- myFICO® Forums

- Types of Credit

- Credit Cards

- Achieving Very Large Amex Personal Revolving Limit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Achieving Very Large Amex Personal Revolving Limits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

@imaximous wrote:

K, are you opposed to using business cards? I think it's safe to say that Amex couldn't care less about the type of spend that goes on their cards as long as you pay them back, and that's certainly not a concern.

You mentioned that you enjoy the float period between statement cycles and due dates, but that can be a big concern when dealing with personal cards that report your statement balance. You wouldn't have to worry about that by moving spend to business cards. I realize that I'm stating the obvious and something you already know, but I still believe that should solve part of your problem. We constantly exceed the limit on 2 Amex biz cards by a lot -- sometimes double or close to triple the limits ($20k and $30k limits). Everything gets paid in full by due date. This is something where Amex is miles ahead of the rest. Even though the limits aren't high, just being able to go way beyond the limits and float those figures is a tremendous benefit for us.

Not really opposed at all. Just got the Business Platinum charge card last month and I've had the SkyMiles Platinum Business for about 16 months. It's quite possible that a Delta Reserve Business might be where I end up late this year or early 2021. It would certainly help with utilization during those heavier spending months if I moved the non-category spending over to what's essentially a hidden (from the 3 major CRAs anyway) tradeline.

I'm not running into utilization or credit line issues anymore (Delta Reserve is at $50k, so about 2/3 of my total Amex revolving limit) so it's not an immediate need. Basically, I just set an arbitrary goal of wanting a $100k Amex revolver and haven't quite made it there. My Amex spending in 2019 dropped drastically (probably $40-50k) as with the Starwood and Marriott merger, those Starpoints I'd been earning were no longer there, and the charges got spread around more mostly to Chase, Citi, and U.S. Bank. For 2020 now having the Business Platinum card, I'm back to making MRs my primary currency again so Amex will basically be seeing everything except mobile payments and places I can't pay with Amex this year on either MR-earning cards or my existing Delta Reserve.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

@redpat wrote:Once you climb the mountain and get approved for all the cards you thought you wanted, then finding out you really didn't need them it really becomes "ho hum" after awhile. Sure I could app for some more cards but wth am I going to do with them.

+ 1, I stopped climbing and have just been admiring the view for years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

Except life is not static and our needs are not the same.

Some people are perfectly happy in Three Card Brigade, others prefer to play with a full deck.

Neither is right or wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

@K-in-Boston wrote:...so actually in the 9 months after being denied that $21k to $63k line increase, they granted me two new $10k cards and two $14k CLIs, a total of $48k which was more than the $42k I asked for that first time around. Then about 8 months later, I got an additional $10k when I opened Delta Reserve, to which I moved $40k of the SPG/Marriott card's limit.

Maybe it is the number of cards / amount of open credit that's the issue. Those are tiny tiny starting limits for someone with your spend and income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

I believe based on myself and friends that amex is similar to chase when it comes to history and aaoa being the magic bullet for high limits. I few a normal high limit as $30-50k, usually less for consumer cards. I dont think its income, I think it file age. what are your stats?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

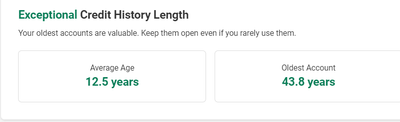

Due to all of the new accounts the past 4 years, my average age of accounts is super low: only 8 to 9 years depending on bureau. ![]()

In seriousness, my AAoA is just over 9 years on Experian. Oldest account still open on Experian is from 1994. My Blue from American Express, (personal) Platinum, and Gold, have all been open since 2002 (I have never closed an Amex card). I waited 15 years before grabbing a 2nd revolver.

While what you wrote would certainly be valid for those newer to credit, I honestly don't think that's it in my case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

what is your file age?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

The one from '94 is the oldest. Most of my oldest cards have fallen off of my reports as they were closed 10-20 years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving Very Large Amex Personal Revolving Limits

let me re-frame it, bring up your ex, what are these 2 #s?