- myFICO® Forums

- Types of Credit

- Credit Cards

- 2 Gaps to fill in my CashBack Lineup

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2 Gaps to fill in my CashBack Lineup

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2 Gaps to fill in my CashBack Lineup

I have 2 big holes to fill in my cashback lineup and I'm a little torn on what to do about it.

1.) Barclay Uber trashed my (4% Dining / 3% Travel) no FTF card with Uber credits. Need a solid replacement.

2.) I still haven't found a solid Wal-Mart spender. (Do NOT want that pathetic CapitalOne Walmart card)

Current:

Citi DC - (2% daily non-category)

BoA Cash Rewards - (3% All Online Shopping)

FNBO Ducks Unlimited - (5% Gas + 5% Sporting Goods)

Discover IT - (5% Category)

US Bank Cash + (5% Utilities + 5% Internet/Cable)

Planned:

US Bank Cash + (#2) - (5% Cell Phone + 5% Fast Food)

ABoC Union Strong - (5% Category, converts at 3.75%)

So, I'm a Costco member and the first thought for the Dining/Travel is the Citi Costco Visa (3%). No FTF so it spends well out of the states, as a good travel/dining card should do. However, with this you are permanently bound to Costco. Really want a better option.

UMB Simply Rewards is really nice, but I'm not in any of their affinity geo-areas. (3%) on Dining, Grocery, Discount stores,......this would effectively cover Walmart regardless if they code as grocery or discount store, and covers Dining as well. (All without having to rotate categories, etc.) This would be pretty nice, but.....ah well.

Huntington Voice covers Dining OR Travel OR Walmart (discount stores), but you have to choose only one. Covers all my needed categories but ultimately a single-purpose card, one category at a time.

So, I thought about getting every 5% category rotater on the market to cover all Dining,Travel, Grocery, and Discount Stores per quarter. I'm a HUGE fan of 5% cards that cover multiple categories......but....

Vantage West Connect is geo-restricted (I'm SC)

Nusenda FCU is somewhat geo-restricted, but too many hoops to jump thru to try to bypass that hurdle.

Chase Freedom is ......meh. Categories seem to be weaker than other rotaters. Was on my wish list for a while but now I'm kinda turned off by it.

The ABoC will be a nice rotater at (3.75%) to pair with the Discover but I will likely still have a lot of gaps in those category quarters without more 5% rotating fire-power.

Any suggestions? Should I just hold out for the next Citi Dividend that rolls out? Lol.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

If you do a lot of monthly spending with them. IMHO, that card is the best bet.

I even use it (Walmart pay) when getting my oil changed and tires rotated/ balanced. It's all 5% cash back currently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

Well I'm an odd cat. I do most of my Walmart spend in-store and I don't want someone else picking out my stuff so I don't use the grocery pick-up. I rarely (if ever) buy on Walmart.com so I don't get the 5% perks. So in-store the best it gets you is 2% and I have a 2% card for all that.

That's why I like cards that cover multiple categories. I don't want a single purpose card just for Walmart alone.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

I got the Capital One SavorOne to replace my Uber card for 3% Dining and Entertainment. Another option is the Wells Fargo Propel with 3% dining, travel (including gas) and streaming services. If you are a Navy Federal member, the NFCU More Rewards is comparable with 3% dining, travel (including gas) and supermarket. All 3 cards with no FTF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

The Costco Visa is a pretty strong cashback card (IMHO), but if you're worried about being permanently tied to Costco then I'd suggest Cap1 SavorOne. It gives 3% back on dining and entertainment--but, if you spend more than $9500 on dining and entertainment, then you'd earn more cashback with the Savor, which gives 4% back, respectively.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

A lot of cards with good earn rates get nerfed before that happens.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

Cap SavorOne was actually on my list for a while too, but entertainment isn't a big category for me. So that would make it a single purpose card for me too. Dining/Travel just play well together. I think maybe I'm just too picky. I like dual/multiple purpose cards if they're going to take a spot in my wallet.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

@wasCB14

That's why I need multi-purpose cards. It has to be worth the while to jump over the 2% daily spender.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

Reading back, I feel like I'm shooting down everyone's suggestions and I really don't mean to come off that way. It just seems like I've exhausted every avenue and I'm frustrated. Sorry if it comes off that way, I really am.

I have 5% roatater envy I think. Some of these guys on the West coast have all the good rotaters and I'm stuck in SC kicking rocks....lol.

Nusenda FCU, Vantage West, Discover, Chase Freedom, ABoC......that would be a solid mix. And there's probably a couple more I haven't come across.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 Gaps to fill in my CashBack Lineup

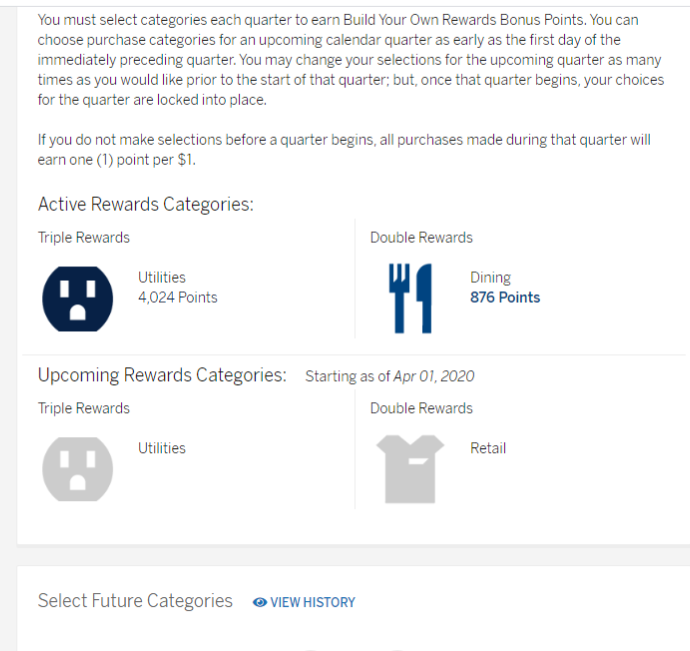

BBVA Clearpoints is a good card with an unlimited 3% category and an unlimited 2% category that can be changed quarterly. The categories and very broad and the cashback posts as soon as the charge posts. The points redeem 1:1, but it is limited to statement credit. The have lots of special offers through the year as well. For January, they offered 4X bonus points on dining, and I had dining set as the 2% category, so we got 6% on dining for the whole month of January. Between utilities and dining, we earned $49.00 in cash back for January

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards: