- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: >>One for the books<<< You will want to read t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

>>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PENFED,CHASE,AUTO-LOAN

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

>>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PENFED,CHASE,AUTO-LOAN

So i have been apart of the community for almost a year now and have really learned allot.

Most the time i go into places and ask about their lending just to see what they might offer me.

When i produce my 3b fico and all my auto scores along with the information that i have gleaned from so many of you out there, most people are left just staring at me or asking me how to learn what i know.

So this process started back in june of last year.

I have been rebuilding my credit from the lurky depths of sub 500 scores over the last 6 years. I did not decalre bankrupcy but instead let all the bad debt soil my name for that period of time. I finally got tired of the situaiton and started to do research on how to get items removed from the credit reports and be able to work with the credit agencies to start and gain som ground on my dying situation.

Fast forward to june last year, i asked on here if i would qualify for anything and posted my small scores of 620 somethings across the board and the layout of may profile.

It was reccomennded that i go and check out CAP1 so i did. I got approved for the QS1 and i used it heavily for about a month and thought why not try with chase since i have a relationship with them and I wold like to have a part in their rewards structure (ultimate rewards) as i like to travel hack where i am able.

Got approved with a starting limit of 500 for a freedom with only 2 years of secure card histroy at 300 a piece and my cap1 for 1 month at 500.

Now i am not suggesting that a person is going to gain favor with various credit lenders for having small card limits like that and for having slighlty larger accounts for only a few months, but what i have seen and will demonstrate here shortly, is that when you do find folks that look at your situation from a risk baased lending but also as a person, you will find that the more things that are in your favor ( payment history, reasons for credit, reasons for balances) the more people are going to want to push it to the Risky side of lending instead of the conservative side.

So i got the CSP (Chase Sapphire Reserve) from chase in november and have loved it, I also was able to get my freedom to 2k limit after 2 months of use and a hard pull. (many of you know but i will stress it again for anyone reading these types of things for the first time, CHASE WILL PULL EVERY TIME) Just know that if you want a CLI, a new product (not a product change but a net new line of credit) they will pull your report.

I also managed to pickup barclay rewards card (garbage card at 500 limit but it does do 2% at utilities and groceries if you dont have anything else), overstock 2k SL and then just maanged to eek out 300 CLI with them 5 days ago SP, and i was able to get a point decrease on Barclay just for asking .

Side tip for Barclay, you may have offers on your account but they WILL NOT AUTO APPLY them for wahtever reason. You must call in and ask if there are any offers on your account. There is no special order in asking that i have seen as some suggest here, Just call and ask if there are offers, if the person says know just reiterate that you would like to double check with a specialist to make sure there isnt any pending offers that they might now see for APR reduction. If you have SP CLI and a Rate reduction they will give you both, but again you must ask.

So yesterday, was talking with the Wife and let her know that i was pre-approved through cap1 autonav for a 3.24-7.25% loan up to 40k . and we started looking at vehicles.

Found one we really liked and a great price however we are 6k upside down in our current vehicle that we refi'd throguh RBFCU (660 TU FICO8 qualified me for 5.1 for 24 months on a 2010 with 145k miles on it) that was amazing coming from the cap1 land of the dead at 17.99%. Any way went into Austin Infiniti and let them know i was pre-approved with cap1 and that i would like to talk numbers on the car.

asking was 27900 i needed them to come off it by at least 1k as they accept CC for a DP.

This is were things get crazy. I checked my fico8's and they were all low because i am in the process of using promo offers on 0% on a few cards and others are reporting to show usage i just didnt time it right and i had 6 reporting which most of the lenders mentioned in this post tend to scowel at.

I knew i was going to put 3k down with my CSP but i needed to have a BT offer so that i could eseentially offload that DP to a 0% BT (manufactured DP assistance)

They ran my credit against Chase,A+ credit union,and cap 1 but because i had negative equity my best rate was 7.25% which is yuck in my opinion.

I had specifically told them to run chase RBFCU and cap 1 so when they said my best rate was 7.25 i thought something isnt right here.

They showed me the chase one first at 9% then the A+ credit denial, then they heralded in the 7.25 ,

Asking about the pulls i said how come RBFCU didnt want to at least finiance at the 5.1 that i was at already. Then from the wood work they let me know that they didnt run it as they knew that rbfcu wouldnt like the negative equity even though i told them i had the original loan through them and had specifcally told them to send it over to them.

They then said they could run it to RBFCU but it would take more time......

So . since i had the time i said go ahead and do it.

Then i thought to myslef i saw a few and i mean bread crumb levels of articles in here about ufcu (university credit union) and folks were really happy with their approvals for auto loans and the few i saw were simliar profiles.

So while sitting in the chair talking with the finance guy who seemed to be lost in a daze when i was explaining various credit union behaviors and that there are literally thousands of pages online at MYFICO that talk about most of the major lenders and what they are looking for. I thought i am going to app for UFCU auto loan since i am already taking the hits for the credit.

5 minuts on my phone and boom approvl with a 663EX pull for a 3,8 @60months for total of my loan. But i forgot to put in all the details so i had to call and set it right to see if they wouyld still honor that rate.

Well it was 6:30 mind you and i called and got someone on the line who was very eager to help and very friendly and let me know they would have to track down a credit specialist to get some assistance with the underwrite. 5 minutes and he was back with UFCU rep i will refer to as Deb (not her name). Deb let me know that they would love to help me with the loan and that i was approved for the 3.8 with my income and if i had any questions. I let her know that the loan amount shown on the approval was not hte walk out the door price but rather i needed an additional 6k from that point. She did the numbers and said it was 117% of what the valur of the car was and that they normally only underwrite 110% but ( and this is where good payment history, a solid understanding of what you are trying to accomplish with your credit comes in handy) she said she liked my profile and my payment history is solid she will submit for manual underwrite and feels very good about the situation.

So now i am at the Dealership and feeling great as I now have a 3.8% loan in sight now i need to determine the best method for DP.

What else comes to mind than the one and only PENFED.

I knew i already pinged my self in the face with all the inquires but thought why not give it a run, so i apped online for the auto loan and they approved me for 6.5 which i didnt want but i called in about my membership info cause i couldnt get it finished online as it wouldnt let me.

A rep picked up and got me all signed up and i asked to speak to a loan officer. 5 minutes and he sent me over to the LO who asked what i was trying to do (again i knew my strategy of balance transfers and points, and down payments and let her know all of it) said i needed 10k of BT options and would like a 20k line.

Keep in mind my cost of credit was pulled at 643 dont know what the nextgen is yet. But she came back and said done. I asked if i could open a promise card as well and she said she could open one for me but it would not be a groundbreaking limit and the apr would be the same so that wouldnt be what i was looking for.

So this morning i get a call UFCU approves my loan 3.8% @ 60 just needed POI and membership to the credit union.

Loan @ 3.8%, BT Card 0% for 12 months 20k SL

And i start thinking i have one more thing that i would like to accomplish before all this hits and casus damage to the report for the next 6-12 months. I want the slate @ 0% for 15months on purhcases and BT but i need at least 4k for it to be worth while.

I still had the offer in my online account so i pulled the trigger.

Approved.....wait for it....500 dollars!!!!

WHAT!

What am i going to do with 500 dollars...!!

So i call in and ask if we can recon the limit, of course....no not without a HP

So i HP

they still say no and i asked for a recon.

Got the lady on the phone wanted and she wanted to hear about why i had 6 new accounts in 6 months and some of them sitting at 80% their CL. Again explained my strategy of using promotional offers of 0% and various cash back as well as points situations and said look at my payment history. On the non promo accounts i dont roll a balance into interest territory always paying in full after statement cuts.

She agreed and let me know she would review, after about 15 minutes of some other questions about spending habits she said she could raise it to 2k and i could barrow 2k from my csp said lets do it.

SO all products that i was able to get are as follows

UFCU loan 32k@3.8% - score pulled EX - 663

PENFED PRV 20k 17.99% - 643 EQ NEXTGEN-?? dont know yet

CHASE SLATE . 4k 23.49% -eq 643 ex 663

RBFCU approved me but i didnt take it 32k 5.1 -659 TU

So yeah moral of the story is know what you are trying to do and Give thanks to the Lord in all things for He is worthy of Paise ( even if i didnt get any of this) .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

that's a busy day at the dealership!!!!

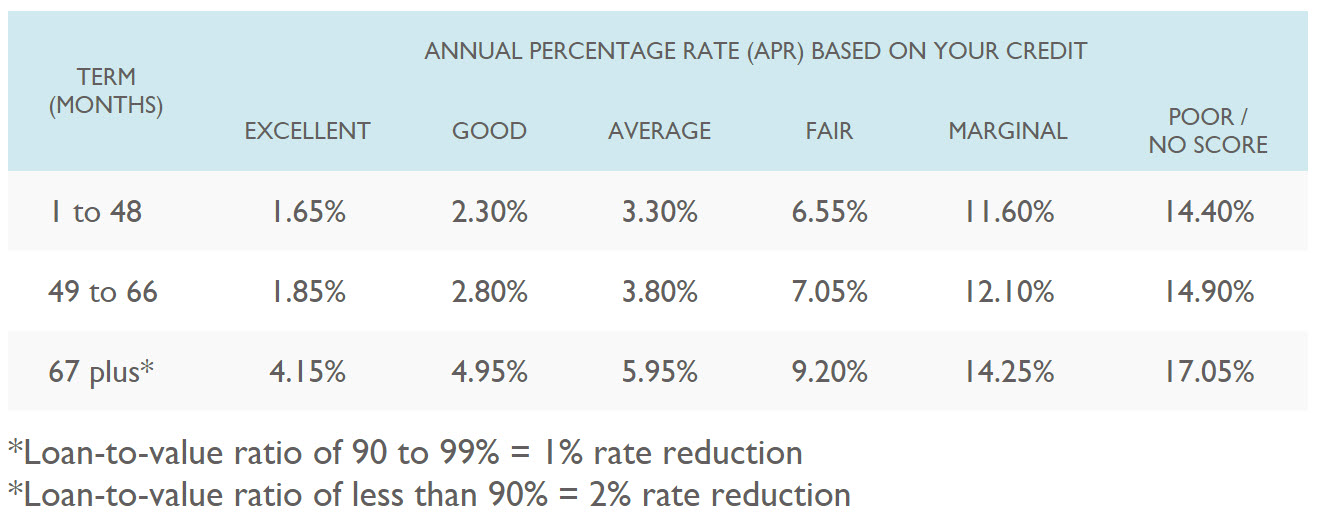

UFCU is amazing to deal with when it comes down to it though! I used them on my first mortgage for a couple of reasons but primarily because I was putting 5% down and their PMI rate was more than 50% less than everyone else. They closed from start to finish in 21 days whcih was unheard of at the time back in 2010. They're helpful and willing to bendover backwards to help if they can see that it's going to be a positive experience for both you and them. Another nice thing with them is as your scores go up you can hit them up for rate reductions on your loans. As you hit new brackets and take a HP they'll drop you to the next lower rate. A couple of years ago as my scores were on the rise they bumped me down time after time on the CC I have with them still to somehting like 6% after a couple of years dropping from ~11%.

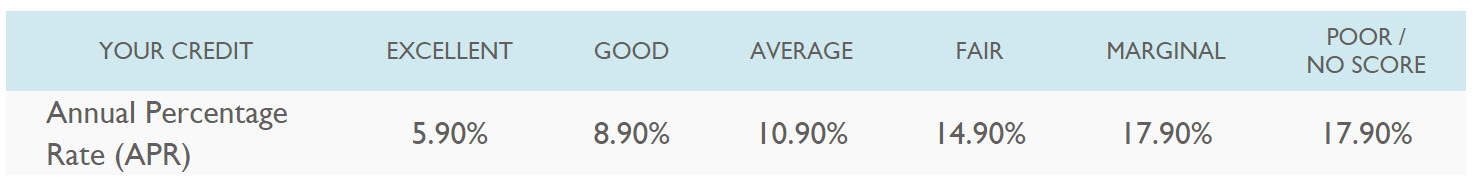

CC rates....

Mind you I can't recall if it's 720 or 740 but, once you get there you can drop your rate to the Excellent rate with a simple HP.

Auto rates....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

I would say if most folks would take some time and do some research on here on what Credit unions and banks are out there and what type of candidates they are looking for most would have more knowledge than the bankers in the dealership who have been hitting send on credit inquires for the last 15 years.

I find a majority of those folks do not have a real understanding of the credit environment as it pertains to demographics and credit profiles. They see a score and think, yup i know what kind of credit this person has but they know nothing about AAoa, Derogs, BK, New Accounts, etc...

So you end up ebing pigeon holed into a bad deal. whether or not it is intentional i do not know, however i know that a person who has set out to learn about what to expect from credit agencies credit lenders, and car dealers, are like folks who put their swimming trunks and pinch their nose before going down the crazy warped water slide of car buying.

I am telling you, once you jump in the car dont kid yourself, if you came to buy, you are now in the tube and the only direction from there is down and fast.

So be ready with your info, know what lenders are looking for, if you know that you are not going to get a rate that you are looking for and can wait, do it, there is no magical maybes here, if you have a bunch of derogs/lates/chargeoffs or you are rolling over a bunch of negative equity, you will be fighting up stream, but as long as you have reasonable expectations you will not be dissapointed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

Congrats, your journey is definitely something to be proud of. It seems you might have reached your internal limit with Chase. I guess you should have gone to another lender for the BT card but the problem is, we never know until they give us a low limit or deny us. It's a real shame they don't just note it in a little window on our portal, "Congratulations! Your new internal limit is 35k" or whatever, lol.

Enjoy the new car :] great job going to a CU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

Great story thanks for sharing enjoy your new car.......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

Moral of the story: if you know you're going to be doing some damage to your credit for a period of time, do MAX damage and get all you can. When the dust clears, the inquiries fall off, and the accounts age, you're sitting pretty with great cards and a car to boot. Nice work!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

WHO RUNS BARTERTOWN!!!

@Federalist

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: >>One for the books<<< You will want to read this post!!>>>UFCU,RBFCU,PE

I have searched penfed and nfcu for rates on new cars for DW. She is not a member of my credit union but she stayed with Vantage Credit union. We can search there and will have money and info in hand beforehand. We will pass on dealer financing$$$$.