- myFICO® Forums

- Types of Credit

- Credit Cards

- AU Spending Habits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AU Spending Habits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@Anonymous wrote:

I have an AU that spends more than my profile would support, but pays in full every month. Does the cc company care about that? Or do they realize it’s the AU card and take that into account?

Honestly, OP, just that you have some concern about this should give you pause and cause you to heed your gut feeling.

First, can you limit amount of monthly spend on AUs account? If yes, I suggest doing that immediately. Just because someone can PIF today, doesnt mean he/she can tomorrow. It’s Murphys Law—anything that can go wrong, will go wrong.

Second, your concern is very real because you are ultimately financially responsible for any and all expenses made on the card.

And, finally, keep this in mind—there’s a reason the AU doesnt have his/her own CC. Just my 2cents.

Follow your gut instincts.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@imaximous wrote:OP, one more thing that you could consider is to include your AU's income to support the spending. Chase (and other lenders) allows you to use someone else's earnings in the total stated income as long as you have access to it for repayment. In your case, you could certainly do that because he/she is paying for his/her expenses regularly. If you think it could become an issue depending on the level of spending, you can just update your profile online.

The guidance issued by the CFPB is quite clear and certainly does not support what you are suggesting:

iii. Consideration of the income or assets of authorized users, household members, or other persons who are not liable for debts incurred on the account does not satisfy the requirement to consider the consumer's current or reasonably expected income or assets, unless a Federal or State statute or regulation grants a consumer who is liable for debts incurred on the account an ownership interest in such income and assets.

Having an authorized user pay their portion of credit card usage, or reimbursing the card holder for expenses incurred is not "a reasonable expectation of access" because such payments can be easily stopped.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@Anonymous wrote:

@imaximous wrote:OP, one more thing that you could consider is to include your AU's income to support the spending. Chase (and other lenders) allows you to use someone else's earnings in the total stated income as long as you have access to it for repayment. In your case, you could certainly do that because he/she is paying for his/her expenses regularly. If you think it could become an issue depending on the level of spending, you can just update your profile online.

The guidance issued by the CFPB is quite clear and certainly does not support what you are suggesting:

iii. Consideration of the income or assets of authorized users, household members, or other persons who are not liable for debts incurred on the account does not satisfy the requirement to consider the consumer's current or reasonably expected income or assets, unless a Federal or State statute or regulation grants a consumer who is liable for debts incurred on the account an ownership interest in such income and assets.

Having an authorized user pay their portion of credit card usage, or reimbursing the card holder for expenses incurred is not "a reasonable expectation of access" because such payments can be easily stopped.

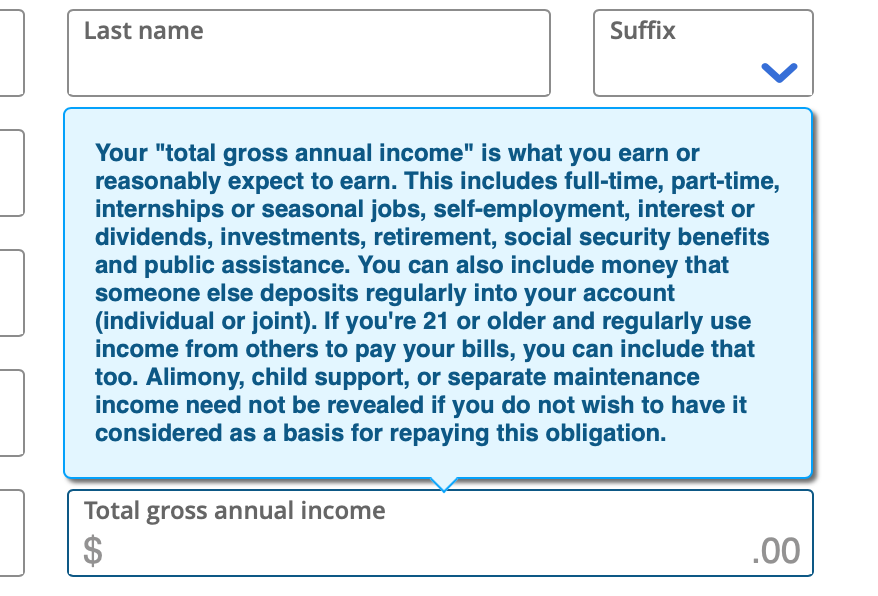

I'm only going by the issuer's rules. I'd never read what you just posted, and I'm not going to pretend that I'm an expert, but if I'm applying with a certain bank, and such bank allows what I suggested before, I'm still in compliance. See the attached screenshot of a credit application by Chase and what they consider Total Gross Annual Income. The part that starts with, "If you're 21 or older..." sums it up. They don't even mention anything about "household" income like some other banks, so they're saying that you if receive money from others to pay your bills, you can include that income as well.

I do understand what you're saying, though. An authorized user isn't responsible for the debt and could potentially spend a ton of money and never pay it back. However, that's more of a risk that someone takes by adding an AU, but it's not illegal or fraudulent to use their income. I'm assuming OP trusts that person. I don't know the particulars of this situation (spouse, friend, relative, gf, bf, etc.), but the application makes no distinction as to whose income may be used for qualification purposes as long as you receive it to pay bills.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@Anonymous wrote:

I didn’t think this would start such a discussion. I’m always receiving offers to add AU’s. So I figured cc company would take it into account.

I think it's great to start a discussion because you may end up learning something new. I didn't know about the site that M&B posted, so I kept on reading to educate myself, and what I said is actually supported there too. It was in the same paragraph, but a few lines below:

"...such income is being deposited regularly into an account on which the consumer is an accountholder (e.g.,an individual deposit account or a joint account), or the consumer has a reasonable expectation of access to such income or assets even though the consumer does not have a current or expected ownership interest in the income or assets. See comment 51(a)(1)-6 for examples of non-applicant income to which a consumer has a reasonable expectation of access."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@Anonymous wrote:

I didn’t think this would start such a discussion. I’m always receiving offers to add AU’s. So I figured cc company would take it into account.

Nope, what CCCs are looking for is more spend and more swipes on their cards.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

Sure...whatever Chase states on its website supersedes federal law.

There's a specific legal definition of "reasonable expectation of access." The OP has not elaborated on the relationship between him/her and the Authorized User or the method by which the OP is reimbursed by the AU so its all speculation at this point.

I was going to elaborate but I saw the "i am not an expert" disclaimer and realized going into detail would be wasting time...plus i got distracted by adding Warren Buffett's income to my own since I've received checks bearing his electronic signature before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

Obviously that’s what they want. Congrats on not having any AU’s I guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@FinStar wrote:

@Anonymous wrote:

Thanks for the replies. I figured chase should be ok. Amex I feel like it could be a problem.AmEx can be finicky in certain situations, but it really depends. Especially, if the reported income doesn't match up or align to the spending patterns, more so on the AU account. IIRC, there's some older FR threads that point to some of those AA scenarios.

Speaking from experience with AMEX, I did not have issues (or encounter benefits) as an AU and heavy spender OR as having an AU, who was a heavy spender, on my account. In both cases, reported income was based on the main account holder and the AU’s income was not considered.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AU Spending Habits

@Anonymous wrote:Sure...whatever Chase states on its website supersedes federal law.

There's a specific legal definition of "reasonable expectation of access." The OP has not elaborated on the relationship between him/her and the Authorized User or the method by which the OP is reimbursed by the AU so its all speculation at this point.

I was going to elaborate but I saw the "i am not an expert" disclaimer and realized going into detail would be wasting time...plus i got distracted by adding Warren Buffett's income to my own since I've received checks bearing his electronic signature before.

IMHO, your implications in this post are a bit over the top.

The average consumer will not be privy to all the details of CFPB guidance, or federal laws you cite. It’s not a consumers responsibility to research laws or guidance above what an issuer may list as acceptable reported income.

That said, I’ve always felt it was best to just report my income on my cards. I’m not in a situation where my DW, or anyone else for that matter, is an AU on any of my accounts that see heavy use. If that were the case, however, I might change my mind. In the end, I think a lot of people follow an issuer’s guidance on what income can be stated. Depending on the circumstances, it might be helpful for the OP to report his AU’s income if it is readily available and meets Chase’s standards in their disclaimer.