- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Surprise again! Capital One QS CLI to $30K

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Surprise again! Capital One QS CLI to $30K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

@Aim_High wrote:

@CYBERSAM wrote:Congrats on your QS CLI. Way to push them for every little K 🤑👍👍

= = = = = = = = = = = = = = =

@cashorcharge wrote:

WooHoo!! Congratulations on your Cap1 Approval!!👏🏼🍾🥂

= = = = = = = = = = = = = = =

@nytokyobred79 wrote:

@Aim_High Awesome. Congrats on steadily growing your QS cl.

Thanks @CYBERSAM, @cashorcharge, @nytokyobred79.

Yes, "milking it" @CYBERSAM. Lol. I do like the SP CLIs on cards like the QS.

I think some members are too quick to add new cards instead of trying to grow their existing limits.

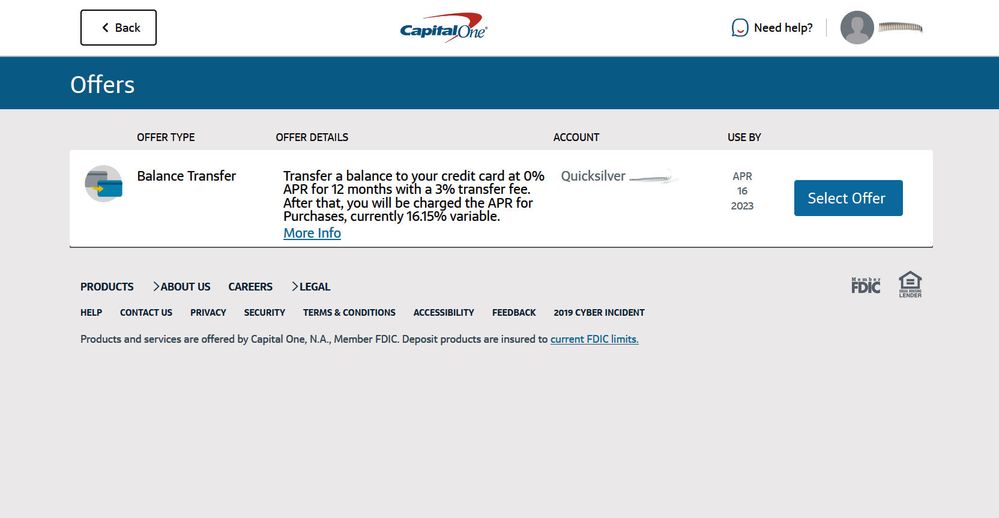

I've thought of closing my Quicksilver over the years (1.5% cash back isn't what it used to be) but these CLIs make a good case to keep it open for utilization padding and flexibility. For example, Capital One is a lender who has regularly offered me good BT offers. Right now, I have a 0% BT offer for 12 months with a very reasonable 3% BT fee. That's like getting 3% APR for the duration of the BT!

They are similar to Discover in offering me consistent BT offers. They've also offered me APRs below the lowest-advertised rate. With the economic changes, I'm up to 16.15% but new Quicksilver cards don't go lower than 19.24% currently. Not too long ago, before the prime rate changed, I was down to 11.90% APR! (see link with screenshot.)

I like some other things about Capital One as I've posted before, even though they have things I don't like as well. They have good and dependable mobile app and website interface. Customer service experiences are prompt and pleasant, and they've had great fraud prevention catching fraudulent transactions before I even noticed them. And they led the 1.5% cash back revolution as well as the no-minimum-redemption model. I still have hopes they will revamp the Quicksilver or offer some additional new industry-leading cards.

Just a word of caution to newbs, YMMV. I think the perks mentioned above are applicable if your card isn't bucketed. Mine started with a 300 limit and only grew to 2400. I got it just before they stopped letting cardholders combine CLs so it's remained paltry.

I've never received a true BT offer, or upgrade. Obviously YMMV, but the bucket is real and some of us are still not seeing CLIs in spite of the increased reports on the forums.

(+102) |

(+102) |  (+106) |

(+106) |  (+151)

(+151)| TU Fico 9: ? | Exp Fico 9: ? | EQ Fico 9: ?| EQ Fico 8 Bankcard: TBA

Initial Goal: Min. 740 w/all CRAs - Met

Interim Goal: 780 w/all CRAs - Met

Current Goal(s): Min. 800 w/all CRAs

Gardening Until: ??/??/202?| Last App: 10/20/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Congratulations ![]()

how often do you ask for CLI ? just wondering

>

>

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Congratulations on your Capital One QS CLI!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

@Traveler101 wrote:Congratulations 🎊

= = = = = = = = = = = = = = =

@gingerflower wrote:

Congratulations on your capital one CLI! 👍

= = = = = = = = = = = = = = =

@911gt34life wrote:

Congratulations

how often do you ask for CLI ? just wondering

Thanks very much @Traveler101, @gingerflower, @911gt34life. ![]()

I assume you mean how often I ask for CLI on my Quicksilver specifically, @911gt34life? It has varied but like with Discover or other lenders who offer a soft-pull CLI request button, you can ask as often as you like without apparent adverse effects. ![]() My successful CLI requests have normally been spaced about no more than once every six months. But as I noted on the links about the recent approvals, I had some approved at about three-month intervals in the past couple of years.

My successful CLI requests have normally been spaced about no more than once every six months. But as I noted on the links about the recent approvals, I had some approved at about three-month intervals in the past couple of years.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

@SweetCreditObsession wrote:

Just a word of caution to newbs, YMMV. I think the perks mentioned above are applicable if your card isn't bucketed. Mine started with a 300 limit and only grew to 2400. I got it just before they stopped letting cardholders combine CLs so it's remained paltry.

I've never received a true BT offer, or upgrade. Obviously YMMV, but the bucket is real and some of us are still not seeing CLIs in spite of the increased reports on the forums.

Yes, that's true, @SweetCreditObsession. That's why Capital One has such a "Dr Jekyll and Mr. Hyde" persona on My FICO, since the perception of them varies based on significantly different experiences. I don't like to paint lenders with too broad of a brush-stroke since the stereotypes can be influenced heavily by the profile of the applicant, which is difficult to summarize and compare accurately on the forum. I think with Capital One, the differences are just more pronounced than with some other lenders since they are known for issuing cards to both prime and subprime profiles. I've written a little about it before, so if anyone cares to read more, go to >this link< and then follow the embedded links back for some further information.

While my Quicksilver started at only a $1K SL, it obviously wasn't bucketed and has been able to grow 30x the SL. But yes, the bucket is real for many of our members.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.