- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: The Anniston Tidal Wave…AOD FCU Approvals Thre...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Anniston Tidal Wave…AOD FCU Approvals Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Anniston Tidal Wave…AOD FCU Approvals Thread

Thanks to @fiddycal for dropping the first pebble in the ocean…

This is an attempt to compile our wave of approvals that smashed through the walls of Anniston Ordnance Depot (AOD) Federal Credit Union. Included are the dates of approval (updated from application date to actual confirmation of approval date as posted), SL, APR, EQ5 score (which is what AOD pulls) at the time of application, new accounts ( x/6, x/12, x/24), UT, and DTI) as disclosed over the various AOD-related threads. This is specifically for the Visa Signature flat-rate 3% cash back card.

Hopefully this will give some helpful DP’s to those interested in applying. I’ll be happy to add in anyone who has a new approval (or confirms an app as noted below). This might be a little late, depending upon whether or not the MF rush has slowed down. Let me know if I have noted anyone’s results incorrectly.

(Courtesy of M_Smart007 )

Total Approvals: 86

4/7/20 Gmood1 $20,000 @ 7.49% (EQ5 744)

4/7/20 galahad15 $7,500 @ 7.49%

4/9/20 Taurus22 $20,000 @ 7.49% (EQ5 729, 0/12, 4/24, 14% UT, 24% DTI)

4/9/20 Rockysocks $5,000 @ 8.99% (EQ5 728, 2/12, 4/24, UT 2%)

4/9/20 Hex $15,000 @ 8.99% (EQ5 684, 1% UT, 5% DTI)

4/9/20 J_in_Minnesota $10,000 @ 7.49% (EQ5 795, 3/12, 3/60days, <1% UT)

4/9/20 coldfusion $20,000 @ 7.49%

4/13/20 Tyrannos $5000 @ 8.99% (EQ5 697)

4/14/20 issac2x $5,000 @ 7.49%

4/15/20 CreditCuriosity $20,000 @ 7.49% (EQ5 735, 20+/24, <1% UT, 30% DTI)

4/15/20 Mv350 $10,000 @ 9.99% (EQ5 669, 7/6, 13/12, 15/24, 4% UT, 22% DTI)

4/15/20 Aim_High $25,000 @ 7.49% (EQ5 780, 4/6, 7/12, 10/24, 7.5% DTI)

4/16/20 Saeren $5,000 @ 8.99% (EQ5 688, 2% UT, 30% DTI)

4/16/20 PullingMeSoftly $15,000 @ 7.49% (EQ5 742, 13/12, 14/24, <1% UT)

4/16/20 blindambition $5,000 @ 7.49% (EQ5 784, 3/6, 4/12, 5/2

4/16/20 Hut1 $20,000 @ 9.99% (EQ 657, 5/6, 6/12, 7% DTI)

4/16/20 mrfufoppss $10,000 @ 9.99% + PLOC $10,000 @ 12.2% (EQ5 678)

4/16/20 ZZWW2017 $15,000 @ 7.49% (EQ5 799, 0/6, 2/12, 3/24, 1-2% UT, 5-8% DTI)

4/17/20 JamP $25,000 @ 7.49% (EQ5 777)

4/17/20 WorldBook $10,000 @ 9.99%

4/17/20 PrimeInterest $5,000 @ 7.49%

4/17/20 FettHutt $25,000 @ 7.49%

4/17/20 Mahraja $25,000 @ 8.99% (EQ5 725)

4/19/20 azpro $10,000 @ 7.49% (EQ5 790, 20% DTI)

4/20/20 OthTielo $15,000 @ 7.49% (EQ5 736)

4/20/20 AllThingsInTime $5,000 @ 9.99% + PLoan $5000 @ 6.49% 24 mo. (EQ5 662)

4/21/20 M_Smart007 $25,000 @ 8.99% (EQ5 738, LOL/24, .01% DTI)

4/21/20 SeanBro $10,000 @ ?%

4/21/20 bruisedcredit $8,000 @ 8.99% (EQ5 723)

4/21/20 CJPM $10,000 @ 7.49% (EQ5 781)

4/21/20 Rotasu $5,000 @ 7.49% (EQ5 759)

4/21/20 snickerpedia $20,000 @ 7.49% (EQ5 779, 18/12)

4/21/20 CBrow $15,000 @ 7.49% (EQ5 765)

4/21/20 ChazzieT $10,000 @ 8.99%

4/21/20 Duke_Nukem (DW) $10,000 @ 8.99% (EQ5 709, 25% DTI)

4/21/20 nosup4u $5,000 @9.9%

4/21/20 PNW_RN $15,000 @ 8.9%

4/21/20 (anonymous) $5,000 @ 8.99% (EQ5 717)

4/21/20 ocheosa $20,000 @ 8.99%

4/22/20 Hut1 (DH) $12,000 @ 8.99% (EQ5 715, 40-60% DTI)

4/22/20 SuPeRxCaC $25,000 @ 8.99% (5/12)

4/22/20 jdbkiang $20,000 @ 7.49% (EQ5 758)

4/23/20 nuohlac $15,000 @ 8.99% (EQ5 713)

4/23/20 Eagered2succeed $8,000 @ 7.49% (EQ5 727)

4/23/20 Zander900 $7,000 @ 8.99%

4/23/20 Wavester64 $5,000 @ 8.99% (EQ5 691)

4/24/20 Five6Two $5,000 @ 7.49% (EQ5 774, 4/24, 10% UT)

4/24/20 hzynneb $7,500 @ 7.49%

4/25/20 AddictedToApprovals $20,000 @ 8.99%

4/25/20 Caught750 $15,000 @ 7.49% (EQ5 755)

4/28/20 Azurite $10,000 @ 7.49% (EQ5 782, 2/24, <1% UT)

4/28/20 370Z $22,000 @ 7.49% (EQ5 813, 3/24, <1% UT, ~26% DTI)

4/29/20 Chitown99 $7,500 @ 7.49% (0% DTI)

4/30/20 welovedee $7,500 @ 9.99% (EQ5 713)

5/4/20 luckthepup $10,500 @ 8.99% (EQ5 708, 0% DTI)

5/5/20 Revelate $10,000 @ 7.49% (EQ5 786, 1/12, 5/24, <3% UT, <18-33% DTI)

5/5/20 kamie24240 $10,000 @ 8.99% (EQ5 723, 0/24)

5/13/20 LandifiedAZ $20,000 @ 8.99% (EQ5 710, 3/6, 5/12, 3% UT)

5/15/20 Juanefny $25,000 @ 8.99% (EQ5 709)

5/22/20 flyingfico $10,000 @ 7.49% (EQ5 800+, 0/3, 1/12, 3/24, 1% UT, ~15% DTI)

6/3/20 kings34 $5,000 @ 7.49%

6/19/20 ficobuilder923 $5,000 @ 8.99% (EQ5 712, 12/24, 2% UT, 30% DTI)

6/24/20 JNA1 $5,000 @ 8.99% (CLI approved 3/15/21, CL now $10,000)

7/20/20 Hasselfree $10,000 @ 7.49% (EQ5 803)

7/20/20 Slackster $20,000 @ 7.49% (EQ5 762)

7/27/20 WalMartTrackSuit $10,000 @ 7.49% (EQ5 774)

7/29/20 Gmood1 (DB) $10,000 @ 7.49%

7/30/20 InfamousRSX $5,000 @ 7.49% (EQ5 770, 26% UT, 30% DTI)

10/6/20 eg2222 $15,000 @ 7.49% (EQ5 764, 0/6, 0/12, 0/24, 0% UT, <10% DTI)

12/11/20 Gmood1 (DN) $5,000 @ 7.49%

12/15/20 ChargedUp $10,000 @ 7.49% (EQ5 763)

12/28/20 CorporatePanda $5,000 @ 8.49%

1/10/21 creditwize $10,000 @ 8.9% (EQ5 697, ~15% DTI, PC'd from platinum card)

1/11/21 sxa001 $15,000 @ 7.49% (EQ5 754, 1/24, <30% DTI)

1/15/21 1GaDawg85 $10,000 @ 7.49% (EQ5 696, 4/6, 4/12, 7/24, 19% UT)

1/28/21 combatmedic2107 $5,000 @ 7.49%

1/28/21 choff5507 $15,000 @ 7.49%

2/8/21 Duke_Nukem $5,000 @ 7.49% (EQ5 725, <1% UT)

2/13/21 Jrl1vin2 $15,000 @ 7.49% (EQ5 799, 1% UT, INQ's 3/12)

2/25/21 mrwoodchuk $7,000 @ 9.99% (EQ5 670, 6/12, INQ's 11/6, 14/12, 20/24, 10% UT)

3/3/21 Dr_Zzz $5,000 @ 7.49% (EQ5 753, INQ 2/12, 6% UT, Avg Age 7 yrs, ~35-50% DTI)

4/1/21 lifestylemaiden $25,000 @ 7.49% (EQ5 804, 0/24, 6% UT, 8% DTI)

4/8/21 jb90 $5,000 @ 7.49% (EQ5 758)

4/8/21 leafonthewind $15,000 @ 7.49% (EQ5 786, 4/6, 5/12, 12/24, low UT and DTI)

4/20/21 TriggerHappy $10,000 @ 9.99% (EQ5 677)

5/6/21 Mr_Mojo_Risin $5,000 @ 9.9% (EQ5 680, 0/6, 2/12, 14% DTI)

Known factors impacting approvals, limits, and APR's:

- Membership approval is required for credit products (see Known successful eligibility memberships/Paths for eligibility below).

- If you apply for the membership and CC at the same time, you may initially receive an approval for the CC, but if denied membership, the CC will also be denied.

- Chex is pulled for membership.

- If you also apply for a personal loan, AOD uses Chex to send a data query to LexisNexis. If your LN is frozen, that will delay the personal loan app process, so be sure to thaw your LN if apping for a PLoan. (Thanks AllThingsInTime)

- HP on EQ (EQ5) for membership, but the same pull can be used for subsequent products for 30 days.

- AOD appears to place an emphasis on DTI when considering application approvals.

- Gross income each month is taken from a 40-hour work week. So even if you are working more hours per week (doing OT etc), they only take into consideration your 40-hour work week. (Thanks Wavester64 )

- When calculating DTI, AOD may use a monthly payment amount that is higher than what is actually being paid if you are on an income-based repayment plan (IBR). At least one user has reported that AOD calculated a monthly payment amount equivalent to a standard repayment plan, rather than the much lower IBR payment amount, hence increasing DTI. (Thanks jel1990)

- EQ5 scores appear to determine the APR

- Income is the primary factor for SL's

- Income verification is required when establishing membership.

- Although the most recent paystub appears to be the common form of income verification, some applicants have been asked for tax returns or W-2 (thanks Moneyfan1974 and galahad15 )

- Identity verification: In addition to an official photo ID (DL is most common), don't be surprised by a request for a selfie while holding a paper with "AOD" or "AODFCU" written visibly in the picture.

Known successful eligibility memberships outside of geo/employment/standard eligibility:

-Northeast Alabama Bicycle Association (NEABA)

(Membership is processed through the International Mountain Bike Association IMBA, NEABA Chapter)

-United Way of East Central Alabama (limited to members rather than donations)

-Anniston Bridge Club

-Anniston Runners Club

Other possible paths for eligibility (thanks batsy71):

-Calhoun Court Chambers Membership ($90 join fee)

-Purple Martin Conservation Association ($35 annual fee) [Reported to no longer be an option, awaiting 2nd DP to confirm]

Current Required Documents (as of 2/8/21, thanks @Duke_Nukem):

- Pic of social security card

- Pic of driver's license

- Proof of residence (utility bill or something like that)

- Most recent 30 days of paystubs

- Pic of yourself holding a sign with AOD written on it

- 2 references with addresses and phone numbers

- DocuSign all the T&C's, electronic banking, fee schedules, etc.

CLI's (as of 3/15/21, thanks @JNA1):

Credit line increase requests are managed through an application process mirroring the process for a new account.

Will be an HP on Equifax

Goes to review just like a new account, and requires proof of income and similar documentation from the new account process (as noted above).

Whether approved or not, the original account doesn't change and retains the same account number and payment history.

Update 3/3/21 (thank you @Anonymous)

- Application has been updated to allow the selection of work hours rather than specifically requiring only 40 hours of income to be stated.

- Applicants CAN use household income on the application even though the application makes it seem like you must enter only personal income (confirmed by the CEO).

- Use household income on the application and include all other income you may have (bonuses, overtime, rental income, etc). (Example: W2s for proof of income and a signed lease agreement for rental income, vs providing 2 years of taxes to show the rental income)

- Underwriting wants a DTI under 50% (confirmed by the CEO) but other factors such as the number of open revolving accounts can still get you denied even if you meet DTI guidelines (35 open revolving accounts on my EQ was too many for them, but after showing documentation of closing 6 accounts and was approved so it seems like the threshold is around 30).

- Consider closing some open revolving accounts if your report shows over 30.

- Be sure to provide estimated repayment documentation from your lender if you have deferred student loans.

- If you have any deferred student loans, go to your lender’s website and review the repayment plan options. Print an estimate showing the lowest payment you qualify for (note this is easy to do if you have federal student loans but I don't know if you can get this information if you have private student loans). If you can get the estimate, ask that they use that payment amount when calculating your DTI. Without it, they will calculate a crazy high payment amount which is like 1-2% of the total balance.

- You may want to apply by phone if you have complicated situations, to ensure you get the chance to actually speak with someone and provide all of your information before they automatically deny you. For example, there is no way to indicate the student loan payment estimate on the online application, so if you have deferred loans they will use the highest calculation by default. There is a notes section in the app, which may be used to state that full income is not entered on the app and that speaking with a representative is requested, however there is no guarantee this will be read, so don’t rely on it.

Update 1/10/21:

- In addition to utilizing initial membership HP's for credit products, AOD will also allow HP's from loan applications to be utilized for credit card account applications within 30 days.

- Product changes are allowed from AOD's Platinum card to the Signature Visa. A new account is created, the balance from the old card is transferred to the new account, and the old account is closed. (thanks creditwize)

- Multiple DP's and anecdotal information indicate that while underwriting criteria has certainly tightened since the summer of 2020, new members are still gaining elibility through known pathways (see below).

- While other credit unions have reduced their earning rates for competing 3%/3x products, AOD has given no indication of any anticipated changes to the 3% rate. There is always the possibilty of AOD enforcing geo restrictions or capping earnings, however that remains speculative.

(Courtesy of Hut1 )

(Courtesy of Taurus22 )

(Courtesy of M_Smart007)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

Whoa! Nice job everyone!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

When you actually see all the numbers laid out... 🤯

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

You can add me to the "Awaiting approval confirmation:" list. I pulled the trigger this morning.

EQ5 713

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

called to double dip for a ploc

apparently the lending department is staying late today to do these applications and call backs lol

someone send them some cookies

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

DH EQ5 715. 😊

Awesome list. Congrats everyone!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

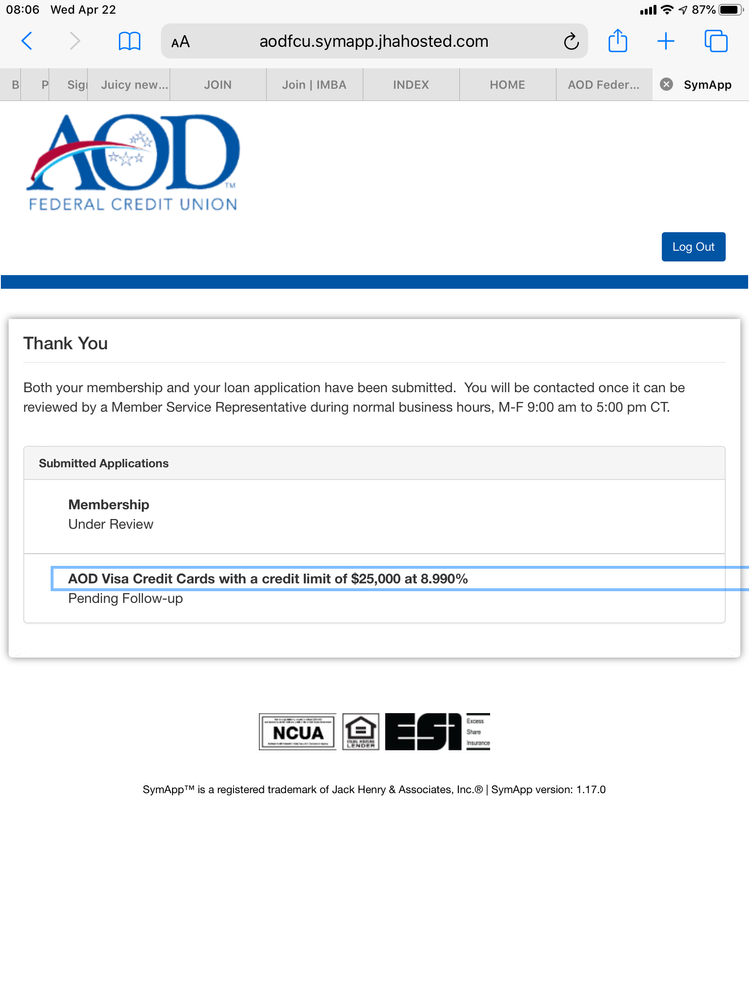

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

Awww, yeah!! Fourth place!! LOL

My CL is $5,000. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Anniston Tidal Wave…AOD FCU Approvals Thread

You can add me to the waiting for approval list, I applied for $15000, it did generate 11.89% but I don't know if that's solid or if it just generates something, says waiting on someone to review it and I'll be getting a call

EQ5- 677

i lost 35 points in February when my mortgage hit