU: 713 | UTL: 23% | Total Credit Limit: $54000

Goal Score: 675 for all FICOS (ACHIEVED NOVEMBER 2021) | NEW GOAL SCORE: 725 for ALL FICOs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

Not gonna lie: I really want that card. (I am re-building, too.) ![]()

Congrats, OP! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

I have the Blaze card with a $2500 limit. I knew what I was getting onto when I applied. I don't mind just an annual fee compared to monthly fees on some other cards. Its a means to an end and when options are limited it's not a bad card. Congrats on the approval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

@sccredit wrote:I have the Blaze card with a $2500 limit. I knew what I was getting onto when I applied. I don't mind just an annual fee compared to monthly fees on some other cards. Its a means to an end and when options are limited it's not a bad card. Congrats on the approval.

$2500?? Wow that was more than I had even read about.

Look forward to growing this thing. I've had no issues with my Legacy VISA and I got an auto CLI after just 3 months from $350 to $500.

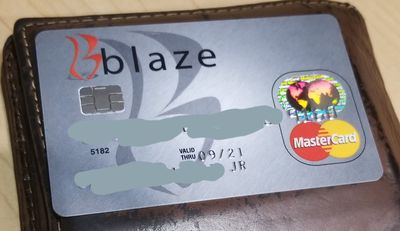

Side note also, it's a decently sharp looking card....Legacy VISA really feels cheap, but the Blaze isn't a bad looking card ![]()

X1 VISA SIG $15,500/ AMEX Gold / Petal 1 $3600 / Wells Fargo Active Cash VISA $3K / VENMO Visa $900 / Verizon Visa $2K / Apple Card $1500 SL / Wyndham Rewards Earner Visa $500 / WALGREENS Store $1K / Amazon Store $5000 SL/ Discover IT Chrome $2500K / BP Prime Rewards VISA $4350 / PayPal MC $3500 / BOA BankAmericard $2K / BOA Cash Rewards $1K / Cap One Savor One $1200 / Cap One QS1 $950 / Blaze MC $2250 / Credit One $850 / Credit One AMEX $1200 / OpenSky $600 / AvantCard $1000 / Discover IT Cash Back (Graduated) $400 / eBay MC $750

FEB '22 EX: 698 EQ: 700 TU: 713 | UTL: 23% | Total Credit Limit: $54000

Goal Score: 675 for all FICOS (ACHIEVED NOVEMBER 2021) | NEW GOAL SCORE: 725 for ALL FICOs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

CONGRATS OP

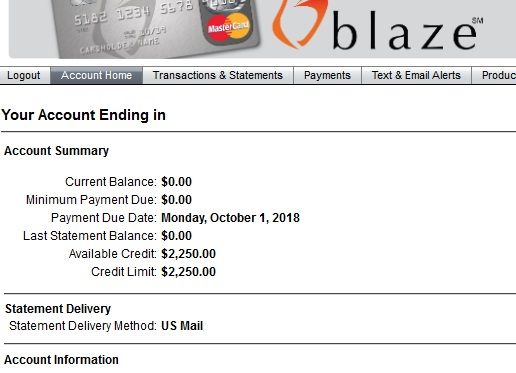

Blaze has been good to me, My limit is $2,250.

After the first year. They have removed the AF for me every year. So if you keep it after a year when your AF post just called them to see if they would remove it (just tell them you are thinking about closing it cause of the AF). Here's a picture of my Blaze. I know i need to close my sub cards but they been good to me i have never had any problems. My scores are almost 800. I still have 3 of their cards. I had 4 but I closed Show Card

- First Savings Mastercard

- First National Visa (Legacy)

- Blaze Mastercard

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

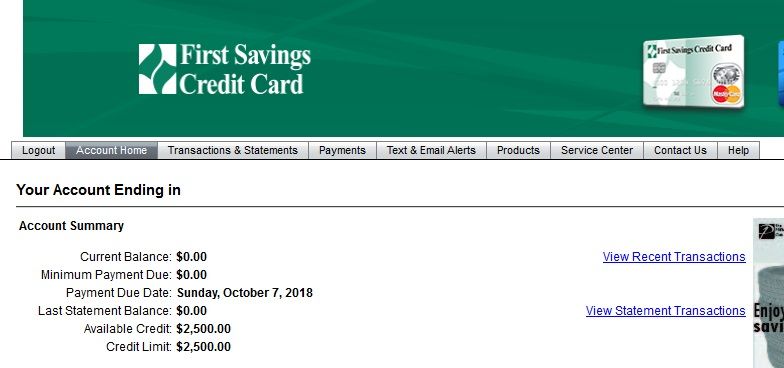

I forgot to add a photo of my First Savings since you mention you saw limits up to 2k my is 2500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

Congrats on your Blaze MC approval! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

@CreditRebuilder2020 wrote:

$500 initial SL, with $75 AF.

I know people are going to trash this card, but I'm stil in rebuilding mode and got a Pre-Qualify mailer, I've done some research on the card and yes it has a $75 AF, yes it racks no rewards, etc etc etc - I'm well aware, but I wanted to pull the trigger because my SL's on my other cards are still so small and I'm running my life through my AMEX Green Card right now. I applied online, was approved, 5 days later the card was in the mailbox and I found out I got a $500 SL which was very nice. I've seen posts on the forums that First Savings Bank increases limits up near $2000 - Which would be great for me as I continue my rebuild. I also acquired a Legacy VISA from First Savings Bank, who also issues Blaze, and it started at $350 and quickly grew to $500. I made a committment to myself that this is the last suprime card I will be getting. I'm 6 months into my AMEX Green Card which I got earlier this year. I'm spending roughly $3K a month on it and plan on doing the upgrade to the PRG next year and hopefully getting a revolver once my scores are up in the 680-690 range. But I'm certainly in the garden for now.

Scores right now EX: 650 EQ: 626 TU: 605

Cards are listed in my signature. My total CL is $3,000 now across a variety of cards. I run my life through my AMEX Green card. Light spend on my Capital One QS1 which I'm on the baby steps program for and will soon get a CL increase from $300 to $500 on my next statement. Little by little, it's been quite a rebuild for me. 2012-2014 I was an utter disaster in my early 20's, bunch of utility, cable bills I blew off when I was moving for work. I had a REPO on my car and also was missing payments all over the place on my student loans. I now have 2 years on-time payments on my rehabbed loans, was able to do some Pay and Deletes, but the REPO is there until 2020 in my collections.

I went from not being able to get a secured card at the beginning of 2016 with a Credit Vantage score of 404 to now having my FICO's in the 600's. Looking forward to a brighter future and I'm starting to taste it.

Cheers my fellow Credit Warriors! Rebuilder on the move!

Congrats. All that matters is that you're taking charge of your credit future based on what fits your needs. I too, like you, started my rebuild some years ago with a $500 walmart card. I tell you that was like having $5,000 at that time. Sounds like you have a solid plan to get where you want to be. I applaud you. I think Amex will reward you for the useage.

___________ 12Njoy

FICO - EX 810; EQ 797; TU 804 I'm climbing back to 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

@CreditRebuilder2020 wrote:

$500 initial SL, with $75 AF.

I know people are going to trash this card, but I'm stil in rebuilding mode and got a Pre-Qualify mailer, I've done some research on the card and yes it has a $75 AF, yes it racks no rewards, etc etc etc - I'm well aware, but I wanted to pull the trigger because my SL's on my other cards are still so small and I'm running my life through my AMEX Green Card right now. I applied online, was approved, 5 days later the card was in the mailbox and I found out I got a $500 SL which was very nice. I've seen posts on the forums that First Savings Bank increases limits up near $2000 - Which would be great for me as I continue my rebuild. I also acquired a Legacy VISA from First Savings Bank, who also issues Blaze, and it started at $350 and quickly grew to $500. I made a committment to myself that this is the last suprime card I will be getting. I'm 6 months into my AMEX Green Card which I got earlier this year. I'm spending roughly $3K a month on it and plan on doing the upgrade to the PRG next year and hopefully getting a revolver once my scores are up in the 680-690 range. But I'm certainly in the garden for now.

Scores right now EX: 650 EQ: 626 TU: 605

Cards are listed in my signature. My total CL is $3,000 now across a variety of cards. I run my life through my AMEX Green card. Light spend on my Capital One QS1 which I'm on the baby steps program for and will soon get a CL increase from $300 to $500 on my next statement. Little by little, it's been quite a rebuild for me. 2012-2014 I was an utter disaster in my early 20's, bunch of utility, cable bills I blew off when I was moving for work. I had a REPO on my car and also was missing payments all over the place on my student loans. I now have 2 years on-time payments on my rehabbed loans, was able to do some Pay and Deletes, but the REPO is there until 2020 in my collections.

I went from not being able to get a secured card at the beginning of 2016 with a Credit Vantage score of 404 to now having my FICO's in the 600's. Looking forward to a brighter future and I'm starting to taste it.

Cheers my fellow Credit Warriors! Rebuilder on the move!

1. you don't need this and it will not grow well so I would close it.

2. You should be asking Cap1 for a CLI each month before the credit steps kick in so you can usually double dip.

3. What's wrong with running your life through the Amex? Amex does their own internal score and you could probably apply for a credit card product with them if you have had the green for a while?

4. Why not upgrade to Gold charge at least for better rewards?

5. Close opensky too... also no growth, add the money to your discover secured!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Blaze MC Approval

@Creditaddict wrote:

@CreditRebuilder2020 wrote:

$500 initial SL, with $75 AF.

I know people are going to trash this card, but I'm stil in rebuilding mode and got a Pre-Qualify mailer, I've done some research on the card and yes it has a $75 AF, yes it racks no rewards, etc etc etc - I'm well aware, but I wanted to pull the trigger because my SL's on my other cards are still so small and I'm running my life through my AMEX Green Card right now. I applied online, was approved, 5 days later the card was in the mailbox and I found out I got a $500 SL which was very nice. I've seen posts on the forums that First Savings Bank increases limits up near $2000 - Which would be great for me as I continue my rebuild. I also acquired a Legacy VISA from First Savings Bank, who also issues Blaze, and it started at $350 and quickly grew to $500. I made a committment to myself that this is the last suprime card I will be getting. I'm 6 months into my AMEX Green Card which I got earlier this year. I'm spending roughly $3K a month on it and plan on doing the upgrade to the PRG next year and hopefully getting a revolver once my scores are up in the 680-690 range. But I'm certainly in the garden for now.

Scores right now EX: 650 EQ: 626 TU: 605

Cards are listed in my signature. My total CL is $3,000 now across a variety of cards. I run my life through my AMEX Green card. Light spend on my Capital One QS1 which I'm on the baby steps program for and will soon get a CL increase from $300 to $500 on my next statement. Little by little, it's been quite a rebuild for me. 2012-2014 I was an utter disaster in my early 20's, bunch of utility, cable bills I blew off when I was moving for work. I had a REPO on my car and also was missing payments all over the place on my student loans. I now have 2 years on-time payments on my rehabbed loans, was able to do some Pay and Deletes, but the REPO is there until 2020 in my collections.

I went from not being able to get a secured card at the beginning of 2016 with a Credit Vantage score of 404 to now having my FICO's in the 600's. Looking forward to a brighter future and I'm starting to taste it.

Cheers my fellow Credit Warriors! Rebuilder on the move!

1. you don't need this and it will not grow well so I would close it.

2. You should be asking Cap1 for a CLI each month before the credit steps kick in so you can usually double dip.

3. What's wrong with running your life through the Amex? Amex does their own internal score and you could probably apply for a credit card product with them if you have had the green for a while?

4. Why not upgrade to Gold charge at least for better rewards?

5. Close opensky too... also no growth, add the money to your discover secured!

Cap One has denied me several times on CLI's. I keep the OpenSky just because it's two years worth of on time payments and it shows up unsecured on my credit report. It's always at a zero balance. Amex denied me on the Delta Gold/Everyday/Upgrade to the PRG. They told me I can only upgrade after a year.....was that bad customer service advice?

I guess I could add money to my Discover IT secured. I hear this card "Graduates" but I'm in 14 months and my scores are now in the 600's and I'm still getting the cold shoulder from them. Either way, appreciate the input.

X1 VISA SIG $15,500/ AMEX Gold / Petal 1 $3600 / Wells Fargo Active Cash VISA $3K / VENMO Visa $900 / Verizon Visa $2K / Apple Card $1500 SL / Wyndham Rewards Earner Visa $500 / WALGREENS Store $1K / Amazon Store $5000 SL/ Discover IT Chrome $2500K / BP Prime Rewards VISA $4350 / PayPal MC $3500 / BOA BankAmericard $2K / BOA Cash Rewards $1K / Cap One Savor One $1200 / Cap One QS1 $950 / Blaze MC $2250 / Credit One $850 / Credit One AMEX $1200 / OpenSky $600 / AvantCard $1000 / Discover IT Cash Back (Graduated) $400 / eBay MC $750

FEB '22 EX: 698 EQ: 700 TU: 713 | UTL: 23% | Total Credit Limit: $54000

Goal Score: 675 for all FICOS (ACHIEVED NOVEMBER 2021) | NEW GOAL SCORE: 725 for ALL FICOs