- myFICO® Forums

- Types of Credit

- Credit Cards

- Accidentally paid minimum. How do I regain grace p...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Accidentally paid minimum. How do I regain grace period?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally paid minimum. How do I regain grace period?

Do I pay remaining statement balance or current balance? It dawned on me today, one day after due date of 9/2, that I paid the $34 minimum instead of my statement balance of $3440. UGH! I immediately paid off the rest of the statement balance which is $3406 effective today 9/3. My current balance including statement balance is 7k. I guess part of the interest is calculated on the $3406 and part on the current balance of 7k. Is that correct? I've looked up how interest is calculated, but it's a tad confusing. Im hoping they'll waive the interest fees once they post, but if they don't, interest will be accrued through only two statements if I pay the statement balance in full??? Is that right or do I need to pay current balance to regain grace period?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum instead of statement balance. Is interest calculated on

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

@Anonymous wrote:

If you otherwise have a good, PIF payment history, I would wait until the finance charge is posted and ask if it could be waived as a one-time courtesy. Especially where you went and made another payment almost immediately after the due date, it should be obvious that was an unintentional mistake.

I spoke with a representative at Cap One and she said she would reset the grace period, so there was no interest charged. I always pay my statement balance in full, as she could see, so she understood that it was a simple mistake. I will definitely be checking my account after statement closing to make sure!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

@delaney1 wrote:

@Anonymous wrote:

If you otherwise have a good, PIF payment history, I would wait until the finance charge is posted and ask if it could be waived as a one-time courtesy. Especially where you went and made another payment almost immediately after the due date, it should be obvious that was an unintentional mistake.I spoke with a representative at Cap One and she said she would reset the grace period, so there was no interest charged. I always pay my statement balance in full, as she could see, so she understood that it was a simple mistake. I will definitely be checking my account after statement closing to make sure!

It really is bank dependent, not all banks react the same way. For Capital One, my experience has been that when you pay the balance to zero during the current statement period, even if you had a balance charging interest prior, that you don't get interest charged in that last month.

I have been transferring small balances to each Capital One account, have autopayment on each that pays the BT off in two or three payments.. When the BT first posts, that first month there is no interest. The second month, interest is charged. The third month, when the payment takes it to zero during the statement period, that statement has no interest charged.

My guess is that if you had paid the balance to zero during this statement period, it likely would not have any interest charged, without even calling CapOne.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

@NRB525 wrote:

@delaney1 wrote:

@Anonymous wrote:

If you otherwise have a good, PIF payment history, I would wait until the finance charge is posted and ask if it could be waived as a one-time courtesy. Especially where you went and made another payment almost immediately after the due date, it should be obvious that was an unintentional mistake.I spoke with a representative at Cap One and she said she would reset the grace period, so there was no interest charged. I always pay my statement balance in full, as she could see, so she understood that it was a simple mistake. I will definitely be checking my account after statement closing to make sure!

It really is bank dependent, not all banks react the same way. For Capital One, my experience has been that when you pay the balance to zero during the current statement period, even if you had a balance charging interest prior, that you don't get interest charged in that last month.

I have been transferring small balances to each Capital One account, have autopayment on each that pays the BT off in two or three payments.. When the BT first posts, that first month there is no interest. The second month, interest is charged. The third month, when the payment takes it to zero during the statement period, that statement has no interest charged.

My guess is that if you had paid the balance to zero during this statement period, it likely would not have any interest charged, without even calling CapOne.

This is good to know. Thank you! But when you say balance are you referring to statement or current balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

@Anonymous wrote:

If you otherwise have a good, PIF payment history, I would wait until the finance charge is posted and ask if it could be waived as a one-time courtesy. Especially where you went and made another payment almost immediately after the due date, it should be obvious that was an unintentional mistake.

Yes Cap1 is pretty good with this sort of stuff.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

@NRB525 wrote:

@delaney1 wrote:

@Anonymous wrote:

If you otherwise have a good, PIF payment history, I would wait until the finance charge is posted and ask if it could be waived as a one-time courtesy. Especially where you went and made another payment almost immediately after the due date, it should be obvious that was an unintentional mistake.I spoke with a representative at Cap One and she said she would reset the grace period, so there was no interest charged. I always pay my statement balance in full, as she could see, so she understood that it was a simple mistake. I will definitely be checking my account after statement closing to make sure!

It really is bank dependent, not all banks react the same way. For Capital One, my experience has been that when you pay the balance to zero during the current statement period, even if you had a balance charging interest prior, that you don't get interest charged in that last month.

I have been transferring small balances to each Capital One account, have autopayment on each that pays the BT off in two or three payments.. When the BT first posts, that first month there is no interest. The second month, interest is charged. The third month, when the payment takes it to zero during the statement period, that statement has no interest charged.

My guess is that if you had paid the balance to zero during this statement period, it likely would not have any interest charged, without even calling CapOne.

Wait a minute....what????? Are you sure about this???? I have not done this personally but on a family members venture one (older cap1 card converted with no AF) it always charges interest from the date the BT posts, just like the barclay ring......

I hope you are right. How is this possible?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidentally paid minimum. How do I regain grace period?

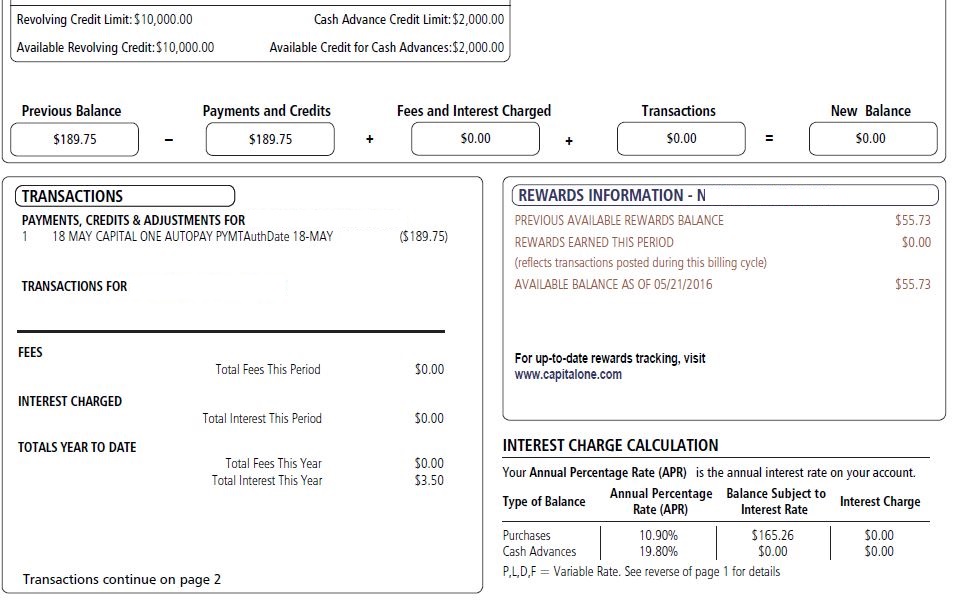

The first image is from my May 21 2016 statement, closing up a previous small BT to the QS card with a payment on May 18, just before the statement closes. So the amount was on the account nearly the entire statement period, no interest charge.

The prior statement did have some interest charges on it, because it had a BT amount at the opening and the closing date of the statement.

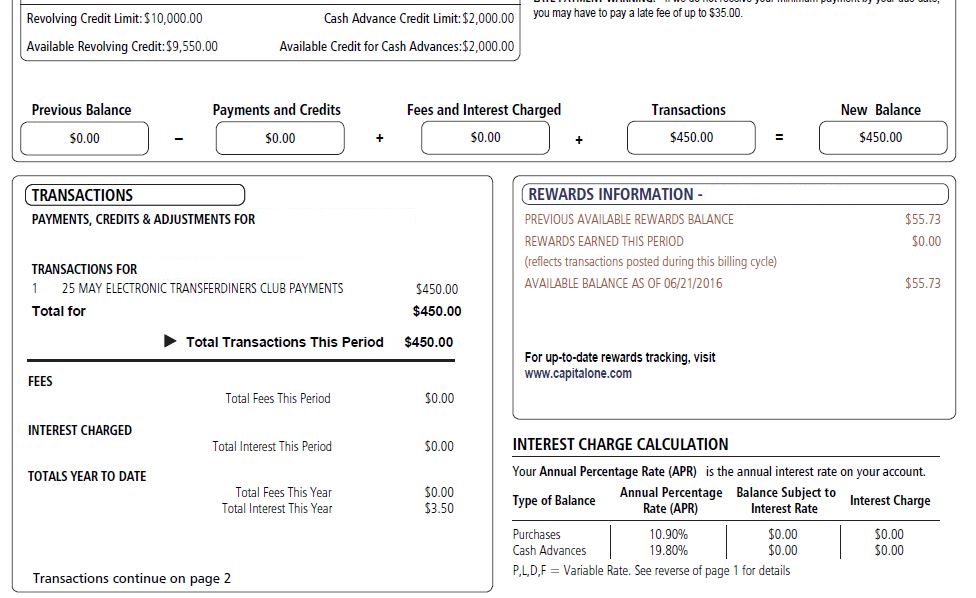

The second image is a subsequent BT onto the same card, on May 25 for the June 21 2016 statement, going from zero statement balance to a BT balance at the start of the statement period. No interest charged the first month on this one.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765