- myFICO® Forums

- Types of Credit

- Credit Cards

- 2% FlatRate Card Advice Needed - Options Pros/Cons

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2% FlatRate Card Advice Needed - Options Pros/Cons

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@Guyatthebeach wrote:Taurus22,

Take a look at the Synovus cash card. You get 3% cash back on restaurants and a category of your choice you pick quarterly. Warehouse stores is a category. You have apply in a branch. I never pursued getting this card because I just haven't had a chance to stop by the branch by my house.

I do have a card with SDFCU and that CU is very easy to deal with. I have yet to ever walk into a branch yet.

I have the Costco Visa. It's a solid card and I have yet to have an issue with the card. You get a voucher in February to spend at Costco.

I have discovered that Costco does accept Apple Pay, but you can only use it with Visa cards. They don't accept MC. I tried it with my Apple MC and my Paypal MC in my Apple wallet at the stores in Columbia and Myrtle Beach. It didn't work.

Hope this helps!

Guyatthebeach

I just want to make a couple of corrections/clarifications:

1. You do not have to spend the voucher at Costco. You can cash the voucher and pocket the funds. Matter-of-the-fact, DON'T use the voucher to purchase items at Costo. Use your Costco Visa so you can still earn rewards.

2. If you order online at Costco.com, you can use Discover, AmX and MC.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

https://www.paypal.com/us/webapps/mpp/credit-card/2-percent-cash-back-mastercard

PayPal 2% card is good.

No minimum cashback redemption

Credit limit will likely grow w/Synchrony.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@Blodreina wrote:https://www.paypal.com/us/webapps/mpp/credit-card/2-percent-cash-back-mastercard

PayPal 2% card is good.

No minimum cashback redemption

Credit limit will likely grow w/Synchrony.

I was thinking the same thing, but OP is looking for a Visa for use at Costco

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@CreditInspired wrote:

@Guyatthebeach wrote:Taurus22,

Take a look at the Synovus cash card. You get 3% cash back on restaurants and a category of your choice you pick quarterly. Warehouse stores is a category. You have apply in a branch. I never pursued getting this card because I just haven't had a chance to stop by the branch by my house.

I do have a card with SDFCU and that CU is very easy to deal with. I have yet to ever walk into a branch yet.

I have the Costco Visa. It's a solid card and I have yet to have an issue with the card. You get a voucher in February to spend at Costco.

I have discovered that Costco does accept Apple Pay, but you can only use it with Visa cards. They don't accept MC. I tried it with my Apple MC and my Paypal MC in my Apple wallet at the stores in Columbia and Myrtle Beach. It didn't work.

Hope this helps!

Guyatthebeach

I just want to make a couple of corrections/clarifications:

1. You do not have to spend the voucher at Costco. You can cash the voucher and pocket the funds. Matter-of-the-fact, DON'T use the voucher to purchase items at Costo. Use your Costco Visa so you can still earn rewards.

2. If you order online at Costco.com, you can use Discover, AmX and MC.

Costco does not accept Amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@cardme

Thanks for the information on SDFCU. Just really sux there's no 0% promo and the SUB is just crazy @ $3,000 spend. That's a lot of spend for a $200 bonus....It's still on my list though.

@ Guyatthebeach

Synovus is actually already on my radar, but not for my 2% flat card. I have a bank within a mile from me and I'm planning to get the Cash Rewards for the 3% dining / 3% choice. This is pretty much a BBVA Clearpoints clone, I just don't know if they have bonus offers like BBVA does.

Costco Anywhere was on my list at one time, but I already have a 5% gas card, Synovus will be my 3% dining until something better comes along, and the 2% costco spend I can cover once I figure out this 2% Visa.

@isaac2x

Hey thanks for the info on the Alliant. I knew about the 2.5% but I didn't know they also have a 2% card....which is weird.....with the AF, why didn't they just make it a 3% card and give the two cards more separation. Anyway, I have a new option to look at now.....thanks! I'll have to search the forum for all the DP's for Alliant.

@Saeren

BBVA charges for ACH transfers? Wow, didn't know that....I'm just drawn to those bonus offers on the Clearpoints card, so I figured having the 2% card as well would be pretty solid. Like I say, I don't mind having another checking account with the right bank....gonna have to look into these extra charges you speak of...

And no worries, I'm not touching that SignatureFCU card.....I've looked at the site before and that thing is pretty stinky. (No offense J_in_Minnesota, just not my kinda card)

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@RehabbingANDBlabbing

I did notice the Alliant is 2 points per dollar. Do you know if they actually convert 1 to 1 or is there a % loss when you redeem? I'm like you, I also rack up cashback pretty quick so $20 redeem minimum is easy peezy, no worries there. Do they require bank membership or direct deposit into an account? Or can you app the card only?

Need some good DP's, if you have anything you can tell me, shoot me a PM.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@Taurus22 wrote:@RehabbingANDBlabbing

I did notice the Alliant is 2 points per dollar. Do you know if they actually convert 1 to 1 or is there a % loss when you redeem? I'm like you, I also rack up cashback pretty quick so $20 redeem minimum is easy peezy, no worries there. Do they require bank membership or direct deposit into an account? Or can you app the card only?

Need some good DP's, if you have anything you can tell me, shoot me a PM.

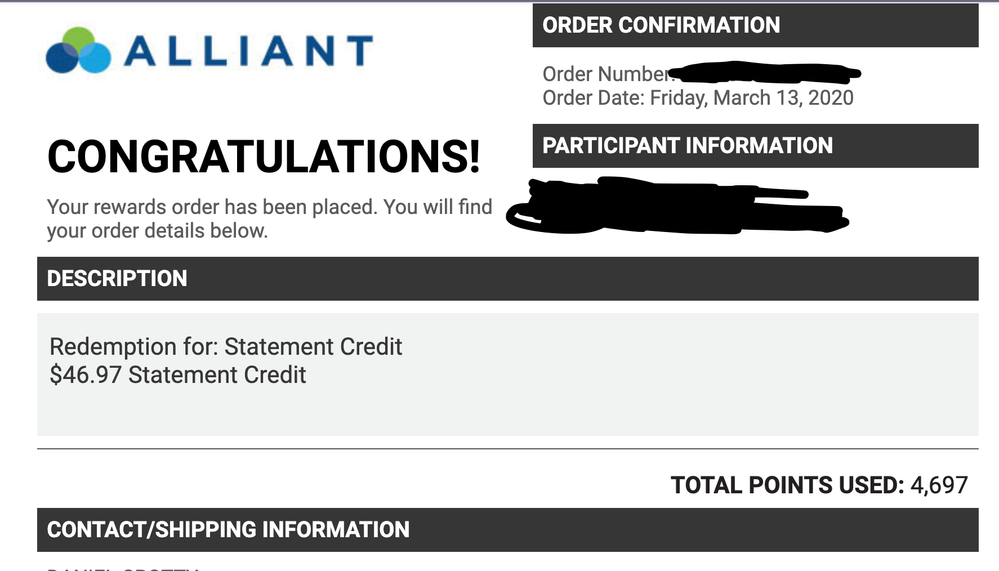

No, it is 1 cent per point. Here's an image of the points I redeemed this month. I redeemed 4,697 for $46.97.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

Surprised I haven't gotten any feedback about FNBO. Surely, someone out there has an account.

Really wanting to know the appeal to PenFed too..... I've noticed that PenFed, NFCU and Langley all fall into a similar group....all EQ pulls, and obviously NFCU is wildly popular for their CL's. Is PenFed similar in that respect as well?

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

@RehabbingANDBlabbing

Nice! So is statement credit the only option, or can you get deposit into any account?

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% FlatRate Card Advice Needed - Options Pros/Cons

The BBVA card requires a monthly direct deposit of $1K into a BBVA checking account to get 2% otherwise it's 1.5%. They charge for outbound ACH push but if you pull from another account, that's free.

Its a bit too much management for me.

As for FNBO, plenty of people who are happy with them but they're not the top of the list. They have a pure cash back card that's actually 2% without redeeming to a FNBO account if you are interested. It was originally supposed to be a limited offer but I don't see the expiration date on there now - https://www.fnbo.com/personal-banking/credit-cards/cashback-rewards/