- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- NFCU 91/3 approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU 91/3 approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@Anonymous wrote:I'm in the same situation as you I think. Started with Navy with a $500 CL Cash Rewards Card and I am eagerly awaiting my 3rd statement / 91st day. Would you mind providing a few more data points? I see what your FICO scores are, but would you mind providing your income, whether you have any baddies on your credit, and what other products you have with navy (I.e. do you have a checking and / or savings account there, do you have direct deposit going there, do you have any other loan products there, etc.)

Sure thing! They pulled transunion.

Fico8- 703

Fico9- 689

$45k income

0 collections

20 inq (including hp for this card)

11 derogs? (These are paid Charge off's still on my report)

5% UTI

I have a checking and savings account with navy that I opened 2/20/20. Applied for the cash rewards the same day. I use this as my main bank account and get my pay check direct deposited to it. I also was approved for the Emergency relief loan ($1k) with navy on 4/26/20.

Also, my CLI was DENIED. I called in this morning and spoke with a rep. Ugh, well I'm still grateful for the new card. I never received a hp for the cli. I wonder if it's because I was given an auto cli at the beginning of April. My EQ 9 is 672 as of 5/7/20.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

Congrats on your approval!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@Anonymous wrote:

@Anonymous wrote:I'm in the same situation as you I think. Started with Navy with a $500 CL Cash Rewards Card and I am eagerly awaiting my 3rd statement / 91st day. Would you mind providing a few more data points? I see what your FICO scores are, but would you mind providing your income, whether you have any baddies on your credit, and what other products you have with navy (I.e. do you have a checking and / or savings account there, do you have direct deposit going there, do you have any other loan products there, etc.)

Sure thing! They pulled transunion.

Fico8- 703Fico9- 689

$45k income0 collections

20 inq (including hp for this card)

11 derogs? (These are paid Charge off's still on my report)

5% UTI

I have a checking and savings account with navy that I opened 2/20/20. Applied for the cash rewards the same day. I use this as my main bank account and get my pay check direct deposited to it. I also was approved for the Emergency relief loan ($1k) with navy on 4/26/20.

Also, my CLI was DENIED. I called in this morning and spoke with a rep. Ugh, well I'm still grateful for the new card. I never received a hp for the cli. I wonder if it's because I was given an auto cli at the beginning of April. My EQ 9 is 672 as of 5/7/20.

I have a question that hopefully you can answer. I opened my NFCU cashRewards a couple of months after yours and received a $500 SL also. I also have some paid derogatories on my CR. TU is my lowest FICO score. I was hoping they would pull my Equifax 9 for my next app, as it's 716.

I'm trying to figure out the prism through which they view me as far as when I should apply for my next card: three months (I doubt it). So six months or a year later. I received a new credit card just a couple of weeks before NFCU and another card the following month, so three new CCs, including NFCU, all within the span of two months. I think getting the BB&T CC after NFCU will affect me as to when I should time my next app with NFCU. In some paperwork (I believe regarding my internal score), they did mention something about the amount of accounts I had opened within the past 24 months.

So my question is: How many CCs did you open within the past 12 months and what months? Were any close in time to opening your first NFCU CC in February, or after?

Thanks.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

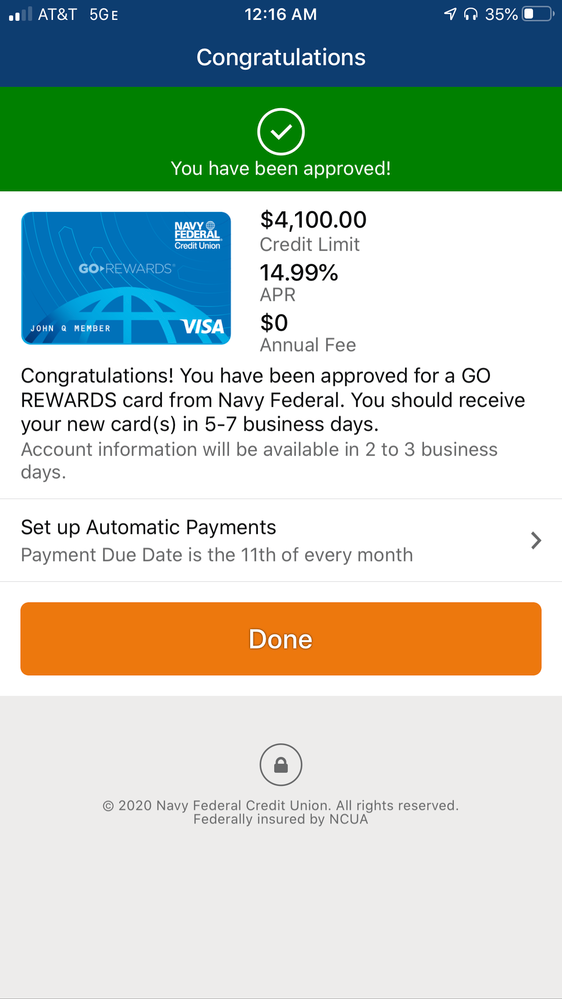

@Anonymous Super Congrats on your Navy Fed GO Rewards $4,100 approval! ![]()

Best of luck as you continue to rebuild. You are certainly on the right track now! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@Anonymous wrote:... Also, my CLI was DENIED ...

Many are denied the 1st CLI attempt -- fret not. ![]() It will grow, just add water & a little sunshine now and then.

It will grow, just add water & a little sunshine now and then. ![]() Congrats! on your new card & thanks for adding those DPs.

Congrats! on your new card & thanks for adding those DPs. ![]() Long Live Navy!

Long Live Navy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@Jannelo wrote:

@Anonymous wrote:

@Anonymous wrote:I'm in the same situation as you I think. Started with Navy with a $500 CL Cash Rewards Card and I am eagerly awaiting my 3rd statement / 91st day. Would you mind providing a few more data points? I see what your FICO scores are, but would you mind providing your income, whether you have any baddies on your credit, and what other products you have with navy (I.e. do you have a checking and / or savings account there, do you have direct deposit going there, do you have any other loan products there, etc.)

Sure thing! They pulled transunion.

Fico8- 703Fico9- 689

$45k income0 collections

20 inq (including hp for this card)

11 derogs? (These are paid Charge off's still on my report)

5% UTI

I have a checking and savings account with navy that I opened 2/20/20. Applied for the cash rewards the same day. I use this as my main bank account and get my pay check direct deposited to it. I also was approved for the Emergency relief loan ($1k) with navy on 4/26/20.

Also, my CLI was DENIED. I called in this morning and spoke with a rep. Ugh, well I'm still grateful for the new card. I never received a hp for the cli. I wonder if it's because I was given an auto cli at the beginning of April. My EQ 9 is 672 as of 5/7/20.

I have a question that hopefully you can answer. I opened my NFCU cashRewards a couple of months after yours and received a $500 SL also. I also have some paid derogatories on my CR. TU is my lowest FICO score. I was hoping they would pull my Equifax 9 for my next app, as it's 716.

I'm trying to figure out the prism through which they view me as far as when I should apply for my next card: three months (I doubt it). So six months or a year later. I received a new credit card just a couple of weeks before NFCU and another card the following month, so three new CCs, including NFCU, all within the span of two months. I think getting the BB&T CC after NFCU will affect me as to when I should time my next app with NFCU. In some paperwork (I believe regarding my internal score), they did mention something about the amount of accounts I had opened within the past 24 months.

So my question is: How many CCs did you open within the past 12 months and what months? Were any close in time to opening your first NFCU CC in February, or after?

Thanks.

At the time of apping in feb 2020 I had 7 new accounts in 12 months. 4 of which were reporting at the time of my app that were opened 2/2019, 03/2019, 04/2019, and 12/2019. The other three new accounts weren't reporting because I had apped 5 days before apping for the cash rewards.

I had one new account report 03/2020 with discover. I also was approved for a loan with NFCU 4/2020

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

Congrats

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@Anonymous wrote:Hey y'all. I apped for the cash rewards card on 2/20/20 and was approved with a $500 limit. With the pandemic, I was given an auto cli that brought my limit to $1k. I have had my 91/3 marked on my calendar since I learned what it meant. I'm actually at about 92 or 93 days. When I opened the app 5/23, it said that my statement end date is 5/24, so I figured they were in the process of cutting the statement. Me, being my impatient self, I requested an increase on my cash rewards and got the 24 hours message. I haven't gotten a hp notification so I guess I'll wait it out and see what happens.

Now, on to the approval. At midnight 5/24 I saw that my statement finally cut so I decided to try my luck and just app for the Go rewards card and see what happens. I got approved for a $4,100 limit! My highest limit so far. Y'all, I am so happy. I have been on a major rebuild journey. My scores were in the 500's and low 600's in dec 2019. In just the past 5 months I've raised them a good amount. I was hoping for a super crazy high limit but I know that this card will grow.

Thats fantastic![]() . My heart always goes out for those of us who have to really work to climb the Navy cl/cli ladder but it will happen

. My heart always goes out for those of us who have to really work to climb the Navy cl/cli ladder but it will happen![]() . It might take us longer to achieve a 20k plus limit but when it happens its the most amazing feeling

. It might take us longer to achieve a 20k plus limit but when it happens its the most amazing feeling![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

@AverageJoesCredit wrote:

@Anonymous wrote:Hey y'all. I apped for the cash rewards card on 2/20/20 and was approved with a $500 limit. With the pandemic, I was given an auto cli that brought my limit to $1k. I have had my 91/3 marked on my calendar since I learned what it meant. I'm actually at about 92 or 93 days. When I opened the app 5/23, it said that my statement end date is 5/24, so I figured they were in the process of cutting the statement. Me, being my impatient self, I requested an increase on my cash rewards and got the 24 hours message. I haven't gotten a hp notification so I guess I'll wait it out and see what happens.

Now, on to the approval. At midnight 5/24 I saw that my statement finally cut so I decided to try my luck and just app for the Go rewards card and see what happens. I got approved for a $4,100 limit! My highest limit so far. Y'all, I am so happy. I have been on a major rebuild journey. My scores were in the 500's and low 600's in dec 2019. In just the past 5 months I've raised them a good amount. I was hoping for a super crazy high limit but I know that this card will grow.

Thats fantastic

. My heart always goes out for those of us who have to really work to climb the Navy cl/cli ladder but it will happen

. It might take us longer to achieve a 20k plus limit but when it happens its the most amazing feeling

.

Amen @AverageJoesCredit , Congratulations 🎉🎈 🍾, @Anonymous and as I always say, you Gotta LOVE NAVY!!! Hang in there, swipe, pay, repeat and the CLIs will come!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU 91/3 approval

Thanks everyone for your kind words!