- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: More BoA AAA Rewards Visa Love! $55K-$65K!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

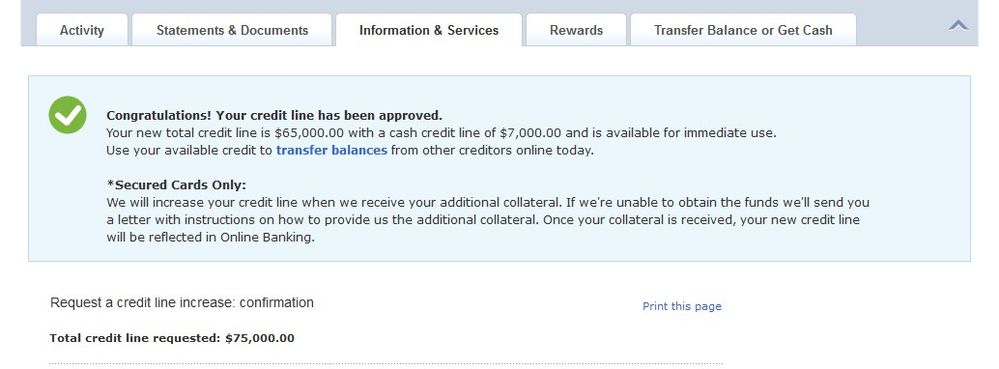

More BoA AAA Rewards Visa Love! $55K-$65K!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:

I opened a University of Michigan Alumni Cash Rewards card with BofA on 8/3/17 and it has grown rapidly; by the two-year anniversary it could be at six figures:8/23/17 - $2,000 Platinum Visa

11/25/17 - $5,900 - Hard pull

3/26/18 - $13,000 - Hard pull

3/29/18 - Requested conversion to Visa Signature

7/3/18 - $23,100 - Soft pull

10/6/18 - $37,000 - Soft pull

1/5/19 - $50,000 - Soft pull

4/29/19 - $70,000 - Soft pull

Very cool! Do you or anyone know what sort of limit BoA generally caps out at relative to income? Also, is there a way or source anyone know of to check out all of BoA's CC offerings? On their site I only see 4 cards, where there are obviously others as indicated by MiB above?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:

@Anonymous wrote:

I opened a University of Michigan Alumni Cash Rewards card with BofA on 8/3/17 and it has grown rapidly; by the two-year anniversary it could be at six figures:8/23/17 - $2,000 Platinum Visa

11/25/17 - $5,900 - Hard pull

3/26/18 - $13,000 - Hard pull

3/29/18 - Requested conversion to Visa Signature

7/3/18 - $23,100 - Soft pull

10/6/18 - $37,000 - Soft pull

1/5/19 - $50,000 - Soft pull

4/29/19 - $70,000 - Soft pull

Very cool! Do you or anyone know what sort of limit BoA generally caps out at relative to income? Also, is there a way or source anyone know of to check out all of BoA's CC offerings? On their site I only see 4 cards, where there are obviously others as indicated by MiB above?

https://www.bankofamerica.com/credit-cards/#filter

Click on "View All Cards" at the top. This isn't a complete list, but there's 22 different offerings.

For the AAA Rewards card that I have, visit...

https://www.calif.aaa.com/financial/aaa-credit-card.html

Note: There are AAA Rewards card available for most AAA regions. Simply Google "AAA Rewards Card" along with the particular AAA network that you belong to.

As far as where CL's top out, @K-in-Boston is hitting a $99.9K ceiling on a BoA card or two, if I'm not mistaken. I would guess his income is at least in the mid 6 figures from his line up. My provable income between my wife and I is around $175K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

well done!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@ChargedUp wrote:Click on "View All Cards" at the top. This isn't a complete list, but there's 22 different offerings.

For the AAA Rewards card that I have, visit...

Thanks. Seems like a lot of travel cards and since I don't travel, those are ruled out for me. The majority of the rest all seem like their basic Cash Rewards card with just a different paint job on them. I've always viewed "3-2-1" cards as simply a "3" card, as a 2% general CB card covers the 2-1. That being said, I don't see much value in taking on a 3% single category CB card, especially when my Freedom and Discover would likely render that 3% category useless 25%-50% of the year. Oh well. I guess I was hoping for something a bit more appealing to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:

@ChargedUp wrote:Click on "View All Cards" at the top. This isn't a complete list, but there's 22 different offerings.

For the AAA Rewards card that I have, visit...

Thanks. Seems like a lot of travel cards and since I don't travel, those are ruled out for me. The majority of the rest all seem like their basic Cash Rewards card with just a different paint job on them. I've always viewed "3-2-1" cards as simply a "3" card, as a 2% general CB card covers the 2-1. That being said, I don't see much value in taking on a 3% single category CB card, especially when my Freedom and Discover would likely render that 3% category useless 25%-50% of the year. Oh well. I guess I was hoping for something a bit more appealing to me.

I get what you're saying... This card may have fallen to the sock drawer if it hadn't grown to be my highest CL (by a HUGE margin!). While I'd rather be earning UR points, I gotta give love to where I get love. BoA has earned a good spot in my wallet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@ChargedUp wrote:Ahh, the reasons I love BoA! They show my TU at 740 as of 5/22.

Wow that's an enormous CL - congratulations! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@ChargedUp wrote:

@Anonymous wrote:

@Anonymous wrote:

I opened a University of Michigan Alumni Cash Rewards card with BofA on 8/3/17 and it has grown rapidly; by the two-year anniversary it could be at six figures:8/23/17 - $2,000 Platinum Visa

11/25/17 - $5,900 - Hard pull

3/26/18 - $13,000 - Hard pull

3/29/18 - Requested conversion to Visa Signature

7/3/18 - $23,100 - Soft pull

10/6/18 - $37,000 - Soft pull

1/5/19 - $50,000 - Soft pull

4/29/19 - $70,000 - Soft pull

Very cool! Do you or anyone know what sort of limit BoA generally caps out at relative to income? Also, is there a way or source anyone know of to check out all of BoA's CC offerings? On their site I only see 4 cards, where there are obviously others as indicated by MiB above?

https://www.bankofamerica.com/credit-cards/#filter

Click on "View All Cards" at the top. This isn't a complete list, but there's 22 different offerings.

For the AAA Rewards card that I have, visit...

https://www.calif.aaa.com/financial/aaa-credit-card.html

Note: There are AAA Rewards card available for most AAA regions. Simply Google "AAA Rewards Card" along with the particular AAA network that you belong to.

As far as where CL's top out, @K-in-Boston is hitting a $99.9K ceiling on a BoA card or two, if I'm not mistaken. I would guess his income is at least in the mid 6 figures from his line up. My provable income between my wife and I is around $175K.

KiB is one of several people here at the $99.9K total CL across all cards, that's a fairly common threshold and there have been DP of people already at that limit who successfully applied for another card only to discover that BoA reallocated the entire CL from another card.

However I'm at $121K total right now with them and I know there are least 2 other members that have quite a bit more than that, so the $99.9K threshold is not an absolute limit.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:

@Anonymous wrote:Very cool! Do you or anyone know what sort of limit BoA generally caps out at relative to income? Also, is there a way or source anyone know of to check out all of BoA's CC offerings? On their site I only see 4 cards, where there are obviously others as indicated by MiB above?

It appears that the cap is at $99,900; above that you'll probably want to look at their Merrill Lynch card(s).

BofA offers affinity cards to university alumni associations and other organizations. You'll typically receive an invitation to apply through the organization rather than directly from BofA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:

@ChargedUp wrote:Click on "View All Cards" at the top. This isn't a complete list, but there's 22 different offerings.

For the AAA Rewards card that I have, visit...

Thanks. Seems like a lot of travel cards and since I don't travel, those are ruled out for me. The majority of the rest all seem like their basic Cash Rewards card with just a different paint job on them. I've always viewed "3-2-1" cards as simply a "3" card, as a 2% general CB card covers the 2-1. That being said, I don't see much value in taking on a 3% single category CB card, especially when my Freedom and Discover would likely render that 3% category useless 25%-50% of the year. Oh well. I guess I was hoping for something a bit more appealing to me.

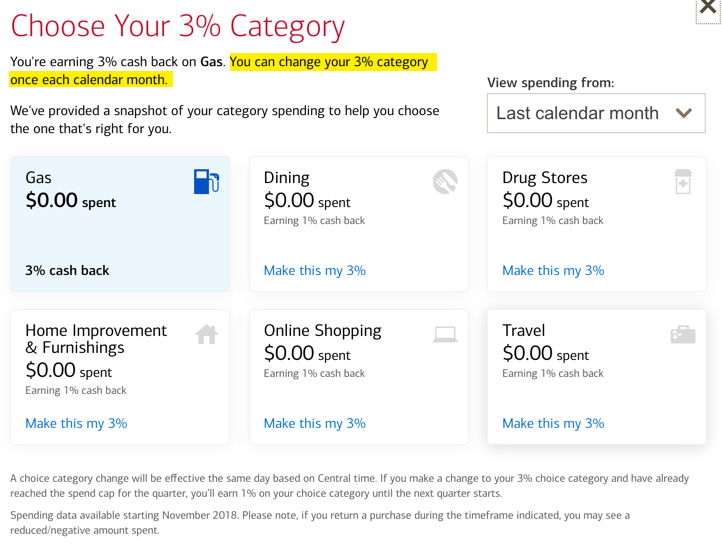

After a recent change you can now assign the 3% category on a monthly basis among several categories. That's different from cards like the Freedom and Discover cards where you can't change reward categories. As far as I know, the only other card that allows you to change categories monthly is the U.S. Bank Cash+ where you can modify the 5% category choice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More BoA AAA Rewards Visa Love! $55K-$65K!

@Anonymous wrote:It appears that the cap is at $99,900; above that you'll probably want to look at their Merrill Lynch card(s).

I guess my next question for anyone at $99.9k would be what your income is, or perhaps better put who with $99.9k out there has the lowest reported income?