- myFICO® Forums

- Types of Credit

- Credit Cards

- AOD FCU Visa > > > ROAD TRIP!!! :-)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AOD FCU Visa > > > ROAD TRIP!!! :-)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@AverageJoesCredit wrote:

Im sure im legend there....." Ah Lord have mercy Chil', this poor gringo tryin' to get our card on his income and to boot from PR!"🤣

Lol ... you crack me up AJC. ![]()

You misspelled it. Lawd, not Lord! Lol

You gots to get the southern accent down right.

I can say that because I grew up in the south. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@Aim_High wrote:

@AverageJoesCredit wrote:

Im sure im legend there....." Ah Lord have mercy Chil', this poor gringo tryin' to get our card on his income and to boot from PR!"🤣Lol ... you crack me up AJC.

You misspelled it. Lawd, not Lord! Lol

You gots to get the southern accent down right.

I can say that because I grew up in the south.

Good man!!!![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@AverageJoesCredit wrote:

@imaximous wrote:

Because of this place, I've been really tempted to go for this 3% card and I really don't need it. So I'm avoiding all threads that read, "AOD..." hahaGood luck lol cuz its in Credit Cards, Applications, and Approvals. Im willing to bet it can be found somewhere in Smorgs too😆

I close my eyes and still see those **bleep** A O D letters jumping around -- funny thing is I don't even know what it stands for. I only see 3%... ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@imaximous wrote:

@AverageJoesCredit wrote:

@imaximous wrote:

Because of this place, I've been really tempted to go for this 3% card and I really don't need it. So I'm avoiding all threads that read, "AOD..." hahaGood luck lol cuz its in Credit Cards, Applications, and Approvals. Im willing to bet it can be found somewhere in Smorgs too😆

I close my eyes and still see those **bleep** A O D letters jumping around -- funny thing is I don't even know what it stands for. I only see 3%...

Anniston Ordnance Depot. They are a military CU (this one is Army).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@imaximous wrote:

@AverageJoesCredit wrote:

@imaximous wrote:

I've been really tempted to go for this 3% card and I really don't need it. So I'm avoiding all threads that read, "AOD..."Good luck lol cuz its in Credit Cards, Applications, and Approvals ...

I close my eyes and still see those **bleep** A O D letters jumping around -- funny thing is I don't even know what it stands for. I only see 3%...

For anyone interested, AOD actually stands for Anniston Ordinance Depot, which is a defunct name.

Anniston refers to Anniston, Alabama which is northeast of Birmingham along Interstate 20 headed towards Atlanta. The military facility is actually located in the community of Bynum, Alabama which is just west of Anniston and now is part of the city of Oxford, Alabama.

Anniston Ordnance Depot was established in February 1941. In 1962, the installation was renamed Anniston Army Depot. In 2004, the name was changed to the Anniston Defense Munitions Center. Since the Credit Union affiliated with Anniston Ordnance Depot was founded in 1950 when the name was still AOD, the AOD name stuck and has been retained.

The Anniston Defense Munitions Center (ADMC) is a multi-functional ammunition facility. The primary mission is receipt, storage, surveillance and shipment of missiles and conventional ammunition. The ADMC is the site of the Department of Army’s only Missile Recycling Center and is one of the Army’s premium ammunition storage sites because it is capable of storing some of the Army’s largest munitions. Capabilities of the center include: ammunition renovation; shipping, receiving, outloading; preservation, packaging and maintenance; quality assurance; explosive demilitarization; and missile recycling. ADMC is housed on 13,160 acres with 33 buildings, 1,124 igloos and a storage capacity of 2,500,000 square feet. (credits to Wikipedia)

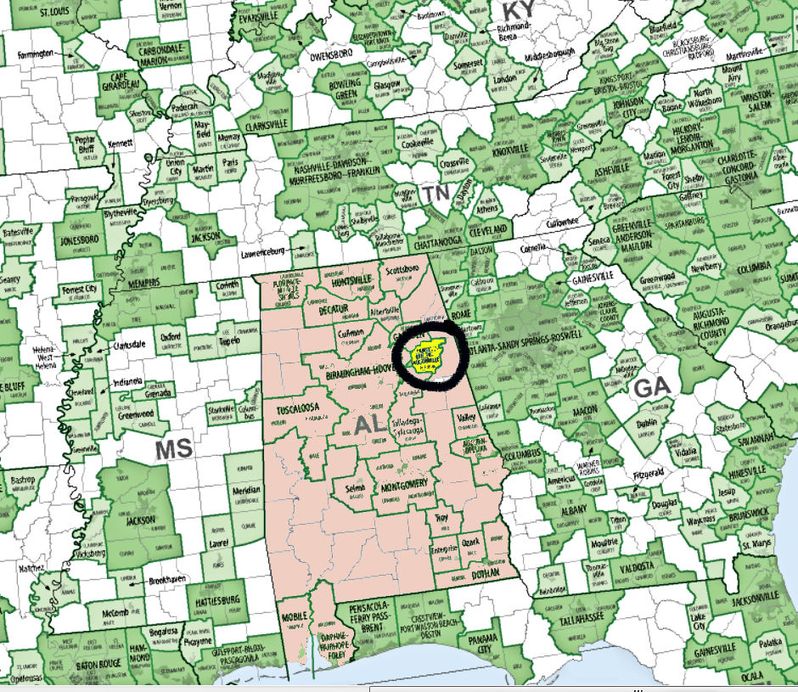

Circled area below is the Anniston-Oxford Metropolitan Statistical Area. Population 112,249 (as of 2000.)

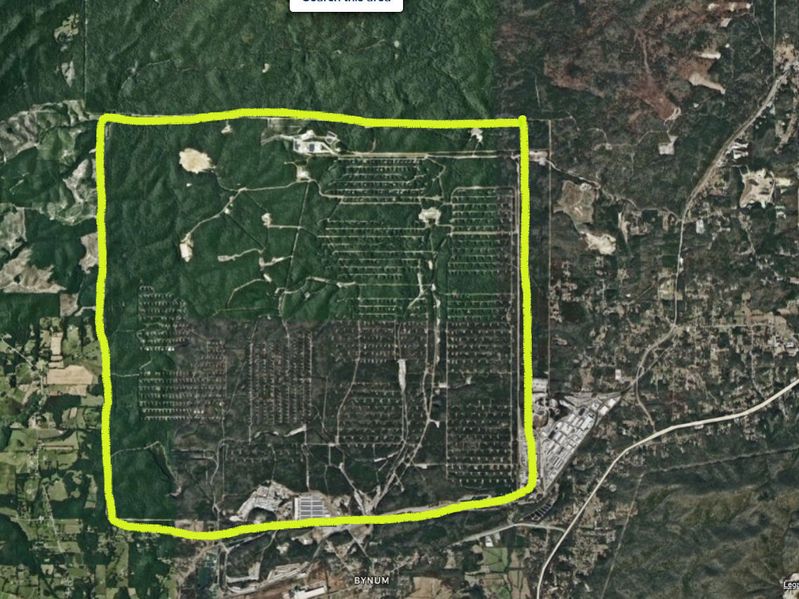

For reference to the huge size of the facility, see this image from Google Maps. ![]() The individual storage "igloos" (hardened bunkers) are separated for safety and the entire facility dwarfs the community of Bynum to the south and the city of Anniston to the east.

The individual storage "igloos" (hardened bunkers) are separated for safety and the entire facility dwarfs the community of Bynum to the south and the city of Anniston to the east.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@Aim_High wrote:

@AverageJoesCredit wrote:

@imaximous wrote:

Because of this place, I've been really tempted to go for this 3% card and I really don't need it. So I'm avoiding all threads that read, "AOD..." hahaGood luck lol cuz its in Credit Cards, Applications, and Approvals. Im willing to bet it can be found somewhere in Smorgs too😆

Oh come on, you know you want it @imaximous! Lol

Do you already have a card that pays 3% uncategorized + uncapped and doesn't require relationship or mobile payment? It's a sweet deal and IMO, we all have enough need for uncategorized spend that this kind of card is helpful over time. There's a reason why it's all over My Fico!

Haha... @Aim_High remind me NOT to come to you for help if I ever have an addiction problem!

I did some calculations based on my spending patterns, and I can honestly say that I'm not missing much. The very worst I can do in terms of cashback is 2.625% with BoA. Yes, it does require a relationship, but it's already there so it's not like I'd have to go out of my way. And, I still don't have much use for it.

Bulk of my spend is on Amazon and that's 5%.

Best Buy comes second and I can use Apple Pay online and in-store. USB AR gets me 3%, but it really becomes 4.5% when I redeem those points.

Walmart is also 5% since I just got the card.

Office supply stores is 5% with Ink up to $25k. Once that's maxed out, I use USB AR for 4.5% or USB Business Cash for 3% plus 25% bonus on annual rewards.

Those are my major expenses (biz) and add up to, well, let's just say a lot of rewards.

All other expenses like travel, dining, gas, groceries, cell, etc., are typically covered with cards that have a bonus category that exceeds 3% CB. My AR sees a ton of spend because it's rare not being able to use Samsung Pay or Apple Pay. The only places where I haven't been able to use mobile wallet are machines where you need to dip your card -- but that's little spend, and sit-down restaurants which can be covered with a dining card anyway.

That's how I've convinced myself that I don't need this card, and the fact that it's a CU so I'd have to do extra work to apply.

I really wouldn't spend enough to justify another card for an extra 0.375%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@Anonymous wrote:

@imaximous wrote:

@AverageJoesCredit wrote:

@imaximous wrote:

Because of this place, I've been really tempted to go for this 3% card and I really don't need it. So I'm avoiding all threads that read, "AOD..." hahaGood luck lol cuz its in Credit Cards, Applications, and Approvals. Im willing to bet it can be found somewhere in Smorgs too😆

I close my eyes and still see those **bleep** A O D letters jumping around -- funny thing is I don't even know what it stands for. I only see 3%...

Anniston Ordnance Depot. They are a military CU (this one is Army).

with a name like that, I know I'm going to forget it as soon as leave the forum today unless I repeat it a few hundred times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

A 3% cash back card is without a doubt, tempting. I don't think it will stay with that same structure however. I think it is more likely to gain market share, and will be reduced in the future. If the 3% is still available in 2 years, I may seek to obtain this card, if I can get in the back door to obtain the membership to this credit union. I have no military route to do so.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@imaximous wrote:

@Aim_High wrote:

@imaximous wrote:

Because of this place, I've been really tempted to go for this 3% cardOh come on, you know you want it @imaximous! Lol

Haha... @Aim_High remind me NOT to come to you for help if I ever have an addiction problem!

I did some calculations based on my spending patterns, and I can honestly say that I'm not missing much. The very worst I can do in terms of cashback is 2.625% with BoA. Yes, it does require a relationship, but it's already there so it's not like I'd have to go out of my way. And, I still don't have much use for it.

Bulk of my spend is on Amazon and that's 5%.

Best Buy comes second and I can use Apple Pay online and in-store. USB AR gets me 3%, but it really becomes 4.5% when I redeem those points.

Walmart is also 5% since I just got the card.

Office supply stores is 5% with Ink up to $25k. Once that's maxed out, I use USB AR for 4.5% or USB Business Cash for 3% plus 25% bonus on annual rewards.

Those are my major expenses (biz) and add up to, well, let's just say a lot of rewards.

All other expenses like travel, dining, gas, groceries, cell, etc., are typically covered with cards that have a bonus category that exceeds 3% CB. My AR sees a ton of spend because it's rare not being able to use Samsung Pay or Apple Pay. The only places where I haven't been able to use mobile wallet are machines where you need to dip your card -- but that's little spend, and sit-down restaurants which can be covered with a dining card anyway.

That's how I've convinced myself that I don't need this card, and the fact that it's a CU so I'd have to do extra work to apply.

I really wouldn't spend enough to justify another card for an extra 0.375%.

I gotcha, @imaximous! Sounds like you're got it covered. I was mostly just teasing anyway and would never want to enable an .... ummmm credit addiction! Lol

I had planned to get that Premium Rewards card with Platinum Honors myself before AOD came along. And I probably will still do it. For one, AOD may or may not last. And another, Platinum Honors also gives me more than 3% cash back on some categories with either Premium Rewards or my Cash Rewards cards.

I think it is possible to get the bulk of most purchases at higher rates, but even with a ton of cards there will be holes in most people's lineup. And most people don't want to make their system overly complicated. So it's great that you have that 2.625% as a catch-all!

Although some cards may offer the categories below, they are often limited with quarterly rotating categories, caps, MCC's, or particular stores or require a separate card just to get higher than a flat 2% to 3% back on a single category. So I think about things such as car repairs, home repairs (Plumbers, electricians, HVAC), medical expenses, utility bills, college tuition or books, department stores, gift shops or small retailers, charitable donations as just a few examples of some potentially major expenses that may not be covered in someone's higher cashback lineup! I don't spend enough on "entertainment" to have a dedicated card like the Capital One Savor, so a 3% card pays as well as the Savor ONE without having to carry an additonal card. Even for smaller categories such as movie theatres which are covered by a cashback card such as US Bank Cash Plus, I might not want to bother having a dedicated card to cover that, so my flat rate card is handy. The other thing about flat rate cards is they can help out if you exceed your spending cap with other cards, which sometimes isn't difficult to do.

In my case, I'm just trying to diversify my options and I like having not only travel rewards (Chase URs) but also pure cash back. Before I got on My Fico, my best flat-rate cash back was limited to only 1.5% on Chase Freedom Unlimited or Capital One Quicksilver. That wasn't bad but it was time for a refresh since I could be doing better. Now I have PenFed Power Cash Rewards Visa (2%), AOD FCU Visa (3%), and Apple Mastercard-Goldman Sachs (2% anywhere on Apple Pay). The other flat 2% or better cards I am might add would be that BofA Premium Rewards and possibly the Navy FCU Flagship Rewards, just to give me future options and diversity.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AOD FCU Visa > > > ROAD TRIP!!! :-)

@sarge12 wrote:A 3% cash back card is without a doubt, tempting. I don't think it will stay with that same structure however. I think it is more likely to gain market share, and will be reduced in the future. If the 3% is still available in 2 years, I may seek to obtain this card, if I can get in the back door to obtain the membership to this credit union. I have no military route to do so.

Yeah, I'm a little skeptical about whether the AOD 3% rate will last but I'm hoping if they close off new applications that I will still retain the higher rewards rate. But I'm also diversifying my options so that if it does get nerfed, I have other good choices.

As for membership, there is no military affiliation required and it doesn't even help. It's a mostly geo-fenced membership but there were a few holes in the available "association" memberships that My Fico members used to join. Unless they close those, anyone can join as long as they first join one of those associations.

The other awesome thing about this card was the super-low 7.49% APR I got on it, as low as my Navy FCU Platinum Visa. While I don't carry balances, I like to have low-apr cards to put charges on in an emergency in case something comes up. (And then it would buy me time to either pay it down without such high interest charges or else find a place to roll it over on a 0% BT offer.)

Worst case scenario, I would think the 3% rewards would either be capped by spend per month/quarter/year or they reduce it to 2% rewards at 7.49% APR which would still be better overall than other 2% cards

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.