- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- NFCU CashRewards Denial/FNBO Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU CashRewards Denial/FNBO Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU CashRewards Denial/FNBO Approval

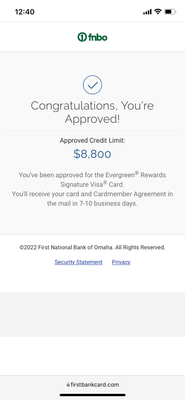

I wanted to get a relationship started with NFCU to garden for the long haul but submitted an app for the CashRewards and was instantly denied (waiting for denial letter to update post). I went over to FNBO pre qualify tool to see where I stood as I’m looking to get rid of my capital one quicksilver because there is better flat cash back cards. FNBO approved me for 8800 SL instantly with no review or income verification.

Income 52k

New accounts 2/6 5/12 6/24

Ex:741 EQ:749 TU:736

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

Grats![]() Sorry about the Navy denial. Very weird considering your current profile seems good enough. Is your profile relatively new?

Sorry about the Navy denial. Very weird considering your current profile seems good enough. Is your profile relatively new?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

Congratulations on your FNBO approval! I'm sorry to hear about your Navy Federal denial! Your current cards lineup and Fico scores make this even more surprising to me! Hopefully next time you apply they will approve you.

Had you considered maybe getting their secured card? I think they could use the same pull to approve you for it. I wouldn't think that someone with your profile would normally get a secured card, but with your goal of establishing a relationship with them I think that could be a good alternative step. You'd likely graduate in 6 months to the Cash Rewards card and then be in a great postiion to get your 2nd Navy Federal card with a decent limit.

Another alternative could be to do one of their Pledge Loans. You could deposit $250 into your Share Account and then call them to set up the Pledge loan (secured loan). In 6 months when you pay it off the chances of approval for a credit card would be great! Best wishes to you with whatever you decide to do!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

Congratulations on your FNBO approval!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

Grats on your FNBO approval ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

Congratulations on your FNBO Approval![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

@Anonymous wrote:Yes, the AAoA is 10 months and AoOA is 2.3 years, I was kind of shocked as well after reading about NFCU on here I was really expecting to get approved even if the SL was on the lower end for the first nfcu card. Definetly looking to phase out my cap 1 QS would it be better in the future to try and PC the quicksilver?

Yes, the AAoA is 10 months and AoOA is 2.3 years, I was kind of shocked as well after reading about NFCU on here I was really expecting to get approved even if the SL was on the lower end for the first nfcu card. Definetly looking to phase out my cap 1 QS would it be better in the future to try and PC the quicksilver?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

@Jordan23ww wrote:Congratulations on your FNBO approval! I'm sorry to hear about your Navy Federal denial! Your current cards lineup and Fico scores make this even more surprising to me! Hopefully next time you apply they will approve you.

Had you considered maybe getting their secured card? I think they could use the same pull to approve you for it. I wouldn't think that someone with your profile would normally get a secured card, but with your goal of establishing a relationship with them I think that could be a good alternative step. You'd likely graduate in 6 months to the Cash Rewards card and then be in a great postiion to get your 2nd Navy Federal card with a decent limit.

Another alternative could be to do one of their Pledge Loans. You could deposit $250 into your Share Account and then call them to set up the Pledge loan (secured loan). In 6 months when you pay it off the chances of approval for a credit card would be great! Best wishes to you with whatever you decide to do!

Once I received the denial letter I was going to try and recon to figure it out or see if at the very least they could turn my HP into a secured card to build that relationship up, I have not been a member very long maybe a little over a month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

That's terrific!! Congratulations on your FNBO Approval!! 🎉🥂👏

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU CashRewards Denial/FNBO Approval

There you go! When one lender won't approve you, another one will! 😂

Congrats on your FNBO approval 👏!