- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- New NFCU Member and cashRewards Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New NFCU Member and cashRewards Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

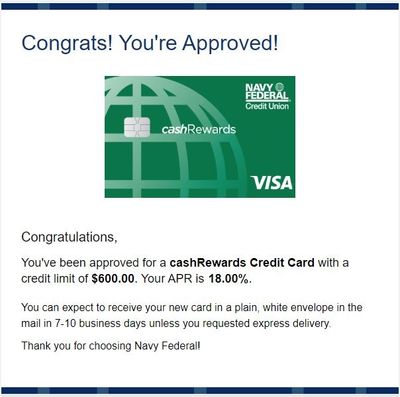

New NFCU Member and cashRewards Approval

So, I've been wanting to get established with NFCU for a while now. Finally called in today and got my checking and savings accounts set up and I am planning on moving all my daily banking to these accounts (my current bank has very little to offer).

After the accounts were created, the CSR asked me if I was interested in any other products. I researched before I called and was interested in their Platinum card to use for balance transfers, but the lady told me I pre-qualified for the cashRewards card. I, wanting to establish a relationship with NFCU, took the path of least resistance by trying for their suggested card rather than risking a denial on the very low APR Platinum. I figured I would keep this card for a while and either PC it to platinum later or outright apply for it later on down the road (or even better find a pre-approval someday).

Anyways, I finished with the banking and the lady transferred me to a guy from the credit department who completed and submitted my application which, as you already know, I was approved for.

SL of only $600 and max APR at 18% but I wasn't expecting much being a brand new member. Even being max APR, it is still my lowest APR card so I believe this card has huge growth potential.

Side note - can someone enlighten me on the likelihood for NFCU to increase the limit if I were to call in and request it? After setting up all the accounts I was ready to get off of the phone and didn't think of it at the time.

Overall, I am very happy. I've been cycling in some hard hitting cards and systematically throwing the sub-primes to the curb which, to me, is indicative of progress. ![]()

DP: Only pulled TU with a FICO 8 score of 672

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

Congratulations!

FICO 8 (Sept 2022):EX- 706, TU- 685, EQ- 684

What's in my wallet:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

Congrats!

Also, how long have you had the Delta Gold Skymiles card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

Congratulations!

NFCU recons are very rarely successful but you can try. With your TU score, I think it to be pretty unlikely that they reconsider but the good news is that if you manage the card well, you might be able to score a much larger approval for a 2nd card at 91/3.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

@Anonymous wrote:Congrats!

Also, how long have you had the Delta Gold Skymiles card?

Thank you - about the Delta Gold card, I just had my first statement close the other day so barely over a month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

@Anonymous wrote:Congratulations!

NFCU recons are very rarely successful but you can try. With your TU score, I think it to be pretty unlikely that they reconsider but the good news is that if you manage the card well, you might be able to score a much larger approval for a 2nd card at 91/3.

Fair enough lol, I'm still very new to NFCU so wasn't sure what their trends are. Could arguably be more beneficial to go for the Platinum as a 2nd card anyways as that is my goal to use for a BT if I ever find a need to lower utilization. Maybe getting the reward card first is a blessing in disguise ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

@Anonymous wrote:

@Anonymous wrote:Congratulations!

NFCU recons are very rarely successful but you can try. With your TU score, I think it to be pretty unlikely that they reconsider but the good news is that if you manage the card well, you might be able to score a much larger approval for a 2nd card at 91/3.

Fair enough lol, I'm still very new to NFCU so wasn't sure what their trends are. Could arguably be more beneficial to go for the Platinum as a 2nd card anyways as that is my goal to use for a BT if I ever find a need to lower utilization. Maybe getting the reward card first is a blessing in disguise

To give you an idea of how rewarding NFCU can be, I started with a $3K SL in September and I got an increase to $7500 in December (which is all I asked for), a CLOC for $500 (all I asked for) and a $7200 Platinum card. $15,200 exposure on $18K income with just 3 months of relationship is stellar growth. ![]()

Just give them time to get to know you and you’ll be in for a big surprise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

@Anonymous wrote:

@Anonymous wrote:Congrats!

Also, how long have you had the Delta Gold Skymiles card?

Thank you - about the Delta Gold card, I just had my first statement close the other day so barely over a month.

Gotcha. Don't forget to request the 3x CLI on it after 61 days!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

YOU...

CONGRATS @ThatGuyXx on your Approval and getting established with NFCU - that's my next goal!!!

Citi Custom Cash WEMC $7.8K | Synchrony (PayPal Credit $6K, Care Credit $15K, & PayPal 2% MC $10K, VENMO VS $6.5K)

PNC Cash Rewards VS $10.5K | NFCU cashRewards VS $14K | NFCU More Rewards AMEX $37.5K | NFCU Flagship Rewards VS $23K

Discover IT $22.5K | BB&T Cash Rewards $4.5K | Macy's AMEX $25K | Bloomingdales AMEX $20K | Apple Card WEMC $9K

PenFed Power Cash Rewards VS $7.5K

Total CL - $284K+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Member and cashRewards Approval

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Congratulations!

NFCU recons are very rarely successful but you can try. With your TU score, I think it to be pretty unlikely that they reconsider but the good news is that if you manage the card well, you might be able to score a much larger approval for a 2nd card at 91/3.

Fair enough lol, I'm still very new to NFCU so wasn't sure what their trends are. Could arguably be more beneficial to go for the Platinum as a 2nd card anyways as that is my goal to use for a BT if I ever find a need to lower utilization. Maybe getting the reward card first is a blessing in disguise

To give you an idea of how rewarding NFCU can be, I started with a $3K SL in September and I got an increase to $7500 in December (which is all I asked for), a CLOC for $500 (all I asked for) and a $7200 Platinum card. $15,200 exposure on $18K income with just 3 months of relationship is stellar growth.

Just give them time to get to know you and you’ll be in for a big surprise.

I'm very hopeful and excited haha - I see crazy limits from them all day long on here.