- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: I knocked on Amex's door

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I knocked on Amex's door

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

12:52 AM

06-29-2020

12:52 AM

I knocked on Amex's door

...and they let me in!

If my lower back wasn't so jacked up, I'd be doing a happy dance right now! 😂

Up until a couple of weeks ago, my plan was to app for the Freedom Unlimited in order to complete my trinity; however, on the very day that I was set to apply, I decided to change course. Since I have no intention of ever having more than three credit cards, it was imperative that I choose wisely to fill the third spot; and after some consideration, I had an inkling that becoming a part of the Amex family would probably tickle my fancy a bit more.

Since I like to read, I settled in and got to work. I ended up doing a deep dive into old threads here on myFico, then perused COUNTLESS Amex cardholder reviews, and ultimately decided that I wanted to add the BCE to my roster. I submitted my info through the prequal link and got a hit for the Cash Magnet; but since the heart wants what the heart wants, I went ahead and applied for the BCE instead.

Based on what I ascertained through my research, I knew that my EX score was where it needed to be; however, I was concerned with how the thinness/newness of my file would be viewed. My EX stats are as follows:

Fico 8 - 719

# of inquiries - 3

# of open accounts - 3

Discover it Chrome 0/1250

Quicksilver 40/500

DCU ssl 650/1000

length of history - 10

# of inquiries - 3

# of open accounts - 3

Discover it Chrome 0/1250

Quicksilver 40/500

DCU ssl 650/1000

length of history - 10

months

When I started my journey in August of last year, my score was only 542. I thought that rebuilding would be a piece of cake, because, with the exception of two medical collections that were outside the SOL and an old Citi account that I was an AU on , I had NOTHING in my files. It hasn't been quite as easy as I thought it would be; and even though I've made a couple of missteps over the past 10 months, I'm pleased with my progress. This approval is definitely the cherry on top, and I'm beyond thrilled to be in with such a prestigious corporation.

When I started my journey in August of last year, my score was only 542. I thought that rebuilding would be a piece of cake, because, with the exception of two medical collections that were outside the SOL and an old Citi account that I was an AU on , I had NOTHING in my files. It hasn't been quite as easy as I thought it would be; and even though I've made a couple of missteps over the past 10 months, I'm pleased with my progress. This approval is definitely the cherry on top, and I'm beyond thrilled to be in with such a prestigious corporation.

*side note*

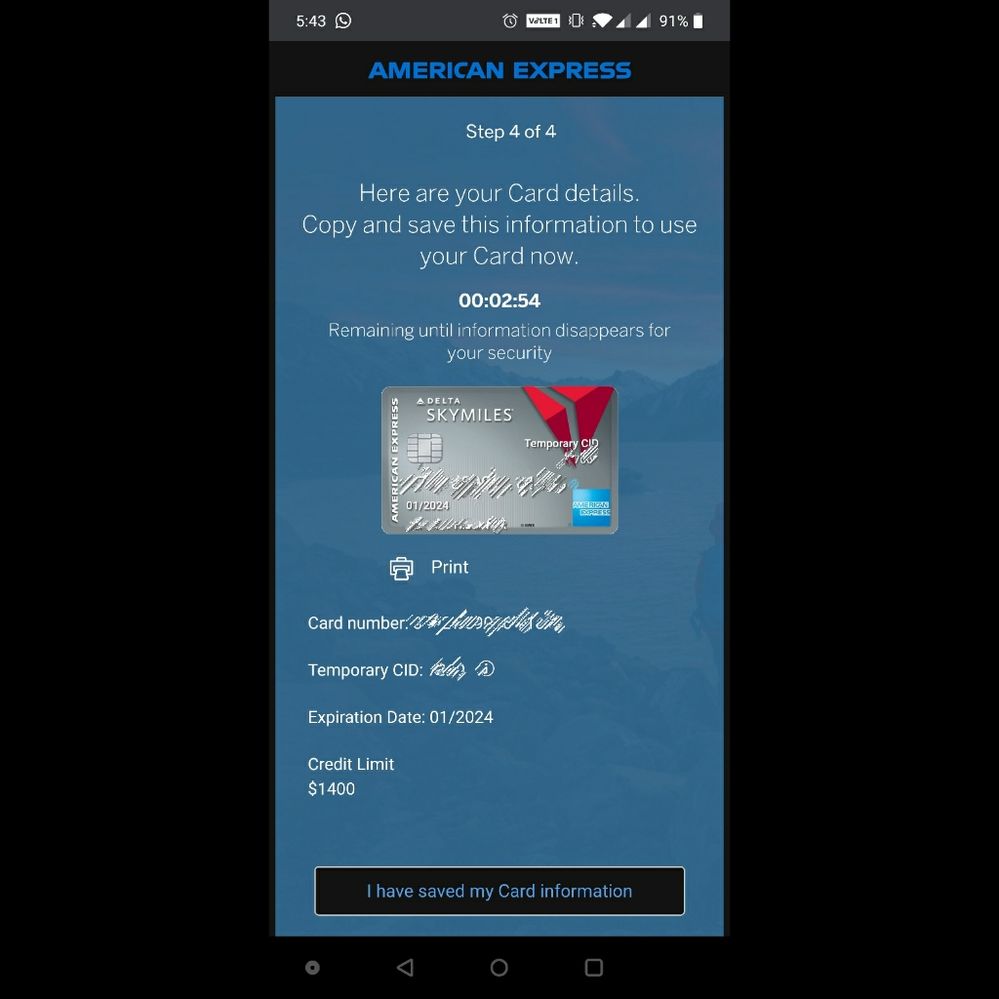

I didn't mention my limit because I have no idea what it is. I expected to receive a pop-up of some sort; however, after the screen showing that I had been approved, the only other thing I saw was the option to get my account number and create my online account. Since I'm sleep deprived, I'm wondering if I missed something?

Message 1 of 16

15 REPLIES 15

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

01:10 AM

06-29-2020

01:10 AM

Re: I knocked on Amex's door

@sourpuss29 wrote:...and they let me in!

If my lower back wasn't so jacked up, I'd be doing a happy dance right now! 😂

Up until a couple of weeks ago, my plan was to app for the Freedom Unlimited in order to complete my trinity; however, on the very day that I was set to apply, I decided to change course. Since I have no intention of ever having more than three credit cards, it was imperative that I choose wisely to fill the third spot; and after some consideration, I had an inkling that becoming a part of the Amex family would probably tickle my fancy a bit more.

Since I like to read, I settled in and got to work. I ended up doing a deep dive into old threads here on myFico, then perused COUNTLESS Amex cardholder reviews, and ultimately decided that I wanted to add the BCE to my roster. I submitted my info through the prequal link and got a hit for the Cash Magnet; but since the heart wants what the heart wants, I went ahead and applied for the BCE instead.

Based on what I ascertained through my research, I knew that my EX score was where it needed to be; however, I was concerned with how the thinness/newness of my file would be viewed. My EX stats are as follows:Fico 8 - 719

# of inquiries - 3

# of open accounts - 3

Discover it Chrome 0/1250

Quicksilver 40/500

DCU ssl 650/1000

length of history - 10months

When I started my journey in August of last year, my score was only 542. I thought that rebuilding would be a piece of cake, because, with the exception of two medical collections that were outside the SOL and an old Citi account that I was an AU on , I had NOTHING in my files. It hasn't been quite as easy as I thought it would be; and even though I've made a couple of missteps over the past 10 months, I'm pleased with my progress. This approval is definitely the cherry on top, and I'm beyond thrilled to be in with such a prestigious corporation.*side note*I didn't mention my limit because I have no idea what it is. I expected to receive a pop-up of some sort; however, after the screen showing that I had been approved, the only other thing I saw was the option to get my account number and create my online account. Since I'm sleep deprived, I'm wondering if I missed something?

Congrats!

When you set up your online account, the card and the limit should be there.

Message 2 of 16

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

03:51 AM

06-29-2020

03:51 AM

Re: I knocked on Amex's door

@sourpuss29 Super Congrats on your Amex approval!!! ![]()

Message 3 of 16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

04:53 AM

06-29-2020

04:53 AM

Re: I knocked on Amex's door

Congrats. When you choose to get your card number, it will tell you the credit limit.

Message 4 of 16

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

05:27 AM

06-29-2020

05:27 AM

Re: I knocked on Amex's door

BOOM! CONGRATS on your approval!

BOOM! CONGRATS on your approval!

KNOCK KNOCK KNOCKIN' ON AMEX's DOOORR................................

Message 5 of 16

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

05:40 AM

06-29-2020

05:40 AM

Re: I knocked on Amex's door

Congratulations!

Message 6 of 16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

06:00 AM

06-29-2020

06:00 AM

Re: I knocked on Amex's door

Congratulations 🎊 🎉 🎈 🍾

"Achieving your goal is great and everything.. But The journey is where all the amazing stuff happens" *Slickwidit*

Score goals - 800+ (85 points away)

Score goals - 800+ (85 points away)

Message 7 of 16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

06:45 AM

06-29-2020

06:45 AM

Re: I knocked on Amex's door

Grats on your Amex approval ![]()

Message 8 of 16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

07:18 AM

Message 9 of 16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-29-2020

07:19 AM

06-29-2020

07:19 AM

Re: I knocked on Amex's door

@Brian_Earl_Spilner wrote:Congrats. When you choose to get your card number, it will tell you the credit limit.

Amex sent me a "welcome" email, so this is exactly what I did.

My limit is $2000; but since I don't carry balances, I didn't concern myself with what the APR is.

Message 10 of 16

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.