- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- app sprees $68,750. FNBO, Sofi, PenFed PathFinder ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

app sprees $68,750. FNBO, Sofi, PenFed PathFinder and Plat (CLI)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

app sprees $68,750. FNBO, Sofi, PenFed PathFinder and Plat (CLI)

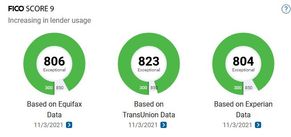

I know, I couldn't help it. I was about to apply for few credit cards 2 days ago but I was holding back. This is the first time I have or had 800s scores from all the credit bureaus even for a short time as in 6 days. Since I just applied for 3 credit cards and 1 CLI, my Experian scores must have gone down by probably 30 points, 10 points on each app? So far, I am not seeing any hp from PenFed but only FBNO and Sofi. That's what I am worrying about.

11/7/2021:

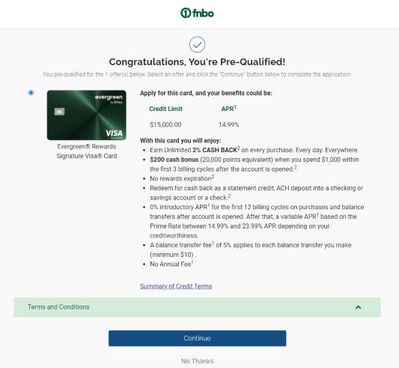

FBNO - $15,000, APR 14.99%

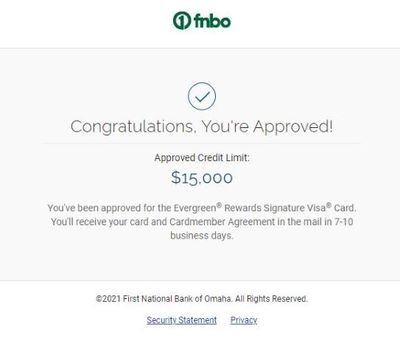

Sofi - $20,000, APR 15.99%

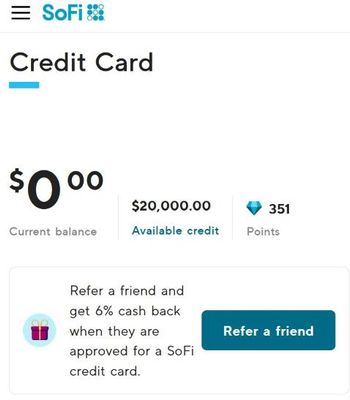

PenFed PathFinder - $20,000, APR 14.99%

11/9/2021:

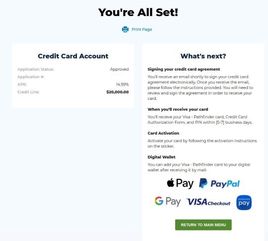

PenFed Platinum CLI approved- $6250 +13750 cli -> $20,000

Total new credit applicaton 11/7 - 11/9: $68,750

Data Points: (11/7/2021)

Utilization before the application - 9% after 8.5% roundup

Utilization after the application - 7% after 6.6% roundup.

The time of application. Fico 8 scores are: EQ 795, TU 820 (Nov 6 Discover), EXP 800.

Updated Fico 8 scores. EQ 795, TU 820 (Nov 6 Discover), EXP 796. (Exp just dropped to 782 - 11/7/2021, 1436)

My credit scores dropped after one of my loans paid off. Both EQ and Exp affected by it but TU scores still going up since Nov 3rd.

Before credit apps: 2 HP on each EQ, TU and EXP.

After credit apps - 2 HP on each EQ and TU. 4 HP on EXP

No HP from PenFed yet since I haven't sign the digital document yet. In fact I don't think I ever receive HP on the auto loan either. I will update once I am getting HP on both.

Before credit apps: 198k overall total credits and after credit apps: 253,780k if everything is going well.

Bank relationship history:

FBNO - No history with them. Just trying my luck with prequal page I learned from this community.

Sofi - Had a $7000 for 3 years personal loan with them and paid it of 1 year plus before maturity. Just recently making some small stocks and digital coins trading with them, less than $200 before I applied for the credit card.

PenFed - Applied for Platinum card on Mar 2020 with no prior history relationship. Refinanced auto loan recently with them before applying for PathFinder. However, I didn't realize something about the HP rule with PenFed. Will ask them about it. However, annual fee is waived for prior military service. "2.)Defender Relationship Members OR co-borrowers who are active or retired from the US military, the National Guard or Reserves, an honorably discharged US military veteran, or widow(er) of a member of the military."

I am hoping the data points help.

Credit applications I am testing:

Failed recent CLI within last 2 weeks - Amex, Capital One,Discover (I received Disco CLI last September for $2000. Clicked to early).

Failed prequal from this week- Home Depot's Citi, Well Fargo , Nasa, Merrick, Gesa CU, Patelco

Success prequal but no detail. Poking the bear and run away - Discover miles, Walmart Capital One, American Eagle CU, US Alliance CU

Credit offer within last 2 weeks - SunTrust. I do not trust their offer because they burnt me last year.

I keep forgetting, never apply credit cards during the weekend as they are going through maintenance mode.

NFCU, Citibank and PenFed are in maintenance. PenFed is working now but the other two are still down or not 100% operational.

Boring drama alert

FBNO and Sofi are pretty much straight forward and instant approval even with firefox browser pop-ups still active. I totally forgot to turn them off. However, for PenFed I ran into a slight technical issue as it didn't redirect me to the happy result page. So I turned the pop-up blockers off and reload the page. Boom, saw the approval. However, next few minutes I couldn't get into PenFed account. After sending them two e-mail messages and suprisingly somebody e-mail me back 20 minutes ago and it is still midnight. Somehow, nobody is answering me the regarding the credit card app but the technical issue which I asked. Now that I could get into my PenFed account, however I still couldn't see the account. Well, now I am paying an attention I could see the message saying I have to sign an electronic document which PenFed would send me. I am assuming that would be the real final approval after a loan officer reviewed my application.

From PenFed:

"Signing your credit card agreement

You'll receive an email shortly to sign your credit card agreement electronically. Once you receive the email, please follow the instructions provided.

You will need to review and sign the agreement in order to receive your card."

Update from another PenFed e-mail:

"According to our records, the application for the PenFed Pathfinder Rewards card

was successfully submitted and received. The application has been approved. You

should receive the credit card by mail within 7 to 10 business days.

Please feel free to reply or find us at PenFed.org/Help if you need further

assistance."

Sweet! That's a relief. Can I dare to apply for another PenFed card to make for a 3rd card or CLI? I will call PenFed customer service tomorrow.

Update: PenFed PathFinder is officially approved and I received an e-mail message from them after I called them. PenFed seems like going through a lot of automatic (system) approval and then manually review. While at it I had a lenghty talk with a rep regarding HP. Anyway, the rep finalized the application for me and I asked for a CLI for the Platinum Signature card. The rep completed the CLI application for me on the phone and just like any other application I had before, it would still go through manual review. Regarding the Annual fee waiver for retired military or Honorable discharged veteran you need to mention that to them each time just in case while on the phone with them even if you filled it on your application. The rep told me, the waiver annual fee is "take your word on it". However, I said I would provide any documetation like DD-214 in case they need it. I think they could find it anyway even without DD-214. Whew! What a 12 hours of application spree adventure.

11/9/2021 :

I thought they are going to deny me but I just found out that actually approved me.

PenFed Platinum CLI approved and increased by $13,750. $6250 -> $20,000

2 HP on each EQ and TU. 4 HP on EXP . So far, there is no added HP. I am hoping it stays that way.

Utilization after CLI - 6% after 6.3% round down.

Total overall changes for Nov:$198,780 -> $267,530 after 3 new accounts and 1 CLI

If you include Discover CLI from Oct: That would be $70,750 new credits! ![]() All thanks to myfico.com community from learning about credit scores and credit responsiblity.

All thanks to myfico.com community from learning about credit scores and credit responsiblity.

Sorry for the multiple images. I am trying not to insert to many and I reduced the sizes. I don't think I ever use this feature in the past.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

Congrats on your approvals

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

Awesome app spree !

Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

Fantastic haul out of just 3 cards, grats on getting all of them ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

Congratulations on your 3 app spree with ALL Approved. Nice SL's too. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

@gdale6 wrote:Fantastic haul out of just 3 cards, grats on getting all of them

Thank you @gdale6 , @4sallypat , @KingRue8500 @Papa_Bear and @CreditMagic7

I can't believe it myself. This is the first time I ever getting 3 large SL within 3 minutes of applications. Must be a dream to me. Need to punch myself to see if it is true. *few momens later*. ouch.. I think it is true. ![]()

![]()

I tried to remember something about these applications.

1. Do not apply credit cards on the weekend as websites might going through maintenance modes.

2. Disable Pop-up blockers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3 apps - FBNO, Sofi, PenFed PathFinder = $55k

WOW! That is impressive.....congratulations!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apps success and denied.FBNO, Sofi, PenFed PathFinder = $55k

Very nice detailed dp's. Congrats on your impressive approvals and awesome sl's! @Anonymous " Poking the bear and run away." LOL!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apps success and denied.FBNO, Sofi, PenFed PathFinder = $55k

Thanks also for the treasure trove of useful data points along with your screenshots.

It gives the term comprehensive a full compliment of what goes into a description.