- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2% - 3% Cashback (CB) Credit Card (CC) - List

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@Anonymous wrote:Apple Mastercard Card with Apple Pay.

But that's somewhat similar to a category, like saying card X gets 3% at supermarkets. The idea of the thread is flat rate, cards that give 2+% everywhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@longtimelurker wrote:

@Anonymous wrote:Apple Mastercard Card with Apple Pay.

But that's somewhat similar to a category, like saying card X gets 3% at supermarkets. The idea of the thread is flat rate, cards that give 2+% everywhere.

So funny, @longtimelurker, but that's exactly what I thought about including the Apple card. ![]() While I have one and think it serves its' purpose, it's not the best all-around 2% or better earner. Again, the cards on this list ideally earn a net uncapped rewards of at least 2% on all uncategorized purchases after accounting for fees. There are too many cards that meet this definition to make exceptions for cards that don't earn 2% all the time. (Apple Card only earns 1% if the merchant doesn't accept Apple Pay and you have to swipe the physical credit card. While Apple Pay is accepted at many places, I've found many more that don't accept it than do accept it. There are some places I can earn 3% with Apple Pay such as at Walgreen's but the places I earn a higher rate doesn't bring the average up to a full 2% return.)

While I have one and think it serves its' purpose, it's not the best all-around 2% or better earner. Again, the cards on this list ideally earn a net uncapped rewards of at least 2% on all uncategorized purchases after accounting for fees. There are too many cards that meet this definition to make exceptions for cards that don't earn 2% all the time. (Apple Card only earns 1% if the merchant doesn't accept Apple Pay and you have to swipe the physical credit card. While Apple Pay is accepted at many places, I've found many more that don't accept it than do accept it. There are some places I can earn 3% with Apple Pay such as at Walgreen's but the places I earn a higher rate doesn't bring the average up to a full 2% return.)

Another card similar to the Apple card is the Navy Federal Flagship Rewards which earns 2% uncapped on general spending as well as 3% on travel spending. I like the Flagship Rewards and have considered adding it to my Navy lineup. However, it has a $49 AF (only offset partially by Global Entry reimbursement) which keeps it from ever earning a full 2% over the long haul (excluding any SUB-added value.) And IMO, you can't really count the 3% travel earnings towards the average cash back since there are several other cards that pay 3% back in travel with no AF (Citi Costco, Well Fargo Propel, Bank of America Cash Rewards, etc.) So for general 2% or better cash back purposes, and even excluding the AOD FCU Visa (at 3%), I think the PenFed Power Cash Rewards, PayPal Mastercard, State Department FCU Premium Cashback+, and Citi Double Cash might all be a better choice for many people.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

Fifth Third Private Bank World Elite Mastercard Card is a 2% cash back card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@Anonymous wrote:Fifth Third Private Bank World Elite Mastercard Card is a 2% cash back card.

Interesting. That's another obscure one I hadn't heard of before! And yes, a true 2% card from the information available online.

However, I did confirm the minimum requirement for Fifth Third Private Bank is to have $1 Million in total assets with the bank, so that sets a high bar that would exclude much of the population.

Fifth Third is currently the 15th largest US bank and headquartered in Ohio. The bank's normal service area is also limited to thirteen states (OH, IN, IL, KY, MI, TN, WV, PA, MO, NC, SC, GA, FL.) However, it appears the bank is not geofenced based on calls to customer service. Personally, if I were investing that amount of money, and signed up as a Private Banking client, I would prefer to have a local branch to do business in person, but it is possible if someone wanted to sign up from outside the banking footprint.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

On the topic of obscure Private Banking 2% cards that aren't truly attainable and practical for the masses, I have one to add from UMB (United Missouri Bank):

UMB Private Bank Visa Signature Preferred Cash Rewards card.

It's actually a very cool looking card also and is metal alloy. ![]()

I imagine the minimum deposit requirements for Private Banking are similar to the Fifth Third, or at least substantial. Typically $1 Million is the deposit number needed for those services at most large banks.

UMB is the 79th largest US bank, headquartered in Kansas City, and operates in eight midwestern states (MO, IL, NE, KS, CO, OK, TX, AZ.) I have a version of their Simply Rewards card, my AFBA/5-Star Bank card which is serviced by UMB, so for that reason I had looked up their premium card offering before out of curiosity.

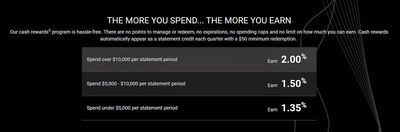

The card earns 2% ... as long as you spend at least $10K monthly on it! Which probably isn't difficult if you're a private banking client. At lower spend, it earns either an unimpressive 1.35% or 1.50%.

But technically, it's a 2% card! ... for those who qualify and would have high spend.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@Aim_High wrote:On the topic of obscure Private Banking 2% cards that aren't truly attainable and practical for the masses, I have one to add from UMB (United Missouri Bank):

And for those who can attain the card, doesn't exactly seem an attractive option! I'm one of the ones who have been less positive than you on the Penfed 2% card, because that requires (in some limited sense, with options) a $500 balance. This requires 2000 times that AND a large monthly spend to get 2%, which is available on a large number of no-strings cards!

And with BoA with just $100K, you can get a 2.625 general spend rate.

So, if you are eligible, just say no!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@longtimelurker wrote:

@Aim_High wrote:On the topic of obscure Private Banking 2% cards that aren't truly attainable and practical for the masses, I have one to add from UMB (United Missouri Bank):

And for those who can attain the card, doesn't exactly seem an attractive option! I'm one of the ones who have been less positive than you on the Penfed 2% card, because that requires (in some limited sense, with options) a $500 balance. This requires 2000 times that AND a large monthly spend to get 2%, which is available on a large number of no-strings cards!

And with BoA with just $100K, you can get a 2.625 general spend rate.

So, if you are eligible, just say no!

Exactly. Even though I've been aware of it for a long time, that's why I haven't included the UMB Private Bank Preferred Cash Rewards Signature Visa on my list of 2% cards. And for the same reason, I would exclude other Private Bank cards such as the Fifth Third card from the general discussion due to the high deposit requirements.

I make an exception for that Bank of America Premium Rewards card since the much lower $100K deposit requirement is far more easily attainable and the rewards are exceptional at 2.625%. Until the AOD FCU and US Alliance FCU cards came along with their 3%, that was the highest uncapped uncategorized cash back rate you could find. Even though I have the AOD Visa, I completed the process of getting that BofA PR card for that very diversity and backup.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

These are 2% cash back cards with $450 AF by Zions Bancorporation:

-Zions Bank Reserve Visa card.

-Amegy Bank Reserve Visa card.

-California Bank & Trust Reserve Visa card.

-Vectra Bank Colorado Reserve Visa card.

-National Bank of Arizona Reserve Visa card.

-Nevada State Bank Reserve Visa card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

HAPO Visa Cash Back Card offers 2% cash back on all purchases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% - 3% Cashback (CB) Credit Card (CC) - List

@Anonymous wrote:HAPO Visa Cash Back Card offers 2% cash back on all purchases.

Geo-fenced.

HAPO membership is available to anyone who lives, works, worships or attends school in Washington State or lives and/or works in Umatilla, Morrow or Clackamas County in Oregon. You may also become a member if you have a relative who is a member or is eligible.