- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Achieved One of My Gardening Goals Today

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Achieved One of My Gardening Goals Today

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@Aim_High wrote:

@Anonymous wrote:As for negotiating best rate, I might have to disagree there. All the benefits CCCs give cost them money. Reward %, credit reports, trip insurance, special transfer rates, CL, no AF, no FTF, and even ease of redemption of rewards (immediate vs. $25 minimum), etc. all cost them money, increase risk, or cut into their revenue if used. I leave interest rate alone, because I don't carry a balance. If they reduce my rate, with all the other things the card offers, it cuts into their profit if I take advantage of it.

I used to call to get my rate lowered with no intention of carrying a balance. Long ago, I was told if I have my rate lowered, I'd have to give up something else. I said no, don't do it then. That's why low rate cards don't offer rewards (opr good rewards), and rewards cards have terrible rates.

I agree that all the terms and conditions that a lender builds into a card is part of a complete package that affects their profitablity and risk. However, for each card, they state a range of APRs that fit into that overall package. The rate you get when you apply for a card is within that acceptable range and is purely based on your risk factors at that point in time. Later on, if you call in when your given APR is 21% and the lowest rate for new applicants as shown on the application page is 15.99%, that is probably the best rate you can reasonably expect to ever get with that card and that lender, regardless of how clean your credit factors. And yes, if it's a rewards card, you're almost certainly paying more for that priviledge. But that doesn't mean that if you're with a lender over time, and your 'risk' level drops as your credit file thickens and your score climbs, that it is increasing their costs in any way to lower your APR. I've never been asked to give anything up when I asked for a rate reduction. The lender either could approve it or not.

I have low rates anyway, I'm finding lol. So I got pretty good deals from cards, because of my credit. Super prime cardholders are low risk, low return customers. Sub prime customers are high risk, high return customers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@K-in-Boston wrote:Re: cobranded card green checkmark offers. The only one I have ever seen is one of the United cards. If a Marriott card ever showed up there, I would be out of the garden faster than you can say Bonvoy.

I would be too if the Rapid Rewards Priority showed up. I am just stoked that I have prequalified offers showing up in the Just For You tab.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@Anonymous wrote:I have low rates anyway, I'm finding lol. So I got pretty good deals from cards, because of my credit. Super prime cardholders are low risk, low return customers. Sub prime customers are high risk, high return customers.

Very true.

My rates are good too as my scores are super prime too, but over my 35 year credit history they've not always been as high as they are now. Same for many on the forums, even if they didn't have BKs and other serious derogs might have had modest scores and improved them. So I discuss it to let people know it's very achievable to renegotiate rates as profiles improve. Things change and life happens in unexpected ways. I've had lenders RAISE my rates easily when things got bad for me during a major career disruption. They aren't so quick to reverse the process unless you make some noise!

I'd wager to bet that your highest APR is that Synchrony Lowe's card, though? Website says "standard rate" for new accounts is 26.99% and you probably would have little success getting it into true super-prime territory since it's a Synchrony Retail card. And lowest rate is probably the Discover IT?

After looking at your lineup, if I may suggest, what seems to be missing is one super-low APR (probably non-reward) card just to keep around for quick use for any major emergency expenses. It's nice to have for immediate use and then you can figure out where to BT to or get money from savings, etc for the long-haul. With excellent credit, there are quite a few under 10%, if not under 8%, that are permanent APRs (not intro or teasers). One I plan to add to my wallet is the Navy FCU Platinum (currently only 7.99% APR after the recent prime rate change). Right now that card also has 0% BT APR for 12 months for anybody that can use it. Most of those lowest APR cards are with smaller local credit unions and regional banks, or military-affiliated national ones like Navy FCU, PenFed, USAA etc. Of course, generally, you get the best APRs on non-rewards cards, but for it's purpose, I probably wouldn't care about rewards in lieu of the reasonable APR. I don't expect to ever use it, but while my credit scores are high, it's a good time to file it away for the future in case anything ever changes for the worse.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@Aim_High wrote:

@Anonymous wrote:I have low rates anyway, I'm finding lol. So I got pretty good deals from cards, because of my credit. Super prime cardholders are low risk, low return customers. Sub prime customers are high risk, high return customers.

Very true.

My rates are good too as my scores are super prime too, but over my 35 year credit history they've not always been as high as they are now. Same for many on the forums, even if they didn't have BKs and other serious derogs might have had modest scores and improved them. So I discuss it to let people know it's very achievable to renegotiate rates as profiles improve. Things change and life happens in unexpected ways. I've had lenders RAISE my rates easily when things got bad for me during a major career disruption. They aren't so quick to reverse the process unless you make some noise!

I'd wager to bet that your highest APR is that Synchrony Lowe's card, though? Website says "standard rate" for new accounts is 26.99% and you probably would have little success getting it into true super-prime territory since it's a Synchrony Retail card. And lowest rate is probably the Discover IT?

After looking at your lineup, if I may suggest, what seems to be missing is one super-low APR (probably non-reward) card just to keep around for quick use for any major emergency expenses. It's nice to have for immediate use and then you can figure out where to BT to or get money from savings, etc for the long-haul. With excellent credit, there are quite a few under 10%, if not under 8%, that are permanent APRs (not intro or teasers). One I plan to add to my wallet is the Navy FCU Platinum (currently only 7.99% APR after the recent prime rate change). Right now that card also has 0% BT APR for 12 months for anybody that can use it. Most of those lowest APR cards are with smaller local credit unions and regional banks, or military-affiliated national ones like Navy FCU, PenFed, USAA etc. Of course, generally, you get the best APRs on non-rewards cards, but for it's purpose, I probably wouldn't care about rewards in lieu of the reasonable APR. I don't expect to ever use it, but while my credit scores are high, it's a good time to file it away for the future in case anything ever changes for the worse.

Yes, Synchrony would **bleep** me with their standard 26.99%. Just checked it out..

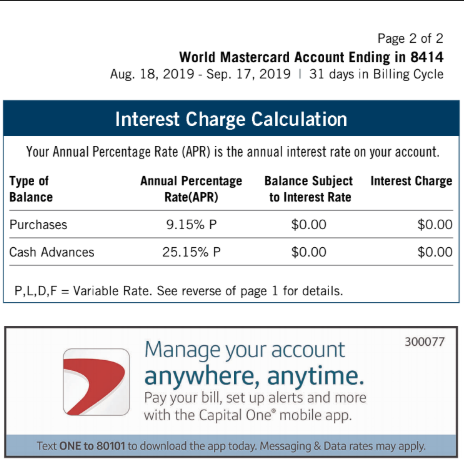

My lowest APR is the Savor card. 9.15%. Plus I don't have an AF with Savor. Discover is 12.99.

Holy s***, my highest other than Synchrony is PNC Cash Rewards at 24.24%. Cash advance, 25.24% lol.

Then the next highest is DC at 19.74%. I've never really looked at them until today.

Probably won't need an emergency card at this time. Sitting on an emergency fund of about $70K in cash and brokerage ETFs and growing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@Anonymous wrote:My lowest APR is the Savor card. 9.15%.

How the heck did you get it that low with Capital One/Savor?!? The lowest published for the no-AF Savor is currently 16.24% unless you product-changed it into the Savor from another card? Lenders don't usually deviate that much from published rates.

Probably won't need an emergency card at this time.

... But when you have a lull in your apps and think you have all your other squares filled for the time being, it's always good to have options for a 'rainy day'.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved One of My Gardening Goals Today

@Aim_High wrote:

@Anonymous wrote:My lowest APR is the Savor card. 9.15%.

How the heck did you get it that low with Capital One/Savor?!? The lowest published for the no-AF Savor is currently 16.24% unless you product-changed it into the Savor from another card? Lenders don't usually deviate that much from published rates.

Probably won't need an emergency card at this time.

... But when you have a lull in your apps and think you have all your other squares filled for the time being, it's always good to have options for a 'rainy day'.

Yes, a PC. Used to be a QS card. I got an email when I got the QS that I was eligible for a special rate, non-promotional rate, fixed at 6.90%. I accepted and it carried over to Savor. Rates went up of course, but 9.15% is still a great rate. Capital One has been very good to me over the years. Maybe Savor is my emergency card. It might be my savior.![]()