- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: MSGCU Rewards Visa Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

MSGCU Rewards Visa Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

@5KRunner wrote:My oldest son was recently approved for SSI benefits, so I paid a visit to our local credit union (Michigan Schools & Gov't CU) to set up an account for him. While there, I asked about their requirements for credit card approvals. The branch manager pulled up my account and said that I was eligible for instant approval (that is, without having to consult with an underwriter). I was approved for their 1% rewards Visa with an SL of $10K and their lowest APR (currently 9.25%). They pulled Experian and reported a score of 740, which must be something other than FICO 8 (Experian refreshed my report today and they report a FICO 8 of 778). Perhaps they pulled one of the mortgage scores instead?

According to the branch manager, they routinely offer 5% bonus rewards in categories that change each month (which makes it similar to the Langley cash back card). But I can't log into the rewards site until tomorrow to register for whatever they're currently offering.

It's a pretty lackluster card overall, but I'm only planning to use it for my son's recurring expenses, which will make it easier to generate a spending report if SSA ever decides to look into how I'm spending his benefits.

Anyways, here are the DPs: annual income $134K, DTI is roughly 20%, 23 INQs in the last 24 months (I knew it was a lot, but, like, whoa), util is just below 2%, and total CLs across all accounts now stands at $176,250.

Nice![]() ill take a 10k 1% sub 10% apr card anyday. I thought this was Madison Square Garden Credit Union

ill take a 10k 1% sub 10% apr card anyday. I thought this was Madison Square Garden Credit Union![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

@AverageJoesCredit wrote:Nice

ill take a 10k 1% sub 10% apr card anyday. I thought this was Madison Square Garden Credit Union

Nah. I'm far, far away from that MSG! 😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

Congratulations on your approval!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

Congratulations on your MSGCU approval!

Current FICO 8 | 9 (February 2024):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

Congratulations on your approval!

FICO 8 (Sept 2022):EX- 706, TU- 685, EQ- 684

What's in my wallet:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

@5KRunner wrote:My oldest son was recently approved for SSI benefits, so I paid a visit to our local credit union (Michigan Schools & Gov't CU) to set up an account for him. While there, I asked about their requirements for credit card approvals. The branch manager pulled up my account and said that I was eligible for instant approval (that is, without having to consult with an underwriter). I was approved for their 1% rewards Visa with an SL of $10K and their lowest APR (currently 9.25%). They pulled Experian and reported a score of 740, which must be something other than FICO 8 (Experian refreshed my report today and they report a FICO 8 of 778). Perhaps they pulled one of the mortgage scores instead?

According to the branch manager, they routinely offer 5% bonus rewards in categories that change each month (which makes it similar to the Langley cash back card). But I can't log into the rewards site until tomorrow to register for whatever they're currently offering.

It's a pretty lackluster card overall, but I'm only planning to use it for my son's recurring expenses, which will make it easier to generate a spending report if SSA ever decides to look into how I'm spending his benefits.

Anyways, here are the DPs: annual income $134K, DTI is roughly 20%, 23 INQs in the last 24 months (I knew it was a lot, but, like, whoa), util is just below 2%, and total CLs across all accounts now stands at $176,250.

How interesting to find another person that lives in Michigan and is near an MSGCU branch.

MSGCU uses Ex FICO 3 which is more sensitive about everything including ULT and HPs. As for the rewards, I am close to getting that card, but I think the monthly 5% rewards maybe a mistake. If they do such a thing, it would have been listed on the Rewards Card page. To the website, the only thing extra is the extra 5,000 points meeting the requirements.

Loans

Ford Credit Car Loan 2-year 6/22/2023 ($299/month)

Closed

Michigan Schools & Gov't CU Titanium 1/4/2019 - 10/2/2020

Ford Credit Car Loan 3-year 7/31/2018-6/6/2021

$1,500 Discover Card 10/2/2020 - 8/18/2021

$3,500 Citi DC 10/14/2020 - 12/11/2021

$8,000 DCU Personal Loan 5-year 5.99% 10/2/2020 - 4/30/2021

$8,000 NFCU CashRewards 1/2/2021 - 7/30/2022

$5,000 MSGCU Personal Loan 3-year 7.75% 4/22/2022 - 10/30/2022

Ford Credit Car Loan 2-year 6/7/2021 - 6/22/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

2018 Dec Starting Score: 700

2018 Dec Starting Score: 700Current Score: 778

Achieved Goal Score 2020: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

@ZackAttack wrote:How interesting to find another person that lives in Michigan and is near an MSGCU branch.

MSGCU uses Ex FICO 3 which is more sensitive about everything including ULT and HPs. As for the rewards, I am close to getting that card, but I think the monthly 5% rewards maybe a mistake. If they do such a thing, it would have been listed on the Rewards Card page. To the website, the only thing extra is the extra 5,000 points meeting the requirements.

I thought the same thing... why wouldn't you promote such a benefit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

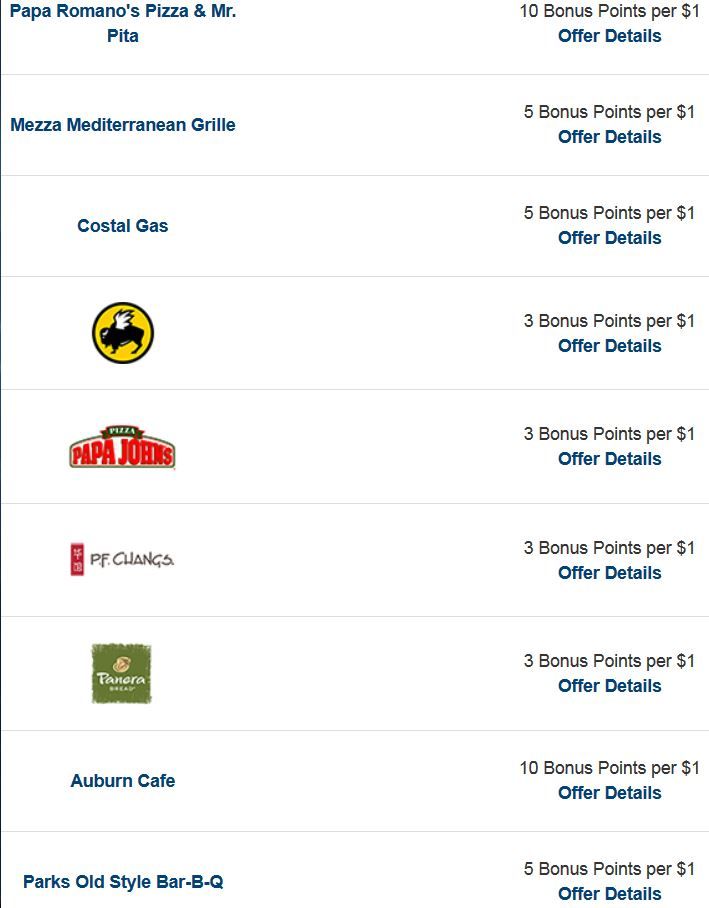

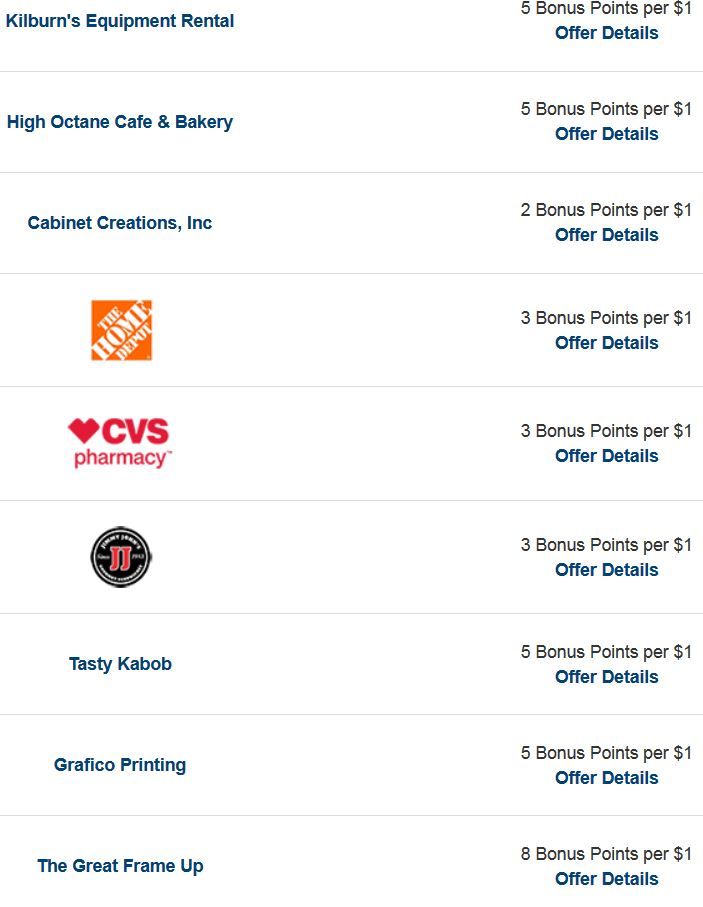

Update for @ZackAttack - I figured out how to access those extra bonus points: while logged into online account management, click on the VISA Rewards link (I suspect that's only active once you've been approved for the card). Then click on the "Open in a new tab" button to get a full-screen view. From there, scroll down toward the bottom and click on Scoremore. It's based on specific retailers rather than categories, so it operates similarly to offers I've seen on my Wells Fargo and PNC cards.

Here's a sample list of active in-store bonuses (and there's another section with offers that require activation, and yet another for online-only offers):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: MSGCU Rewards Visa Approval

Here's another tidbit for those who may be eligible for membership: they instantly issue cards in-branch if you're approved. I walked out with my debit card and credit card, as well as my son's debit card. Very nice!