- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- NFCU Credit Approval relationship datapoints... my...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU Credit Approval relationship datapoints... my journey

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU Credit Approval relationship datapoints... my journey

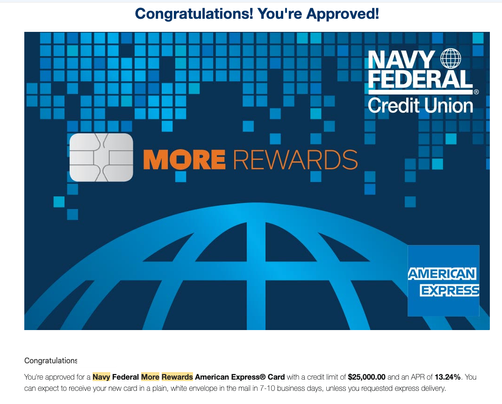

Got approved for More Rewards Amex in Late June this is some info to use for data points and a possible new member lan of action...

Here is my 5 month old NFCU journey.

- 3/7/2022 Joined Navy Federal with $250 cashed from my Evergreen Visa for which I got 2% rewards.

- Everyday Checking ($100) and Savings ($150) on initial opening

- Started a bi weekly transfer (~$501.23) using Astra to mimic Direct Deposit (some banks have given me credit for DD for these transfers.)

- 4/26/2022 Applied for CLOC (Everyday Checking) - Application Approved for $500. Hard Pull Transunion.

- 4/28/2022 Deposited additional funds to use for Pledge Loan $2400

- Late night on 4/28, opened Pledge Loan via telephone for $2400 for 36 months @ 2.25%

- 4/29/2022 Started bill pay from checking to start paying other bills

- 4/29/2022 Payed 93% ($2232) of Pledge Loan as soon as the loan was visible on my account leaving $168 and next payment of 2/14/2025, I divided the balance by the remaining term and pay $4 per month, though my understanding is NFCU reports PAid as Agreed regardless as the $2232 is a "prepay" of the loan.

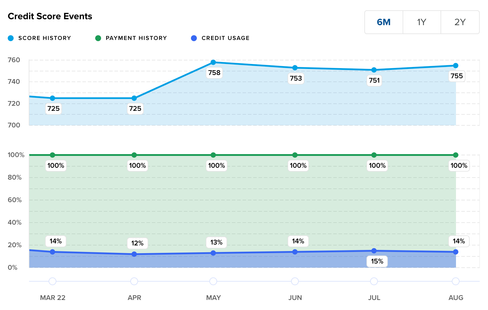

- 5/1/2022 Pledge Loan reported to CRAs and my FICO jumped ~38 points for each bureau. (averaged 750)

This is a vantage chart but shows the jump from the pledge loan hack

- Some day in May I converted (easy online product change) the Everyday Checking to Flagship Checking and updated my real Direct Deposit to the Flagship checking account. I wasn't ready to keep the $1500 average daily balance for flagship (to have a $0 fee) until this time.

Opened second checking account as Everyday Checking. I use Flagship as incoming Income, and Everyday to pay all non-NFCU bills.

- Shortly after May 3rd, the payment amount was released from the pledge loan and back available for my use as cash again.

- 5/20/2022 Opened 12 Mo Savings CD which had a 2.9% offer, and a bonus of $30 if had recurring transfer 3 times before 60 days from opening. Setup bi-weekly transfer to the CD.

- 6/7/2022 received a email offer for More Rewards, then a snail-mail offer a few days later.

- 6/24/2022 accepted the offer at surprising SL of $25K @Anonymous.24% with 0.99% for 1 year. Hard Pull Transunion.

Since this relationship has started to prove it self less than 4 months in, I cancelled a 24 year old CAPOne account , for which they had bucketed me and couldn't get a CLI to save a life.

DTI is 4%

UTI ~14%

0 Baddies since 2018

> $130K income

This goes to show you using their products can get you going with the credit products pretty quick. YMMV of course

I have not received my Internal Score, but will update when I have it.

————-

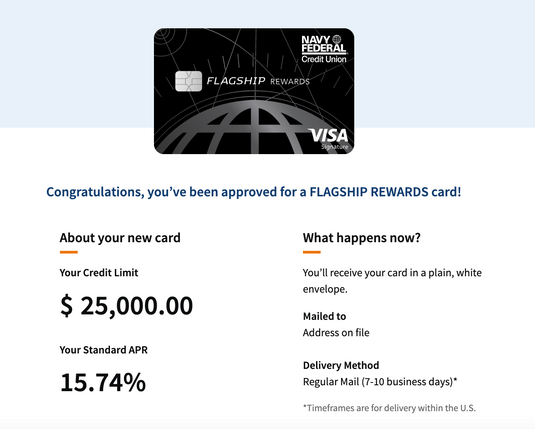

Added to my approval with NFCU today 10/20 Relationship age 7 months 13 days.

Applied and was approved for Flagship Visa SL $25K

Total for my 2 cards currently $50K

Hard Pull notified in Mission: Credit Confidence, Transunion HP confirmed.

Will post Internal score also.

I will be gardening for a while now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

Congrats. Hope that old Cap card doesnt hurt your AoOA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

Amazing! Congrats!

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

Congrats, and thanks for the DPs. Did you learn your internal score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

Great DP, makes me think I should try out the pledge loan to build the relationship a bit more along with my CD and direct deposit. Is the CLOC a hard pull?

Business Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

Congrats on your NFCU More Rewards approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

I'll update my post, Yes it was a Hard pull on Transunion. I have the least pulls there, so was not too worried.

Pledge loan for relationship is probably not as big a win as the credit mix benefit (if you don't have an installment loan already.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

I didn't but will update when I get it.

@Anonymalous wrote:Congrats, and thanks for the DPs. Did you learn your internal score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

AaOA is still 8y8m. The CapOne account was my second to oldest, but had an annual fee (was an older Direct Merchants Bank card I believe so probably bucketed as sub prime), To me was worth more gone than keeping it for the age. I believe I was hit 1-2 points when that was cancelled but have those back already. I have 2 others (22y and 14 y). Those are a little better on the limits, but recent CLI requests were measley $250 increase on one and denied on the other.

@FireMedic1 wrote:Congrats. Hope that old Cap card doesnt hurt your AoOA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Credit Approval as a you relationship... my journey

My understanding is the Flagship Checking holds alot of weight on internal scores. Good luck with it. Your current card limits and scores look like they would fall in line with some approvals through them for that goal More Rewards goal card.