- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- CSP - at last :)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CSP - at last :)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

@GenesisLS wrote:

@meanmchine Prequal link from Myfico?? How do I not know of this? Where do I find it?

Enjoy and good luck

https://ficoforums.myfico.com/t5/Credit-Cards/Pre-Approval-Sites-June-2015/td-p/4059266

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

Couple data points I wanted to clarifiy just b/c i'm still a bit pleasantly surprised I got this card.

1) I was def. OVER 5/24 when I opened a Chase checking account and had planned to just sit in "the garden" as people call it here until next Feb as that would be when the two oldest cards that were opened in the last 24 months would age out. But I admit to being weak when their app kept teasing me with the offers. <hangs head dejectedly>

I get paid the last business day of the month (i'm paid monthly) and only had the min. direct-deposit set up (500) to avoid any fees on an account I'd planned to not really use much. These "you're pre-qualified" banners showed up on a ton of cards on my just-for-you page (which used to load empty) exactly 7 days after my first direct deposit hit on the 30th or whatever. It didnt take the 30-60 days as others have said here. Judging by the uptick in Chase approvals being listed in this thread lately -- it would seem to me that Chase is potentially not enforcing 5/24 while the economy is still strong? But this is just a guess on my part. I could have just been lucky.

I only opened a checking account with Chase to foster a relationship with them. They've also constantly sent me mailers with "get 400/500 dollars for opening an account." As I said, I've been dissatisfied with my credit union's piss-poor website so having a slicker experience was something I missed. I am still considering just moving all my everyday banking to Chase after this windfall approval. I can just pay my credit union car loan and measly credit union credit card payment via Chase's BillPay.

2) Chase's "Check for Pre-qual" offers webpage STILL says I have no offers; but when I'm logged into the mobile app on any device, the "just for you" section lists all the offers I posted that screenshot of STILL (the only exception being that the CSP is still offered but there is no longer a banner above it.)

These offers just won't show up on their web site which is odd to me. Also, I find that often, specific card pages lack the "sign in to apply faster" button---not sure if this is intentional or if their site is just a work in progress???.

3) Credit Journey has been pretty pointless/useless for me. It lists my vantagescore as lower than any of my fico scores (712 right now when my FICO Transunion bankcard 8 score is still north of 730 as of this very moment.)

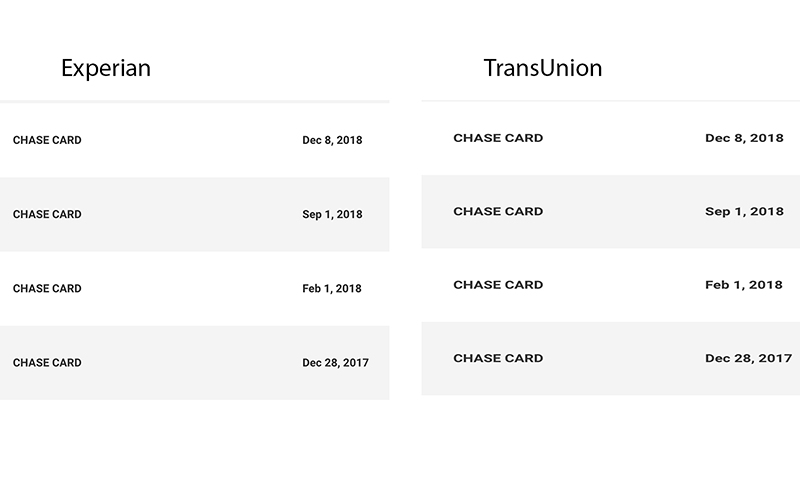

4)Also, it's not clear to me who Chase pulled when I opened my account---my notifications came up on the free monitoring I get from Capital One and even Chase itself. These tools use TU data to give me the FAKO vantage scores. MYFICO (I sub to the 39.95 3B product) didn't notify me of the inq. until the next day. I find it odd that the product I pay for lags when it comes to notifications like that but the two free ones don't.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

@jwa77 wrote:

1. Chase is still actively enforcing the 5/24 rule. If you did not have a pre-qualified offer and just made a cold application there's a high probability it would have been rejected. The only two ways to bypass the 5/24 rule are through in-branch pre-approvals and Just for You/Selected for You offers shown in your online/mobile app/Chase Credit Journey. I've never known an in-branch pre-approval to be rejected but sometimes Just for You/Selected for You offers can still be denied.

2. Its not out of the ordinary to not get offers through the Pre-qualifed webpage. In all my time with Chase I've gotten an offer through the webpage once; but I regularly get offers when I check with a teller or personal banker when I go into a branch.

4. Chase usually double-pulls TransUnion and one of the other two bureaus depending on where you live. In my case they always pull TU and EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

When I app’d for the CSP (first card w Chase and no pre-existing relationship) they double pulled EX and EQ. I see that your double pull included TU. Do you happen to have know or have an opinion on whether TU is pulled when it is a secondary card application or for those who may already have a banking or pre-existing relationship?

I realize that you can’t say with certainty. I’m just wondering what you think or have observed with others.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

@Anonymous wrote:

@MaizeandBlue (And everyone else)

When I app’d for the CSP (first card w Chase and no pre-existing relationship) they double pulled EX and EQ. I see that your double pull included TU. Do you happen to have know or have an opinion on whether TU is pulled when it is a secondary card application or for those who may already have a banking or pre-existing relationship?

I realize that you can’t say with certainty. I’m just wondering what you think or have observed with others.

Thank you!

Perhaps I shouldn't say with certainty that Chase always pull Transunion. However, they will pull two of the three credit bureaus based on the where you live. I have checking, savings, and business checking, and You Invest accounts so I had an existing relationship with Chase but for every card application I made they pulled Experian and TransUnion. YEMV based on your location.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

Everytime I've applied with Chase (three times, two cobranded card denials last year, and March with a CSP approval), they've double pulled EQ & EX (in NC).

Since my approval, they've been softpulling EX every two weeks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

@jwa77 wrote:thank you---btw; I was over 5/24 if you count the store cards...but wasn't if you only count actual credit cards (was 3/24 if that's the case)

Congrats![]()

Btw Store cards are credit cards , just not bankcards![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSP - at last :)

You guys are so helpful and I really appreciate that ![]()

I live in Washington state (if not obvious by my shameless plug for my credit union {OBee; which was the credit union formed for the employees of the old Olympia brewing company![]() }) It appears they pulled EX and then TU on the same day. There is literally a 20+ point diff between the two heh.

}) It appears they pulled EX and then TU on the same day. There is literally a 20+ point diff between the two heh.

Second question--after I make the spend for this card and get it's SUB (should be able to do so easily b/c I can put work travel on it) -- can I sign up for Freedom (and is that recommended) if I still have the pre-qual banner?