- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Citi AAdvantage Executive CLI from 23k to 30k ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

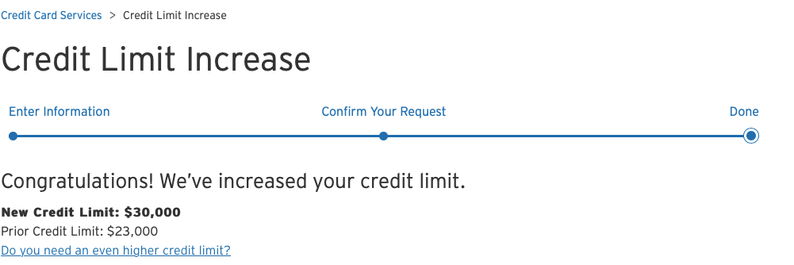

Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

Howdy friends, I got a 3x CLI today on my Amex Cash Magnet card so I decided to also try a CLI with Citi AAdvantage Executive card. Instant approval from $23k to $30k with a soft pull. Woop Woop!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

Awesome CLI! Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

Outstanding CLI!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

thats a great SP CLI, Congrats!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

Considering all the other cards that you have, what type of spend do you put on the AA card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

@imaximous wrote:

Congrats on the CLIs!

Considering all the other cards that you have, what type of spend do you put on the AA card?

Normally about 3-5K every month. A few on my card are in the sock drawer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

@avp99 wrote:

@imaximous wrote:

Congrats on the CLIs!

Considering all the other cards that you have, what type of spend do you put on the AA card?Normally about 3-5K every month. A few on my card are in the sock drawer.

I was curious about the type of purchases you use it for. Is it mostly for AA travel or regular spend too? I have an AA card, but even my AA tickets go on a card that get me a better return. Just trying to get some ideas on how others use the card. I only have it for the perks and put a charge here and there to justify its existence.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

@avp99 wrote:Howdy friends, I got a 3x CLI today on my Amex Cash Magnet card so I decided to also try a CLI with Citi AAdvantage Executive card. Instant approval from $23k to $30k with a soft pull. Woop Woop!!

Congratulations!! Well done. I am curious how do you know if it will be a soft pull or HP? I was approved in April 2019 for the Citi AAdvantage Platinum Card but whenever I click the Love button it states they will pull my credit report. Is this the case or not? Anyone?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

@chucky1234 wrote:

@avp99 wrote:Howdy friends, I got a 3x CLI today on my Amex Cash Magnet card so I decided to also try a CLI with Citi AAdvantage Executive card. Instant approval from $23k to $30k with a soft pull. Woop Woop!!

Congratulations!! Well done. I am curious how do you know if it will be a soft pull or HP? I was approved in April 2019 for the Citi AAdvantage Platinum Card but whenever I click the Love button it states they will pull my credit report. Is this the case or not? Anyone?

The soft pull verbage will come up after 3-6 months and then you can most likely get a SP cli depending on your profile, more towards 6+ months to get one if it says a pull will not be done or along those lines and every 6 months there-after assuming your profile supports it and you havent been obtaining a ton of recent credit, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Executive CLI from 23k to 30k Soft Pull

@chucky1234 wrote:

@avp99 wrote:Howdy friends, I got a 3x CLI today on my Amex Cash Magnet card so I decided to also try a CLI with Citi AAdvantage Executive card. Instant approval from $23k to $30k with a soft pull. Woop Woop!!

Congratulations!! Well done. I am curious how do you know if it will be a soft pull or HP? I was approved in April 2019 for the Citi AAdvantage Platinum Card but whenever I click the Love button it states they will pull my credit report. Is this the case or not? Anyone?

I knew it was a soft pull because when you go to the CLI page, it says that they will either "not require a new credit pull" or it "will require a new credit pull". I basically go back once in a while and look for the will not require a new credit pull.