- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: AMEX ED vs EDP: Downgrade? CLD?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX ED vs EDP: Downgrade? CLD?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

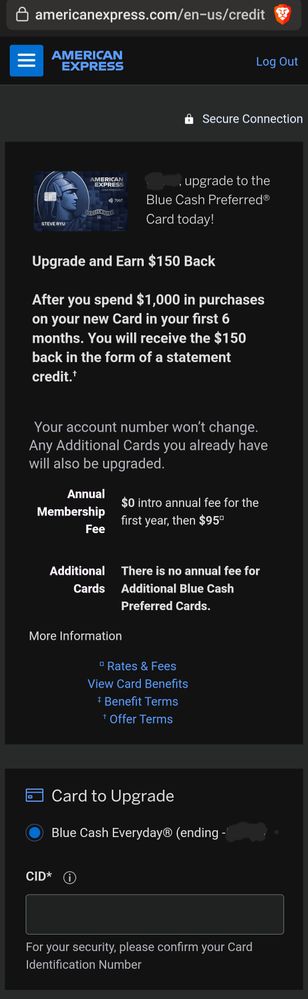

Ah... so something like this then?

So churning, in this case, would be to upgrade this BCE to BCP, use it for 1 year while obtaining the $150 bonus, then downgrade back to BCE before the AF hits, and then, look for another upgrade offer back to BCP, rinse & repeat?

Interesting concept.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

@Absolution16 wrote:

Ah... so something like this then?

So churning, in this case, would be to upgrade this BCE to BCP, use it for 1 year while obtaining the $150 bonus, then downgrade back to BCE before the AF hits, and then, look for another upgrade offer back to BCP, rinse & repeat?

Interesting concept.

Yes, your example is a type of targeted offer. Even if you previously had the Blue Cash Preferred card, the targeted offer would still make you eligible to collect an upgrade bonus. However, you must take care to not close the account for at least one year. Yes, that means you would have to pay some of the annual fee which would cut into the full value of the upgrade bonus. It's up to you to decide when a targeted offer is worth taking. For example, the last upgrage offer I got to go from ED to EDP was 40,000 points. That was worthwhile even with a $95 annual fee.

Do some reading about the Amex RAT team. That is the Rewards Abuse Team that monitors whether or not people are using an offer as Amex intended. There are many instances where bonuses have been "clawed back" when Amex determines that someone has run afoul of the terms of the offer. One of the things that could trigger such an action would be if you downgraded your card before a full year. To be safe, some of us will keep an upgraded card until we have paid a full annual fee and not just a prorated portion.

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

And anyone else that may want to chime in:

If I were to decide to downgrade my 20.5K CL EDP to ED, and plan on only using that downgraded ED sparingly just to keep the account open, do any of you suggest that I transfer some or most of the 20.5K CL into my 9K CL BCE? Maybe as drastic as move ALL but 1K CL?

My EDP is due for an AF in a couple of months, and if I do the downgrade, I will surely not use the ED much, if at all. BCE still will have uses though because it still has good enough cashback rewards for groceries, gas, and online shopping. I figure that if ED is gonna get the SD treatment with small and rare spend every few months, maybe it might be safer to make that a 1K CL card?

One thing that concerns me though, on that approach, is the fact of having a No-AF BCE with a 28.5K CL. Not sure if that is smart or not.

What do you all think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

@Absolution16 wrote:And anyone else that may want to chime in:

If I were to decide to downgrade my 20.5K CL EDP to ED, and plan on only using that downgraded ED sparingly just to keep the account open, do any of you suggest that I transfer some or most of the 20.5K CL into my 9K CL BCE? Maybe as drastic as move ALL but 1K CL?

My EDP is due for an AF in a couple of months, and if I do the downgrade, I will surely not use the ED much, if at all. BCE still will have uses though because it still has good enough cashback rewards for groceries, gas, and online shopping. I figure that if ED is gonna get the SD treatment with small and rare spend every few months, maybe it might be safer to make that a 1K CL card?

One thing that concerns me though, on that approach, is the fact of having a No-AF BCE with a 28.5K CL. Not sure if that is smart or not.

What do you all think?

I wouldn't, unless you're planning to make giant purchases on the BCE, which seems unlikely, or carry a balance on it, which seems even more unlikely.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

Then you'd suggest just leaving the CLs as they are, even if the EDP gets the downgrade and SD treatment?

I am not sure what the safest and the most optimal way to go about this. I currently don't have any need to spend these MR points right now....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

@Absolution16 wrote:And anyone else that may want to chime in:

If I were to decide to downgrade my 20.5K CL EDP to ED, and plan on only using that downgraded ED sparingly just to keep the account open, do any of you suggest that I transfer some or most of the 20.5K CL into my 9K CL BCE? Maybe as drastic as move ALL but 1K CL?

My EDP is due for an AF in a couple of months, and if I do the downgrade, I will surely not use the ED much, if at all. BCE still will have uses though because it still has good enough cashback rewards for groceries, gas, and online shopping. I figure that if ED is gonna get the SD treatment with small and rare spend every few months, maybe it might be safer to make that a 1K CL card?

One thing that concerns me though, on that approach, is the fact of having a No-AF BCE with a 28.5K CL. Not sure if that is smart or not.

What do you all think?

Personally, I wouldn't bother reallocating. I only care about CLs on cards that get significant spend.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

How about with the assumptions that:

1. all my spending on my current EDP get absorbed by BCE

and

2. downgraded ED gets the SD treatment with a tiny purchase maybe every quarter?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

@Absolution16 wrote:

How about with the assumptions that:

1. all my spending on my current EDP get absorbed by BCE

and

2. downgraded ED gets the SD treatment with a tiny purchase maybe every quarter?

How much spend would BCE be getting per year between supermarkets and eligible online shopping?

*And do you have a 2%+ card or anything like that?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX ED vs EDP: Downgrade? CLD?

Between groceries and online shopping, excluding gas, I'd say between 1K to 2K, with $500 (considering the 6K annual cap) on groceries reached quite easily.

EDP has grossly high CL for my spend on groceries. I don't "need" it that desperately, but I certainly don't want a CLD/AA/closure either.

2+% cards? I have a psudo-2% card in Apple Card. I was searching around the forums about these 2+% cards to see what are out there. If I were to get one, it needs to be No-AF, No-FTF. Alliant and PenFed seem to have one of these, but I am reading a lot of negativity with these CUs.