- myFICO® Forums

- Types of Credit

- Credit Cards

- Alliant Visa Signature increases annual fee to $99

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Alliant Visa Signature increases annual fee to $99

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

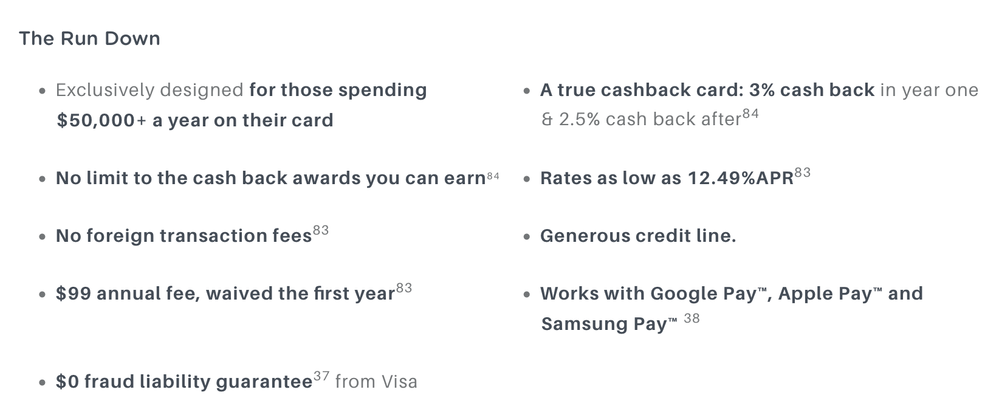

Alliant Visa Signature increases annual fee to $99

Unclear what happens to existing cardholders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

If this is a trend, then I predict that the NFCU Flagship will soon raise its annual fee from $49 to $95 or $99.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

I think they need to recoup some of their money, so best way is to raise fee's. I would hope that current cardholders are grandfathered in, or at least for a few years, but I think all lenders are looking how to cut corners right now, and we will see this eventually from everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

@digitek wrote:

This changes the math so that you now need ~$20k spend per year to make it equal to a normal 2% card with no Annual Fee...

The old breakeven point of $12,000 was more than I was willing to commit to this card, putting it at the bottom of my wishlist. The new breakeven point of $20,000 takes it off my wishlist completely. Alliant’s statement that the card is for those who will spend $50,000 a year is finally true.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

@Blodreina wrote:Unclear what happens to existing cardholders.

Alliant seems bound and determined to lose all its customers.

I've been a non-rewards platinum card holder for around 5 years, and used it primarily for no-fee balance transfers. Now they've added a balance transfer fee and raised their cash advance fee. Their interest rates were already much higher than my other credit union platinum cards. So the card has become worthless to me.

Now it seems they're going after their cash back card with the same idea in mind: losing all their customers. There are so many excellent cash back cards out there with no annual fee, why on earth would anyone pay a $99 annual fee for theirs?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

@UpperNwGuy wrote:

@digitek wrote:

This changes the math so that you now need ~$20k spend per year to make it equal to a normal 2% card with no Annual Fee...The old breakeven point of $12,000 was more than I was willing to commit to this card, putting it at the bottom of my wishlist. The new breakeven point of $20,000 takes it off my wishlist completely. Alliant’s statement that the card is for those who will spend $50,000 a year is finally true.

It takes over $100,000/yr to hit 2.45%, that would round up to 2.5%

At $25,000 a yeay it is a 2.1% card

A big spender that needs no FTF (maybe), but big spenders that travel have travel cards (No FTF) and points that put 2.1 - 2.4 cashback to shame !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Alliant Visa Signature increases annual fee to $99

For anyone with the income to spend $50k/year on a credit card, having $100k in retirement/cash/taxable accounts at BofA seems like a pretty low requirement for Platinum Honors on the Travel or Premium Rewards cards (2.625%). Premium Rewards has a $95 AF but a $100 airfare extras credit.

I never had any interest in this card, even at the old $59 AF.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select