- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Adverse Action for excessive "new" accts?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adverse Action for excessive "new" accts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

Someone please correct me if I'm wrong, but don't banks issue an account number that isn't your credit card number? That account number won't change, but the card number would need to fit security purposes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@wasCB14 wrote:Is Synchrony the only major issuer that will routinely report a replacement card as a new account?

Other issuers may do it now and then in error, like my extra Citi account on EQ from the PC to Costco.

Some CUs tend to do the same and USAA used to do so eons ago. FWIW, any SYNCB accounts I've had that were compromised due to fraud (PayPal MC, Marvel MC, etc.) never had a second tradeline report in its place, IME. By the same token, other members' outcomes have differed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@Anonymous wrote:Someone please correct me if I'm wrong, but don't banks issue an account number that isn't your credit card number? That account number won't change, but the card number would need to fit security purposes.

Are you talking about an internal customer profile number or...?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

I suppose so, maybe. This came up recently, I don't recall the specific situation, but in order to verify something or other, someone had to provide their account number from their CR, specifically not their card number. I'd be really surprised to learn that issuers don't keep an account number for a customer that isn't the card number. Then again, I've been surprised a lot lately. 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@wasCB14 wrote:Is Synchrony the only major issuer that will routinely report a replacement card as a new account?

Other issuers may do it now and then in error, like my extra Citi account on EQ from the PC to Costco.

Oh, gee. Thanks. I PCd from Rewards+ to DC recently. With my luck, this will happen to me, too. EQ is already my most battered report ![]()

I pulled out my TU report and all of my cards. The cards list the first 12 digits of the acct #. But, my DCU card, which happens to be the only CU-issued card that I have, lists my member #. The TU report says, "For your protection, your account numbers have been partially masked, and in some cases scrambled." Blocking out the last 4 is protecting my acct in TU's eyes. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@Anonymous wrote:I suppose so, maybe. This came up recently, I don't recall the specific situation, but in order to verify something or other, someone had to provide their account number from their CR, specifically not their card number. I'd be really surprised to learn that issuers don't keep an account number for a customer that isn't the card number. Then again, I've been surprised a lot lately. 🙂

You may be thinking of American Express. They put a 'pseudo' account number on your credit report, and if you have to call regarding a credit report issue they'll ask you to provide the number from the actual credit report, which is different from the card number.

As far as I know, Amex account numbers on credit reports often (always?) start with 3499; my own all have, including my now-closed Amex installment loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

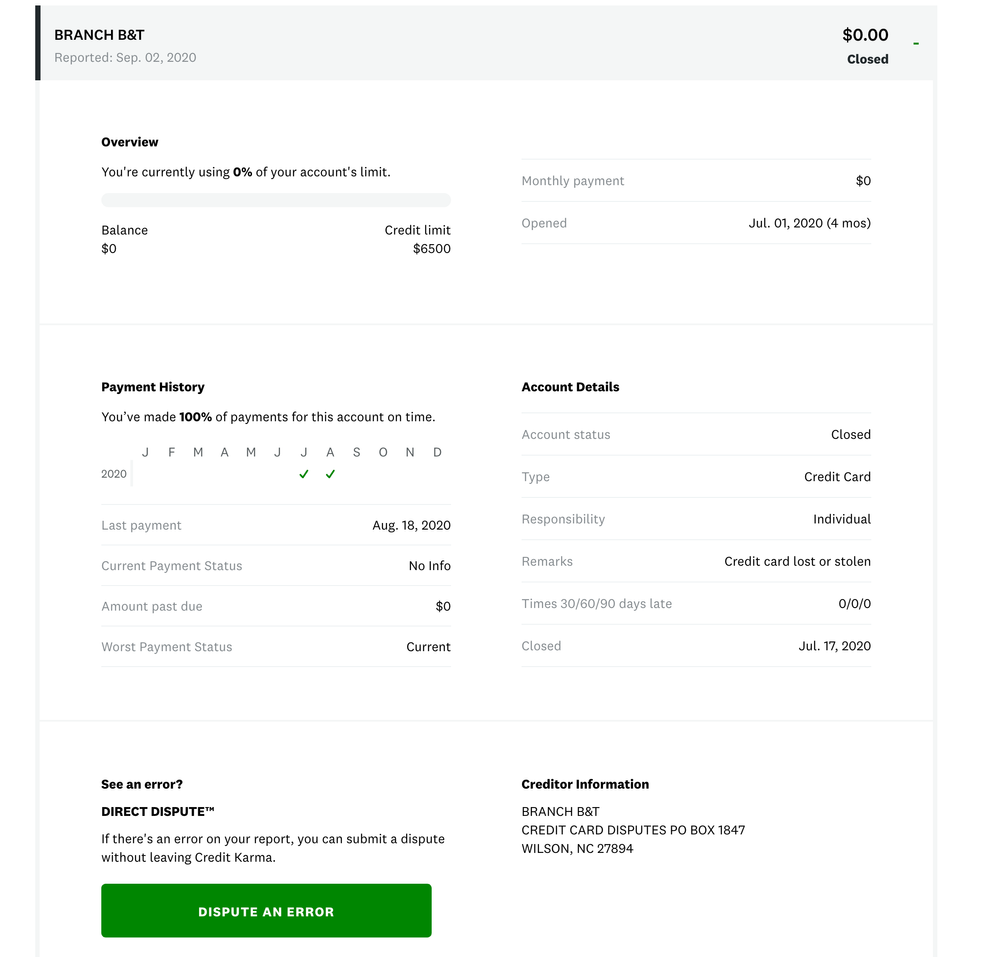

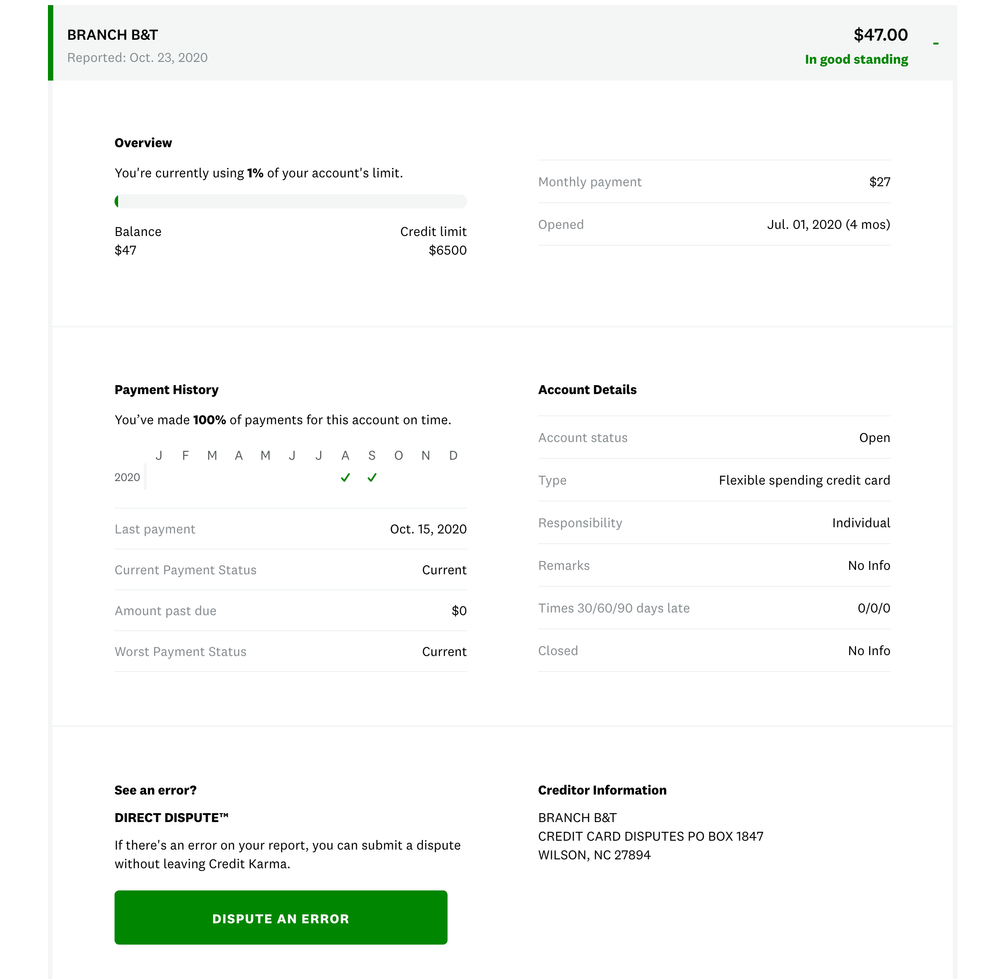

I can confirm that BB&T does report a new account if you report your card lost/stolen. For me, the first card never arrived. I waited a month, because they can be slow, but it never showed up. So they reported the first card as lost/stolen and sent me a new one. Unfortunately, they then reported as second trade line with the new account number on Equifax and TransUnion. On Experian, they did it the right way and updated the original one.

Now, when I say they reported a new account, they did report it as being opened on the same opening date. They marked the original trade line as "lost/stolen" so there are now two new accounts showing on my EQ and TU reports. If your card was opened for a while, this might not be a problem. But this was a brand new card, so I now have 2 brand new accounts showing. Here is what it looks like on my TU report from CreditKarma.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

I swear the people at BB&T are extremely incompetent. My credit report now shows that the accounts have been closed, even though multiple reps, including someone from their "executive escalations" team told me last week that I have until this upcoming week to get the replacements. However, they were closed on or before the 20th. I just can't believe that they can make so many mistakes on one account. Unbelievable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@cr101 wrote:I swear the people at BB&T are extremely incompetent. My credit report now shows that the accounts have been closed, even though multiple reps, including someone from their "executive escalations" team told me last week that I have until this upcoming week to get the replacements. However, they were closed on or before the 20th. I just can't believe that they can make so many mistakes on one account. Unbelievable.

After all that and then some, I just closed my cards with them. My card had gotten compromised at a gas station. I only use this card for gas, so I need a card that can be easily replaced if it gets compromised. If I reported it lost again, that would ANOTHER new account. What really made up my mind for me was that they put me on hold for over and hour to report it lost. I tried again a day later, and they put me on hold for 40 minutes, then hang up. That's ridiculous when Cap1, Discover, DCU, Alliant, and AmEx all allow me to report my cards lost online with the click of one or two buttons. And they don't proceed to report a new account on my credit file....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adverse Action for excessive "new" accts?

@RehabbingANDBlabbing wrote:

@cr101 wrote:I swear the people at BB&T are extremely incompetent. My credit report now shows that the accounts have been closed, even though multiple reps, including someone from their "executive escalations" team told me last week that I have until this upcoming week to get the replacements. However, they were closed on or before the 20th. I just can't believe that they can make so many mistakes on one account. Unbelievable.

After all that and then some, I just closed my cards with them. My card had gotten compromised at a gas station. I only use this card for gas, so I need a card that can be easily replaced if it gets compromised. If I reported it lost again, that would ANOTHER new account. What really made up my mind for me was that they put me on hold for over and hour to report it lost. I tried again a day later, and they put me on hold for 40 minutes, then hang up. That's ridiculous when Cap1, Discover, DCU, Alliant, and AmEx all allow me to report my cards lost online with the click of one or two buttons. And they don't proceed to report a new account on my credit file....

That sucks. I'm sorry. I know that you worked to get your score up. I hope that it doesn't affect it too much...

Yes, their service is horrible, at least when dealing with their actual managers, who are combative. I handle escalations for banks. So, I'm always shocked when I encounter this level of service. Their three-week escalation response time policy is just laughable and shows that they don't care. The banks that I work with respond within 1-2 business days...

If you're looking for a new "throwaway" card, I recommend Capital One. I've had one particular Cap1 card reported lost twice bc of fraudulent charges and all Cap1 did is remove the fraudulent charges and send me a new card number. No new account was ever reported either time. I misplaced my Barclays card last month and they promptly sent a new card with a new number. They only updated the card number on my credit reports.