- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- NFCU is really a joke to me!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU is really a joke to me!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU is really a joke to me!!!

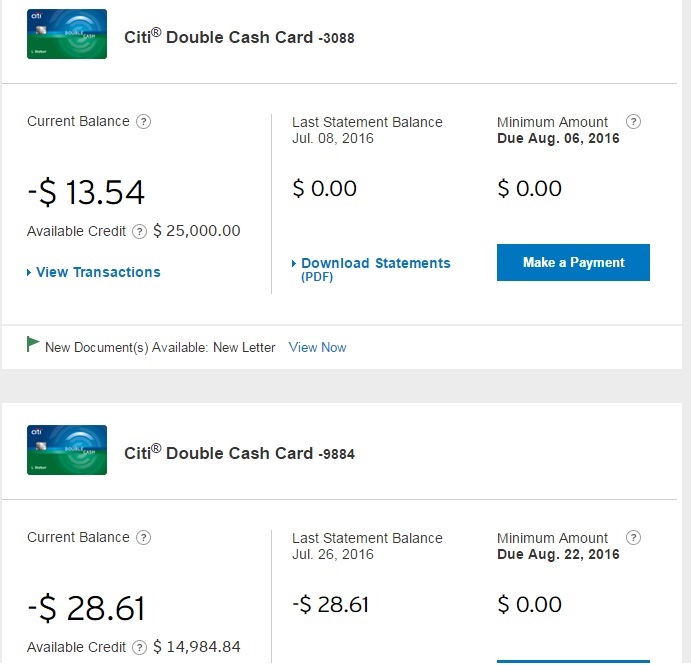

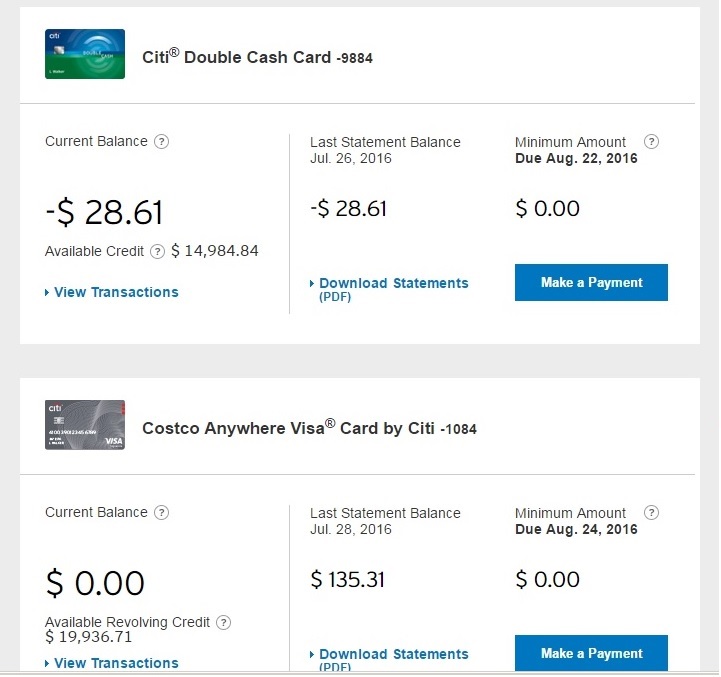

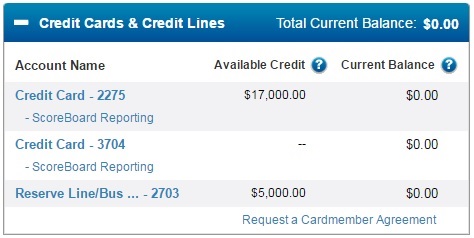

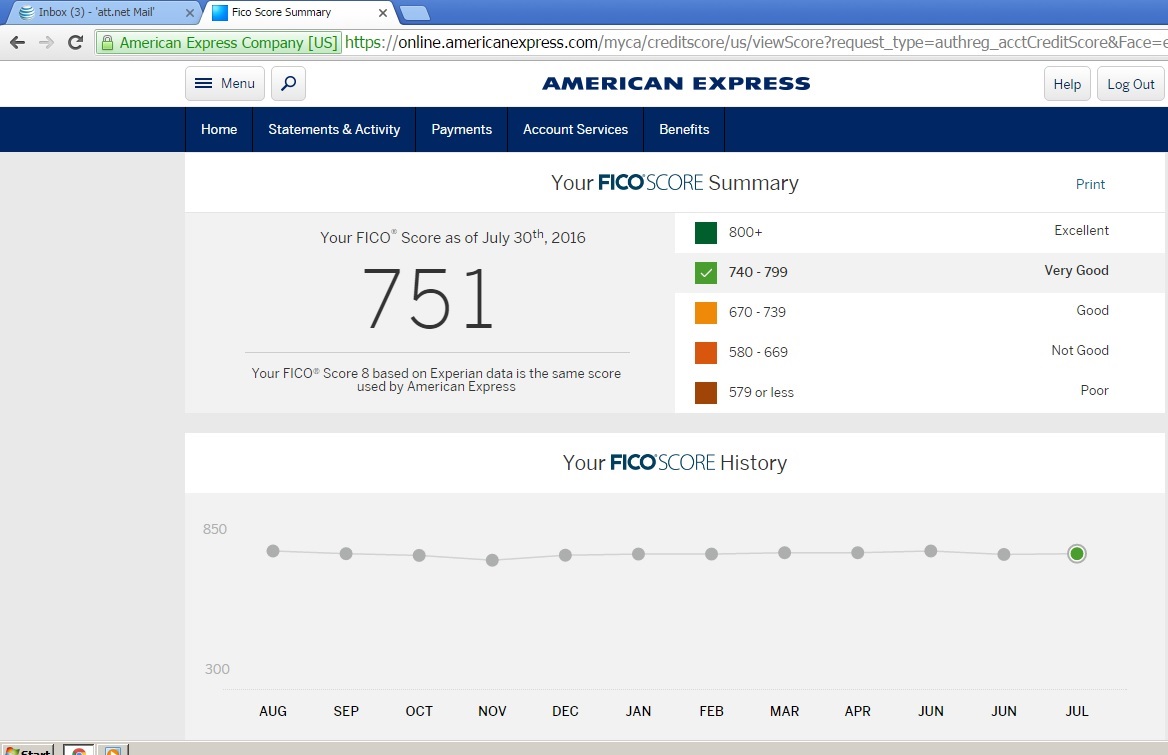

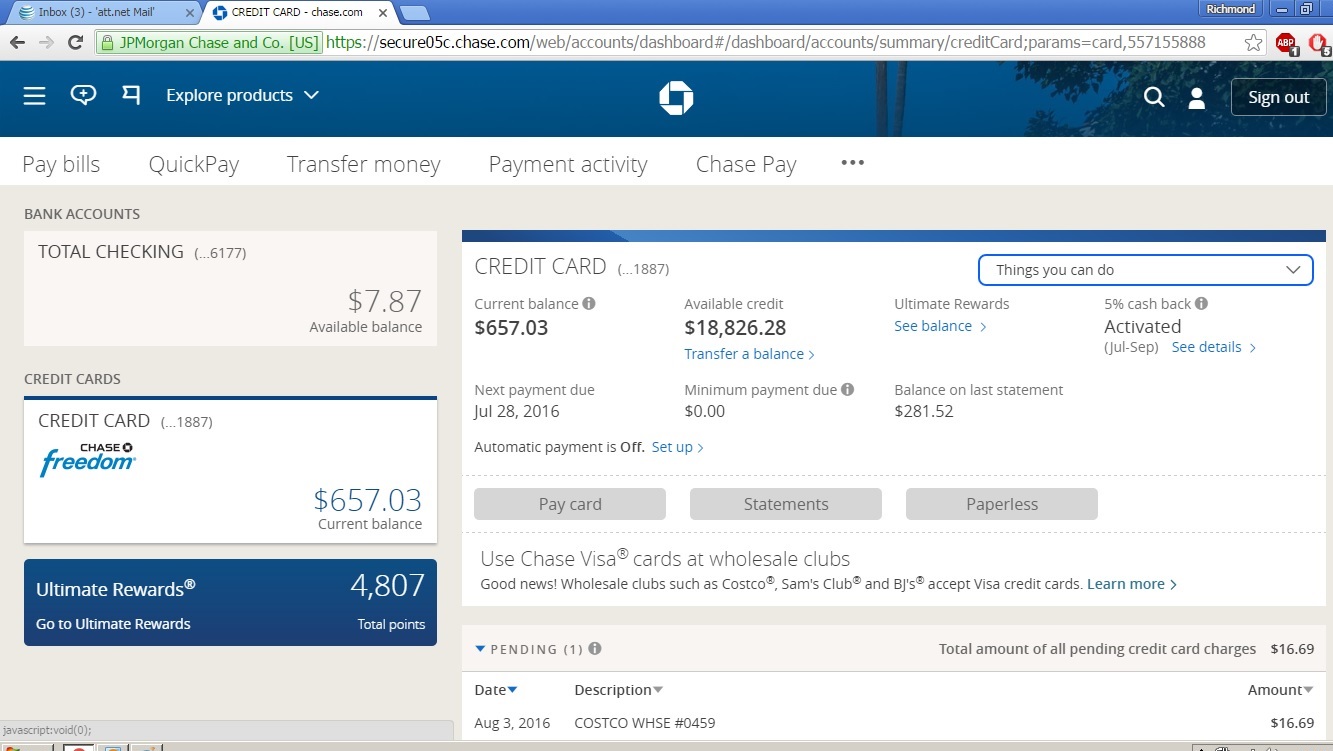

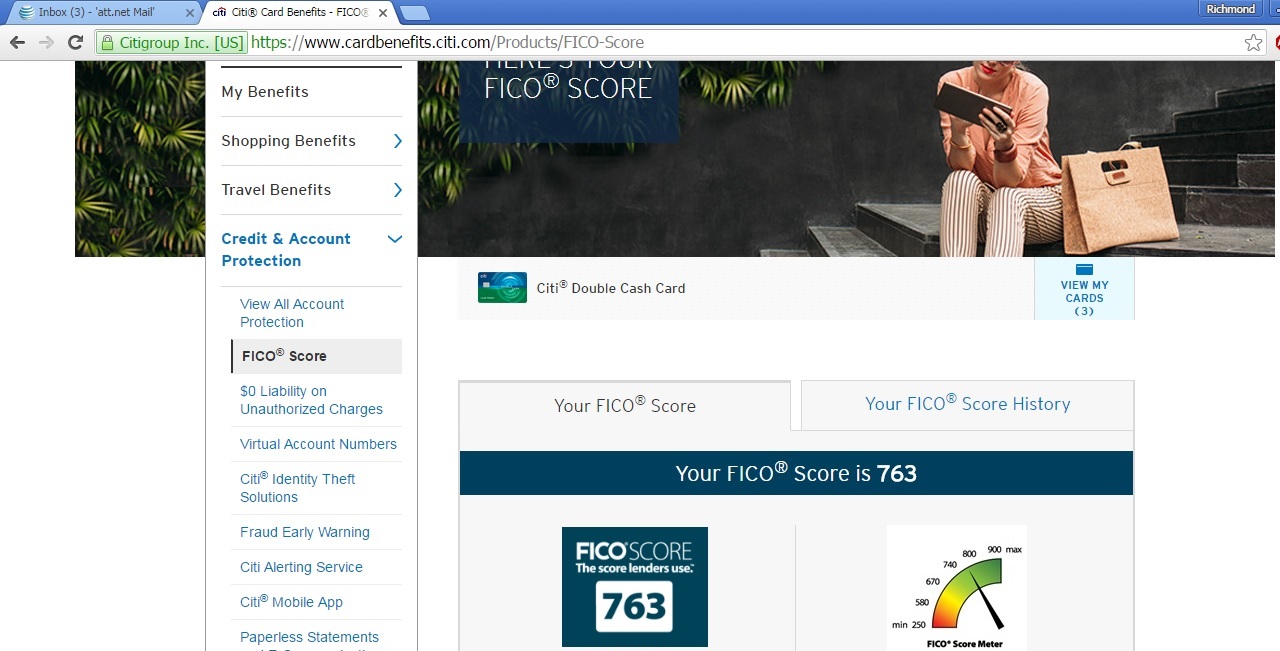

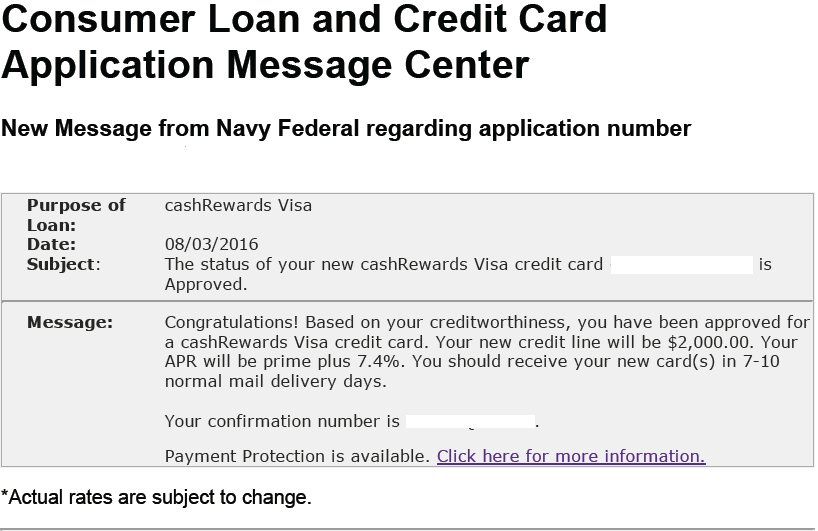

The pics say it all! I rarely travel, so a travel card is not my choice. However, I'm gonna have a short trip soon, thus a card without foreign transaction fee with a good benefit is in mind. Speaking of which, why not cashReward from Navy Federal over Quicksilver from CARP ONE? Look at what they did to me with an HP! I'm done with Navy Federal!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

So, they are a joke because they didn't give you the credit limit you wanted? They assess your profile at the time of the application and make their decision. Maybe they think you have too much credit? Just because you have other cards with high limits that doesn't mean that they will match them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

Yup.

Your lines (especially Citi) look about as outstanding as it gets and such.

There seems to be some sort of a twisted twang in their system at least starting out with some of us.

Crap even i got a mildly and somewhat sheepish (compared to MANY) $4K SL but i'm just gonna sit on that for now until the next AR or better yet as Creditaddict seems to suggest, at least until after 3-4 full statement cuts and see how they are on increases.

I wouldn't get too bent out of shape just yet though (although i do get it) because there have been results for some low limit cardholders where they really bloat up your credit limit from those.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

@jace8602 wrote:So, they are a joke because they didn't give you the credit limit you wanted? They assess your profile at the time of the application and make their decision. Maybe they think you have too much credit? Just because you have other cards with high limits that doesn't mean that they will match them.

It's not about the limit I wanted. It's about their scoring system, model. Some cardholders have very thin file but are given a wacky starting line of 25K. My credit history is 17 years and 9 months with no late payment even once, always PIF and look at what I got.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

Sometimes the best APR end up in a very low SL, you can always request a CLI upon activation. You have the option to request max amount which goes up to 50k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

@nrm wrote:

@jace8602 wrote:So, they are a joke because they didn't give you the credit limit you wanted? They assess your profile at the time of the application and make their decision. Maybe they think you have too much credit? Just because you have other cards with high limits that doesn't mean that they will match them.

It's not about the limit I wanted. It's about their scoring system, model. Some cardholders have very thin file but are given a wacky starting line of 25K. My credit history is 17 years and 9 months with no late payment even once, always PIF and look at what I got.

Approvals are based on more than just scores. Just becuase I have a 745+ score (which I do) it doesn't mean that I would get high limits. Fortunately like mentioned previously they do AR often and you can get a nice CLI. I know you are disappointed, and honestly a small SL sucks when you have higher limits, but have patience and the card will grow. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

Capital One strikes again. They are always generous with starting CL.

|| TU08: 811 || EQ08: 811 || EX08: 802 ||

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU is really a joke to me!!!

Ill tke it if you dont want it ;p

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content