- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: WTH? The CLs with each new card, keep droppin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

Most all my cards have $10,000+ limits. My AOD in fall of '21 at $5k was my first 4 digit limit. Then in summer of '22, my Shop your Way was $4k. Now, today, I was preapproved and then applied for the Cap One WalMart card and my limit is $3k. They keep dropping, lol. Oh well, it's really only for 5% CB on WalMart+ groceries and the occasional order on walmart.com.

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

Congratulations on your Walmart card!!

A few weeks ago I was approved for a Bank of the West Mastercard but with a starting limit of $3,000. I received two CLIs today that were more. I'm okay with it though. I like BOTW too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

It may be a little easier to throw some Ideas out if we had a bit more info on your profile, scores, aggregate utilization at the time of applying, open dates of your cards... Not too familiar with AOD, however if you've been too actively opening cards, especially with a short history, I've heard that Sync can be a bit stingy. Of course in today's banking environment, I aint surprised by anything.

I'll tag a few of my MyFico spirit animals who can probably help you sort it out. @SouthJamaica @M_Smart007 @FinStar @longtimelurker @GApeachy

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

@805orbust wrote:It may be a little easier to throw some Ideas out if we had a bit more info on your profile, scores, aggregate utilization at the time of applying, open dates of your cards... Not too familiar with AOD, however if you've been too actively opening cards, especially with a short history, I've heard that Sync can be a bit stingy. Of course in today's banking environment, I aint surprised by anything.

I'll tag a few of my MyFico spirit animals who can probably help you sort it out. @SouthJamaica @M_Smart007 @FinStar @longtimelurker @GApeachy

Thanks 805. I guess I am not really asking for any feedback. The "WTH?" was rhetorical, lol. I already think I know what it is. I have excellent credit..... except...... one baddy - a $3k medical collections from 2021. I have no intentions of paying it so it is what it is. Credit otherwise flawless. $150,000/yr with $2,000 mortgage. I think only 3 new cards in 12mo and maybe 5 in 24mo. When I check my credit scores, they range from mid/high 700s to low 800s. Not sure what my utilization is but my $320k mortgage and $35k auto are the only recurring loan payments. All cards PIF each month, no other debt.

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

@ptatohed wrote:

@805orbust wrote:It may be a little easier to throw some Ideas out if we had a bit more info on your profile, scores, aggregate utilization at the time of applying, open dates of your cards... Not too familiar with AOD, however if you've been too actively opening cards, especially with a short history, I've heard that Sync can be a bit stingy. Of course in today's banking environment, I aint surprised by anything.

I'll tag a few of my MyFico spirit animals who can probably help you sort it out. @SouthJamaica @M_Smart007 @FinStar @longtimelurker @GApeachy

Thanks 805. I guess I am not really asking for any feedback. The "WTH?" was rhetorical, lol. I already think I know what it is. I have excellent credit..... except...... one baddy - a $3k medical collections from 2021. I have no intentions of paying it so it is what it is. Credit otherwise flawless. $150,000/yr with $2,000 mortgage. I think only 3 new cards in 12mo and maybe 5 in 24mo. When I check my credit scores, they range from low/mid 700s to low 800s. Not sure what my utilization is but my $320k mortgage and $35k auto are the only recurring loan payments. All cards PIF each month, no other debt.

The low limit approvals, been there;

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

@ptatohed wrote:Most all my cards have $10,000+ limits. My AOD in fall of '21 at $5k was my first 4 digit limit. Then in summer of '22, my Shop your Way was $4k. Now, today, I was preapproved and then applied for the Cap One WalMart card and my limit is $3k. They keep dropping, lol. Oh well, it's really only for 5% CB on WalMart+ groceries and the occasional order on walmart.com.

Could be the economy.

But could be an indication that you should cool your heels on applying for new cards for a while.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

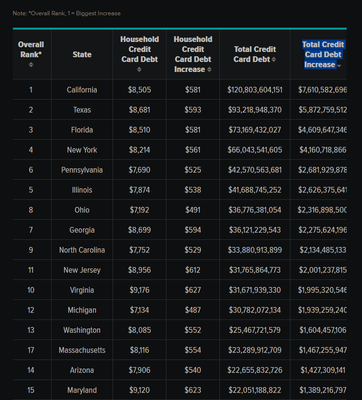

With the way times are right now. Higher prime rate and so on. You can blame that possibly. I believe @M_Smart007 posted a CC debt on the rise graph. Or somebody else. All the banks will get stingier as time goes on I believe. Congrats though!!!!!!!!!!

3 in year....now 4.....maybe calls for a hmmmmmmmmmm ![]()

Edit: Ha! Posted 1 minute after @SouthJamaica . Must have been typing at the same time. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

@FireMedic1 wrote:With the way times are right now. Higher prime rate and so on. You can blame that possibly. I believe @M_Smart007 posted a CC debt on the rise graph. Or somebody else. All the banks will get stingier as time goes on I believe.

@FireMedic1, Good Memory!

https://wallethub.com/edu/cc/credit-card-debt-study/24400

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: WTH? The CLs with each new card, keep dropping, lol. Cap One WM card approval....

@M_Smart007 wrote:

@FireMedic1 wrote:With the way times are right now. Higher prime rate and so on. You can blame that possibly. I believe @M_Smart007 posted a CC debt on the rise graph. Or somebody else. All the banks will get stingier as time goes on I believe.

@FireMedic1, Good Memory!

https://wallethub.com/edu/cc/credit-card-debt-study/24400

(Click image to enlarge)

@M_Smart007 So no dementia. Yet. ![]()