- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: PenFed FCU Pre-Approval offer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed FCU Pre-Approval offer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

Congrats

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

I almost joined them last year sometime. I started the membership application but stopped when I saw it was a HP just to join. Lol. I did join Langley thinking I'd get approved for at least $10k, but only got $5k. However, Langley did ask me for POI. I've only had Langley and Signature FCU ever ask me for POI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

Congrats on the big win @kjonesjr00! PenFed is great and they make things quite easy. I'm not sure if the agent meant "you would be declined for another card because right now you (specifically) are only approved for $25k in total cards" vs "$25k is their max limit". They did change their policies recently about $25k being the new cap for any single card (and this may be what she was referring to), but they extend up to $50k between all cards you get with them. The 3 rules are

"You can get as many cards as you want as long as:

- (1) - combined they don't exceed $50k and

- (2) - no single card is more than $25k

- (3) - you're not currently at your max internal limit with us (the bank)"

If you're not at your internal cap with them from this approval, they would approve another card.

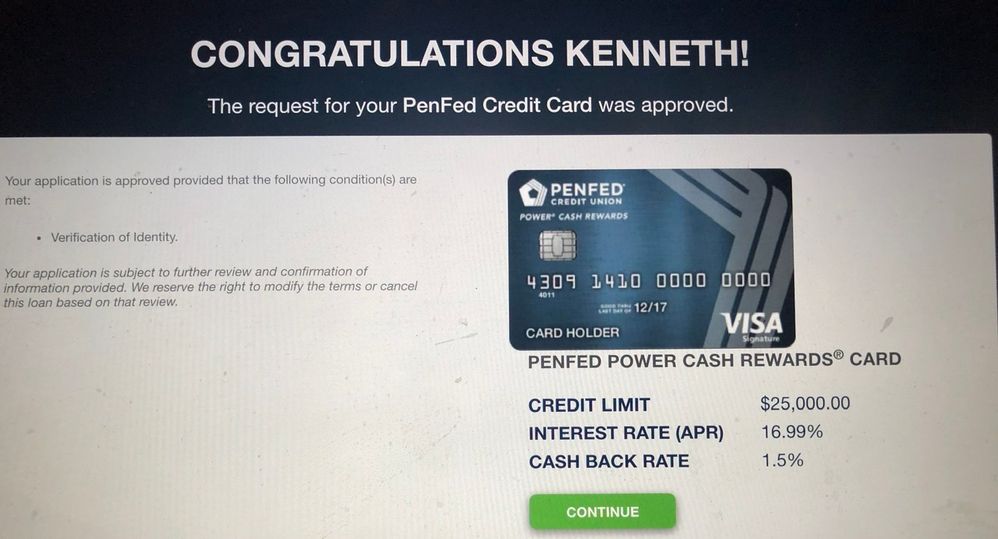

They've also been really heavy on the HP's lately so that's also something to consider, but some folks have walked away with (2) $20k cards in a week so sometimes it's worth the 2 HPs - YMMV of course. ![]() Either way, $25k and 16.99% is a great spot to be in! Congrats again

Either way, $25k and 16.99% is a great spot to be in! Congrats again

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

Congratulations on your approval!

FICO 8 (Sept 2022):EX- 706, TU- 685, EQ- 684

What's in my wallet:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

Congrats on your approval!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

@kjonesjr00 wrote:Received a pre-approval offer in the mail from Pen Fed for their Power Cash Rewards. Wasn't planning on applying for any cards for a while since my feelings were still hurt from Navy FCU not increasing my $20k limit. I figured what the hell, I'd apply and see what I'd get approved for. I was pleasantly surprised and it was instant. My Equifax score was 786 at the time. I had to call in because of identity verification. They just wanted my DL, copy of social, and a utility bill. When I called and spoke to

the rep, I asked about applying for another credit card using the same pull. I was told that I would get declined because $25k was their limit on credit cards. She did tell me if opened a checking account and kept $500 as my balance, I'd get 2% cash back instead of 1.5%. She also told me about a promotion for new members. I had to deposit stimulus money of $1,200 and use my debit card 5 times, and I earn $200. No brainer. Just use my debit card 5 times for $10, and bam 💥 $200. I did also apply for a separate personal line of credit too. Waiting to hear back. Stay tuned.

Congratulations!!

I received a mailer last month and got approved for $15k out the gate. I'm $400 away from securing the SUB. This was my highest SL to date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

@credit_is_crack The rep made it sound as if $25k was the max in credit card limits period, but I called again today and was told different. I can apply for another card. Now the million dollar question is will they use the same pul which she couldn't answer. Yesterday after the rep gave me bad info, I decided to apply for a personal line of credit. I got the turned down this morning for $20k which was the max. What was odd is that I got a notification from credit karma about a new inquiry but it only shows 1 inquiry from PenFed on 5/20, but not 5/19 anymore. 🤷🏾♂️ I wonder if I should try for another credit card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

i got one of these in the mail last week and threw it out...

now i dont have the code anymore

i guess i will wait to see if i get another one

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed FCU Pre-Approval offer

@kjonesjr00 wrote:@credit_is_crack The rep made it sound as if 25kk was the max in credit card limits period, but I called again today and was told different. I can apply for another card. Now the million dollar question is will they use the samepull which she couldn't answer. Yesterday after the rep gave me bad info, I decided to apply for a personal line of credit. I got the turned down this morning for 20kk which was the max. What was odd is that I got a notification from credit karma about a new inquiry but it only shows 1 inquiry fromPenFedd on 5/20, but not 5/19 anymore.🤷🏾♂️️ I wonder if I should try for another credit card?

I've never experienced the multiple HP's from them. Whenever I've applied, its been good for 90 days, but I'll do all my "shopping" in 30 days to be sure. Now it's been at least 6 months since I applied for anything with them so they could be more aggressive with it today.

I wouldn't focus on the HP though, because SP or HP, you're going to take a bigger hit when the new account reports anyway. And same as the HP, the impact will lessen over a few months. If you want the card, strike while the iron is hot. I'd expect a HP, and if it wasn't then you count your blessings.

Loan criteria is different that credit cards so a denial there does not mean a denial on the CC. If you apply and get shot down, at least you know you're likely at your internal limit and need to wait about 6 months to try again. If you try and get approved, well you'll have a few more reasons celebrate.