- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: AMEX Pre-qualified??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX Pre-qualified??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

@Harmony12 wrote:

That's exactly what I have been trying to figure out. I was hoping the card would improve my chances for a corporate card approval. My department will be ending soon so once that happen I need to be able to apply for a promotion quickly. With that I will need to be approved for a company Amex corporate card also.

Dont "decide" quite yet. I am sure other people who have some experience with corporate card approvals (and if there is any relation when personal card is already present) will chime in at some point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

Two quick things:

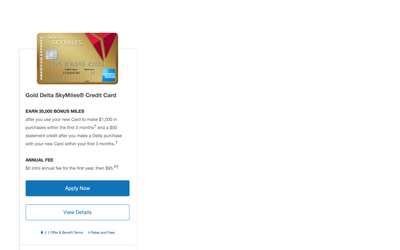

As others have stated, the underwriting for Amex Delta Gold seems to be a bit looser and it’s not out of the question for being approved with your current Experian score. But a low starting line is more likely if approved.

My other question is that since this is an employer-issued Amex Card, you shouldn’t need to already have an American Express account issued in your name. Corporate and Small Business are different; my assumption is that other employees may have been denied a card due to a previous negative experience with American Express and they are blacklisted from being issued a card. I would certainly want to clarify that as I’ve not heard of employees being denied SB or Corporate cards due to their personal credit reports. But if an Amex account was charged off or included in bankruptcy, they have a long memory.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

I have had a little experience but many years ago. First was my step father's co. He was CFO of a Russell 2000 firm and they simply told Amex who to add to their corporate card list because the the firm paid the bill Also I owned a firm that had about 10 coporate cards. As long as I was willing to sign as the requestor and them as the user they added cards. For compay cards with revenue over a few million dollars IMO it is easy to get added. I feel they will not be looking at the user but at the firm's credit. Now there are cases with firms with bad credit. I have a client now that has revenue of over $100 miilion that we will not allow the pass through expenses to get over $500 and a net 10 days because they simply don't pay bills . No one gives them credit of any large amount.

In this case you scores IMO are very low. I would work on raising scores befoe applying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

@K-in-Boston wrote:Two quick things:

As others have stated, the underwriting for Amex Delta Gold seems to be a bit looser and it’s not out of the question for being approved with your current Experian score. But a low starting line is more likely if approved.

My other question is that since this is an employer-issued Amex Card, you shouldn’t need to already have an American Express account issued in your name. Corporate and Small Business are different; my assumption is that other employees may have been denied a card due to a previous negative experience with American Express and they are blacklisted from being issued a card. I would certainly want to clarify that as I’ve not heard of employees being denied SB or Corporate cards due to their personal credit reports. But if an Amex account was charged off or included in bankruptcy, they have a long memory.

I've known a couple of people that were originally denied for a corporate Green card because their recent personal credit histories had derogs that were serious enough to meet the required mininum requirement but not serious enough to fail an internal security check. They ultimately got cards but there was some hoop-jumping.

I don't know if there were special conditions specified or not as condtions of being issued the cards.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

@K-in-Boston wrote:

My other question is that since this is an employer-issued Amex Card, you shouldn’t need to already have an American Express account issued in your name.

You don't need a prior personal relationship with AMEX to be issued a corporate card.

You can also choose to use different accounts to manage your corporate and personal cards, or you can choose to manage them under the same account. It's a much more seamless process than for example Chase' way of integrating personal and business cards.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

@Harmony12 wrote:I have been checking the Amex site almost daily to see if I could be pre-qualified. This morning I got a credit score and so I decided to check for a prequalification. Well, I was prequalified for the Delta Gold Amex. I have never had an Amex and I have been able to get bouns points/miles. I travel often and will do so even more once I look for another promotion. How does Amex prequalifications work...should I take the bait? I know once you have at least one that the others are just a soft pull. I need an Amex for work soon. I don't want my career to be put on hold because I can't qualify for an Amex corporate card. (There has been many people unable to qualify for the Amex corporate card at my company.)

I currently have several Comenity bank store cards that I got 4-5 years ago, 3 Capital One cards, and Discover IT. My inquiries are low but I still have 2 unpaid COs (making payments), several paid COs, and 1 collection. A lot of these will fall off within the next 8 months.

Any help is appreciated...current scores are in my Siggy.

You can relax a bit. There is no need to apply for a personal AMEX card as that will have no affect on your ability to qualify for your company's AMEX Corporate Card. Corporate cards are based on your company's credit profile (Dunn & Bradstreet report and Paydex Score). Some corporations sign up for 100% liability for all corporate card expenses, while others will share the liability with the employee. Either way, AMEX will pull your EX report; however, the tradeline will NOT report on your CRA's unless your company's plan administrator is seriously (90 - 120 days) delinquent paying the bill. With your score and history, the absolute worst that could happen, in my opinion, is that your card would be approved, but restricted (e.g. $2,500 in total T&E expenses each month/$300 in retail charges per month) until purchase patterns have been developed. Even with a 649 EX score, I would not be too concerned about being approved. If your derogs are falling off in 8 months, they have sufficiently aged and your recent good habits will help you.

Good luck with your promotion!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

I've seen people get a corporate amex while being blacklisted personally. In those cases, the business was handling the payments rather than the cardholder being reimbursed. So that's something to keep in mind. Also, if you apply for a card now, you'll lower your score for the inquiry, new account, and AAoA hit. Right now you're extremely borderline for a gold charge, but you may not qualify in a few months after the hit from a new card. As for whether you would get approved for the Delta Gold, probably. 640 appears to be the magic number. I didn't get approved with mid-630, but 8 days later I was approved with a 641.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

So your Delta Gold card hasn't improved any but you now have 4 additonal Amex cards? Are those other cards worth the annual fees? I'm not 100% for sure how Amex works but I have seen the many annual fees that slightly scare me.

TU 503

EQ 498

Discover EX 537

FICO 8

7/7/18 05/24/21

EQ 557 701

TU 566 715

EX 514 711

Mortgage Scores FICO 5,4,2

7/7/18 05/24/21

EQ 494 685

TU 480 703

EX 479 693

Goal Score 720

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

@Harmony12 wrote:

So your Delta Gold card has improved any but you now have 4 additonal Amex cards? Are those other cards worth the annual fees? I'm not 100% for sure how Amex works but I have seen the many annual fees that slightly scare me.

Different cards have different rewards systems and different fees. You need to get cards that match your spending habbits and lifestyle not letting the card drive the life style. DW and I both have Amex BCP cards. We get enough out of the grocery spending to justify the $95 fee on each. The grocery is 6%. Dw has an Amex magnet card that has no fee for some misc spend. I use for misc a Citi Double Cash card.

We have other cards for specific uses like US Bank Cash Plus uitilies and fast food, Sams Club Gas, and Chae Freedom for Shop with Chase. We don't need a travel card as sil work for United and we get free travel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Pre-qualified??

Okay, I'm going to try to answer many of the questions. It is the Amex Corporate Green card with a very large global company. I have seen people denied an Amex corporate card and I have also seen some get approved but with very low limits. Those with the best credit get approved with higher limits 10K+. The company makes payments on the accounts once the expenses are approved. If expense is not approved, then the employee makes the payments.

I'm trying to avoid being denied the corporate card. However, a personal travel card would not be terrible as I do travel a lot personally now (at minimum 8 times a year).

So should I wait a few more months until my scores improve to get a better SUB and/or better card? Also, what is the hype of Amex cards as they are not offered at many places?

TU 503

EQ 498

Discover EX 537

FICO 8

7/7/18 05/24/21

EQ 557 701

TU 566 715

EX 514 711

Mortgage Scores FICO 5,4,2

7/7/18 05/24/21

EQ 494 685

TU 480 703

EX 479 693

Goal Score 720