- myFICO® Forums

- Types of Credit

- Credit Cards

- Am I rushing it?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Am I rushing it?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I rushing it?

My scores having gone up drastically from where they were, and I'm wanting to get one or two more cards, eventually, as for the timing. That's why I'm here…

Why do I want two more cards?

- my credit limit is very low, $600.00, 2 cards at $300.00 each.

- apparently my file is "very thin."

- aoa is pretty short. originally I thought it was 4 months, but it's 3.6 years. getting them w/i a short span, closer together would help me more because I can let them age and closing them later if need be wont hurt as bad.

I've noticed offers through "free" credit reporting apps and sites, for the very cards I've had my eye on have officially popped up and … for whatever reason, are showing me that my odds of approval are "good." That should be satisfying but now i'm scared to submit an app because I have 2 HP on my file now.

The cards I would like to get (eventually …) are

- Citi Custom Cash

- Chase Freedom FlexSM

- Chase Freedom Unlimited

I know from reading here that Chase has a 5/24 rule. I don't know about Citi, but everywhere I've looked (I haven't been able to find anything w/ score specifics needed for which card) says 690-770 is the range needed for approval for all the ones I just mentioned I would like to get.

Should I wait? I don't want to waste my hard inquiries based on bogus results.

Most Updated Scores as of 5-2

Transunion - 687 - (from 594 as of 4-24-22)

Equifax - 604 - (no change since 04-24-22)

FICO - 676 - (though, I received an email from a lender saying my score was 695, was at 600 on 4-24-22)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

@ksuudilla wrote:My scores having gone up drastically from where they were, and I'm wanting to get one or two more cards, eventually, as for the timing. That's why I'm here…

Why do I want two more cards?

- my credit limit is very low, $600.00, 2 cards at $300.00 each.

- apparently my file is "very thin."

- aoa is pretty short. originally I thought it was 4 months, but it's 3.6 years. getting them w/i a short span, closer together would help me more because I can let them age and closing them later if need be wont hurt as bad.

I've noticed offers through "free" credit reporting apps and sites, for the very cards I've had my eye on have officially popped up and … for whatever reason, are showing me that my odds of approval are "good." That should be satisfying but now i'm scared to submit an app because I have 2 HP on my file now.

The cards I would like to get (eventually …) are

- Citi Custom Cash

- Chase Freedom FlexSM

- Chase Freedom Unlimited

I know from reading here that Chase has a 5/24 rule. I don't know about Citi, but everywhere I've looked (I haven't been able to find anything w/ score specifics needed for which card) says 690-770 is the range needed for approval for all the ones I just mentioned I would like to get.

Should I wait? I don't want to waste my hard inquiries based on bogus results.

Most Updated Scores as of 5-2

Transunion - 687 - (from 594 as of 4-24-22)

Equifax - 604 - (no change since 04-24-22)

FICO - 676 - (though, I received an email from a lender saying my score was 695, was at 600 on 4-24-22)

What specific scores are these? On the surface it looks like your Transunion and Equifax scores may be Vantage 3.0 from Credit Karma, Which FICO score is this, and based on which reporting agency?

Don't trust odds of approval from 3rd party sites like Credit Karma or WalletHub. Those odds are based upon general demographics, not a detailed evaluation of your report.

Are there any derogs showing up on your reports, or high utilization reporting on either of your cards?

Citi does not have a true equivalent to a 5/24 rule but they do have velocity rules in place regarding Citi cards (2 cards in 60 days) and there is a sensitivity to the number of new accounts over the last 6-12 months; the state of ones credit history strongly influences their level of sensitivity.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

Did you mean Experian rather than "FICO" on that last score?

Anyway I'd say yout scores are borderline, and an approval could go either way (assuming those are FICO 8 scores). Your current limits are very low, and while lenders of course decide on their own what your limit will be, generally speaking, seeing higher limits on your file could possibly influence them/make their AI more "comfortable" seeing higher limits.

One final thing, ignore any and all "approval odds" you may see on Credit Karma or Experian or Wallethub or wherever. They're not true pre-approvals. They're just marketing and they just want you to apply through them because they get a little kickback if you do and happen to get approved. If you want to *actually* gauge your approval odds, I'd suggest going directly to the lender's site and running their pre-approval tool, though in this case neither Citi nor Chase currently has a working pre-approval tool.

Finally, even with a thin file, your scores seem rather low. Do you have high utilization and/or any derogatories present?

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

There are many many types of FICO scores and you may have different scores for each bureau with each model. Do you know which bureau the "FICO" score is, and which version? (Experian FICO 8, Equifax FICO 9, etc.) Are the Equifax and TransUnion scores from a site such as Credit Karma that provides VantageScore 3.0 scores? Almost all lenders will use FICO scores (Synchrony and VantageScore 4.0 is a noted exception) and FICO 8 is the most commonly used version for credit card lending. You can get all 3 of those FICO 8 scores from a free trial at experian.com to use one example. VantageScore 3.0 scores rarely align with FICO scores, many people will have scores that differ +/- 100 points or more and that is a huge difference in credit scoring where "good" credit has such a narrow range.

For your average age, many credit monitoring sites will exclude authorized user accounts or closed accounts when displaying your average age, however both do factor into scoring. Is the discrepancy from months to years due to authorized user account, open or closed loans, etc.?

Any derogatory info like late payments, chargeoffs, collections, etc.?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

@ksuudilla wrote:My scores having gone up drastically from where they were, and I'm wanting to get one or two more cards, eventually, as for the timing. That's why I'm here…

Why do I want two more cards?

- my credit limit is very low, $600.00, 2 cards at $300.00 each.

- apparently my file is "very thin."

- aoa is pretty short. originally I thought it was 4 months, but it's 3.6 years. getting them w/i a short span, closer together would help me more because I can let them age and closing them later if need be wont hurt as bad.

I've noticed offers through "free" credit reporting apps and sites, for the very cards I've had my eye on have officially popped up and … for whatever reason, are showing me that my odds of approval are "good." That should be satisfying but now i'm scared to submit an app because I have 2 HP on my file now.

The cards I would like to get (eventually …) are

- Citi Custom Cash

- Chase Freedom FlexSM

- Chase Freedom Unlimited

I know from reading here that Chase has a 5/24 rule. I don't know about Citi, but everywhere I've looked (I haven't been able to find anything w/ score specifics needed for which card) says 690-770 is the range needed for approval for all the ones I just mentioned I would like to get.

Should I wait? I don't want to waste my hard inquiries based on bogus results.

Most Updated Scores as of 5-2

Transunion - 687 - (from 594 as of 4-24-22)

Equifax - 604 - (no change since 04-24-22)

FICO - 676 - (though, I received an email from a lender saying my score was 695, was at 600 on 4-24-22)

Your approval chances depend on your negatives, type and recency.

Since you haven't addressed those, it's not possible to guess your chances.

The approval odds you're seeing are simply referral links..you apply, they get paid regardless of whether you're approved or denied, so if you want to be income source, follow what they say.

Otherwise, just clarify what's going on with your profile and we can start helping you decide if it's possible/good idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

@Remedios

@K-in-Boston

@OmarGB9

@coldfusion

So, the "fico" score is fico 8 from Experian, and Discover scorecard. The other two Vantage Scores are from Credit Karma, but I use other freebies such as CreditWise, Wallethub … my Equifax hasn't boosted from my last reporting.

- I have one derog payday loan itemized from (reported on Aug 18 2018)

- Kays Card from 2012 (never used/shows as closed, ~10 years ago)

- Barclay Card from 2011 (never used/shows as closed, ~10 years ago)

- Walmart Store Card from 2011 (closed and does not show)

- BestBuy store card from 2012 (closed and does not show)

- capital one card that I went over on the CL by 5.60, interest ... I made a payment immediately but it was too late because I hadn't known the difference between due date and statement dates. I've got that down now, but it has heavy usage. I normally use it for everything, pay it down, fill it up again (generally 900.00-1200.00/mo depending) before my due date, and then I pay all but 2.00-3.00, leave it be until my statement cuts. and the CU on it right now is 2% -

- Credit One card has very low usage, but it's at 6% CU right now.

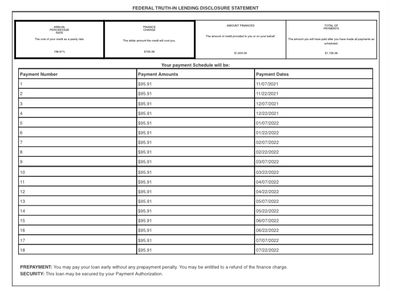

- I also have an installment loan right now, that's a little less than 500 principal left (51% interest) that will be done on July 22 unless i pay it off early.

- I haven't missed any payments since opening any of these accounts. (Cap1, Credit1, OppFinanc Loan)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

@ksuudilla wrote:@Remedios

@K-in-Boston

@OmarGB9

@coldfusion

So, the "fico" score is fico 8 from Experian, and Discover scorecard.

OK that's a good one

The other two Vantage Scores are from Credit Karma, but I use other freebies such as CreditWise, Wallethub … my Equifax hasn't boosted from my last reporting.

Those are all meaningless. Disregard them.

- I have one derog payday loan itemized from (reported on Aug 18 2018)

- Kays Card from 2012 (never used/shows as closed, ~10 years ago)

- Barclay Card from 2011 (never used/shows as closed, ~10 years ago)

- Walmart Store Card from 2011 (closed and does not show)

- BestBuy store card from 2012 (closed and does not show)

- capital one card that I went over on the CL by 5.60, interest ... I made a payment immediately but it was too late because I hadn't known the difference between due date and statement dates. I've got that down now, but it has heavy usage. I normally use it for everything, pay it down, fill it up again (generally 900.00-1200.00/mo depending) before my due date, and then I pay all but 2.00-3.00, leave it be until my statement cuts. and the CU on it right now is 2% -

- Credit One card has very low usage, but it's at 6% CU right now.

- I also have an installment loan right now, that's a little less than 500 principal left (51% interest) that will be done on July 22 unless i pay it off early.

51% interest? Pay it off.

- I haven't missed any payments since opening any of these accounts. (Cap1, Credit1, OppFinanc Loan)

OK my suggestion would be to apply for one of these: Discover IT card or Amex Blue Cash Everyday card. If you get approved, take good care of it and revisit your scores in 3-6 months. If you get denied, wait 3-6 months and try again.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

Outside of some niche uses like occasional use for apartment renting, payday loans, rent-to-own agreements, utilities, etc. the VantageScore 3.0 scores provided by those sites are unfortunately not very useful. The scores cost less to obtain than FICO scores, but they were never adopted by any traditional credit lenders.

The Kay's and Barclay cards are definitely helping due to their age and clean history, although if they were closed 10 years ago they may fall off at any point going forward. You stated the closed Walmart and Best Buy cards are not showing; if they are not on your credit reports today it is unfortunately just as though they never existed.

While your CapOne card may show that your highest balance was over your current credit line, utilization is a snapshot in time (ignoring new models like VS4 and FICO 10T that use trended data, the former only used by Synchrony and the latter not yet in use as far as we are aware) and does not affect scoring.

Hoping that the 51% interest on the loan is either missing a decimal point or refers to the portion of payments on what your payments will consist of if you maintained the existing installment plan? 51% APR seems like it could be a violation of usury laws, although those do vary by state. If it really is 51% interest pay it off as soon as you are able. If it is more reasonable, you may want to ride it out as you are receiving a healthy scoring boost by having an open installment loan if it is reporting as such.

Sounds like you are managing the utilization on your open credit cards quite well. What type of derog is the payday loan reporting as? Late (how many days)? Collections? Charged off? A little over 2 years is at least not too recent but will still sting regardless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

They have a class action they just settled, this company "OppFi" … the only issue is, I needed to build the credit and I needed the money. I don't know how paying it off will affect me. That's something I've been looking into, I just havent come across the right "treat me like I'm five breakdown."

I thought about purchasing a credit-builder loan, before I close this one or pay it off. But I do know it's atrocious … I'm reminded everytime a payment comes out and I see how little my principal decreases. @K-in-Boston

As for the derog loan, it's in collections at 951.00.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I rushing it?

That shows 158.91% APR, which is absolutely insane. By all means, absolutely pay that off as soon as you possibly can. I just did a quick look and according to a Reuters article about CA suing them, "On average, the loans carried interest rates of 153%, while California caps interest on small consumer loans at 36%, according to the lawsuit." Apparently, their partner bank is located in Utah which has no usury laws that limit interest rates.

You may take a bit of a score hit if there are no other open loans, but you can rectify that with doing a Share Secured Loan at a credit union that does not shorten the loan term when additional payments are made (i.e. deposit $xxx, borrow $xxx, immediately pay back most of it).

With the other account still being in collections, I don't think the Chase or Citi cards you are looking for will be an option for the time being.