- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: Life After BK7 - The NFCU Triple Play!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Life After BK7 - An NFCU Triple Play!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Life After BK7 - An NFCU Triple Play!

Hello, everyone. It’s been a while since I’ve posted, but I wanted to share a few data points that might help those members who, like me, are rebuilding after a BK7 filing.

Thirteen months ago, I joined NFCU and opened a Cash Rewards Visa ($2,500 SL), a CLOC ($1,000), and an SSL ($5,000, 60-month term) as part of my rebuilding strategy. Since then, I’ve carefully followed the mammoth NFCU thread on this forum, wherein folks have generously shared strategies about when to app for credit increases and new cards. (The “91/3” strategy, wait three months for a CLI, wait 6 months for an even bigger CLI, etc.). While very informative, I couldn’t find many posters whose profile seemed to mirror mine – that is having emerged from bankruptcy a little more than two years ago. (After all, what works for someone with a "clean" file may not work at all for someone like me with a "dirty" file!) A few posters did suggest that bankruptees like me might have the best success if we waited until we had at least one year’s worth of history with NFCU under our belts before trying for a new product or an increase on an existing card. (I think I might have read that that is actually NFCU policy now.) That made perfect sense to me, so I decided to adopt that as my strategy and be patient. And this morning, it paid off . . . big time!

- First, I requested an increase on my Cash Rewards Visa to $10,000. If approved, I was going to request a product change to the Flagship card. NFCU countered my request by doubling my limit to $5,000. Not exactly the result I was hoping for, but I decided to soldier on.

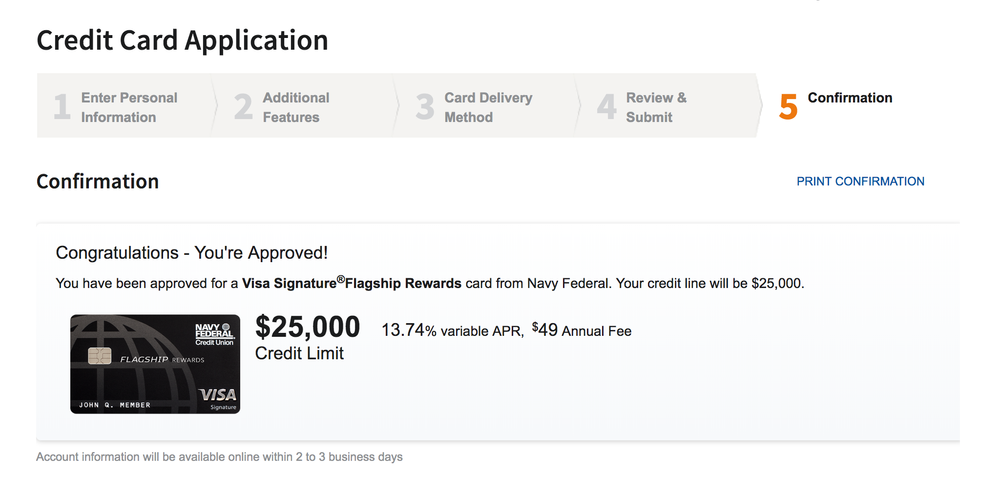

- Second, I’d read that some NFCU members are often, counter-intuitively, denied a credit line increase on an existing card but approved for a second NFCU card, often with a massive credit line. So, I took a deep breath, applied for the Flagship card, and was approved instantly with a $25,000 SL! (If I wore dentures, they would’ve been on the floor!)

- Third, I requested an increase on my CLOC from $1,000 to $5,000, which was granted about 20 minutes after I completed the application.

And the best part of this? Perhaps because I made these requests on the morning shortly after our bi-monthly account review data posted, this $30,000+ in additional credit cost me only one credit pull: TransUnion for the Flagship application!

(A few other relevant data points: Overall utilization 4%, DTI 13%, no additional derogatories since my BK7 discharge in 2017. Prior to approaching Navy this morning, only one inquiry was reporting on each credit bureau: the one on EX should fall off this month, and the ones on TU and EQ were from NFCU last June. )

A heartfelt thank you to all the posters here who give so freely of their time on these boards with very useful advice that helps guide me and others back to the land of the creditworthy! There’s still more work to do, to be sure, but with MyFico on my side, I’ll get there!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

Impressive! Congratulations on your approval and massive SL! Having a solid plan in place was a success for you and perhaps will help someone else in the future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

Congratulations on your success!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

AverageJoe, I hear you! Navy has been exceptionally kind to me since I've joined, and I plan to do my best to be worthy of their trust. I still have no idea why they can be less generous with CLIs than they are with starting limits on second and third cards, but I'm not going to overthink this one! (If they had granted my initial CLI request to $10,000 on the Cash Rewards and then product changed it to the Flagship, I never would've applied for the Flagship outright.)

My plan now is to garden for a year or so and then go after Citibank by applying for their secured product, and then upon graduation, converting it to a Double Cash card. Unfortunately, with a BK reporting, I think this may be my best bet at reestablishing a relationship with a major bank in the near term.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

Congratulations!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

Congrats!

I swear NFCU will be out of money by the time my 91 days is up!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

So awesome!!!!!!!!! Navy Fed is Amazing!!!!!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Life After BK7 - The NFCU Triple Play!

@ZenMan wrote:

Hello, everyone. It’s been a while since I’ve posted, but I wanted to share a few data points that might help those members who, like me, are rebuilding after a BK7 filing.

Thirteen months ago, I joined NFCU and opened a Cash Rewards Visa ($2,500 SL), a CLOC ($1,000), and an SSL ($5,000, 60-month term) as part of my rebuilding strategy. Since then, I’ve carefully followed the mammoth NFCU thread on this forum, wherein folks have generously shared strategies about when to app for credit increases and new cards. (The “91/3” strategy, wait three months for a CLI, wait 6 months for an even bigger CLI, etc.). While very informative, I couldn’t find many posters whose profile seemed to mirror mine – that is having emerged from bankruptcy a little more than two years ago. (After all, what works for someone with a "clean" file may not work at all for someone like me with a "dirty" file!) A few posters did suggest that bankruptees like me might have the best success if we waited until we had at least one year’s worth of history with NFCU under our belts before trying for a new product or an increase on an existing card. (I think I might have read that that is actually NFCU policy now.) That made perfect sense to me, so I decided to adopt that as my strategy and be patient. And this morning, it paid off . . . big time!

- First, I requested an increase on my Cash Rewards Visa to $10,000. If approved, I was going to request a product change to the Flagship card. NCFU countered my request by doubling my limit to $5,000. Not exactly the result I was hoping for, but I decided to soldier on.

- Second, I’d read that some NFCU members are often, counter-intuitively, denied a credit line increase on an existing card but approved for a second NFCU card, often with a massive credit line. So, I took a deep breath, applied for the Flagship card, and was approved instantly with a $25,000 SL! (If I wore dentures, they would’ve been on the floor!)

- Third, I requested an increase on my CLOC from $1,000 to $5,000, which was granted about 20 minutes after I completed the application.

And the best part of this? Perhaps because I made these requests on the morning shortly after our bi-monthly account review data posted, this $30,000+ in additional credit cost me only one credit pull: TransUnion for the Flagship application!

(A few other relevant data points: Overall utilization 4%, DTI 13%, no additional derogatories since my BK7 discharge in 2017.)

A heartfelt thank you to all the posters here who give so freely of their time on these boards with very useful advice that helps guide me and others back to the land of the creditworthy! There’s still more work to do, to be sure, but with MyFico on my side, I’ll get there!

Congrats man! I just got approved a week ago for the Cash Rewards for 8k when I fully expected to get denied. The relationship is key, hopefully in 3 months when I apply again, I get approved for the Flagship (plan to have my file as close to clean as possible by then), or maybe try for the AMEX.