- myFICO® Forums

- Types of Credit

- Credit Cards

- Amazon Prime Store Card Credit Builder

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amazon Prime Store Card Credit Builder

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

Just a followup, maybe it'll serve as a data point for Synchrony. Sole reason for the denial was my BK, so I am guessing since I IIB they are not friendly to me. They did pull both, and did not deny for being frozen on TU, so they went to EX is the guess since they list both on the letter. No indication of secured on letter, possible slim chance something comes in the mail after, but I am not holding my breathe.

TU/EX - 657/661

IIB - post 2yrs, 1 month (closer to 2)

Unrelated to Amazon, they also denied my application for WalMart, citing the same reason of BK. Guess we will try for Wally when Cap 1 taken them over, since they have been pretty awesome to me with 2x 2500 limit cards... one a week post and offered me the QS 7 months later. As for Amazon, I can wait and try after it falls off in 2022.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

January 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

Just as another datapoint, I applied about a week and a half ago, expecting the secured card, and was approved for the unsecured card. They gave me a $1,500 limit.

They pulled TU. I don't have a FICO score for TU since my oldest account is about two months old. My FAKOs are low 600s. However, no derogs.

As a random aside, they also ask you to list NET income (most places ask for gross income). I wasn't sure what to list because I take out a lot for 401k and HSA, plus quite a bit in extra tax withholdings and an employee stock purchase program, but a lot of that is optional stuff I could end if I wanted to. So I answered based on gross income minus mandatory tax and other withholdings.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

Does this actually report as a store card or just another regular revolving tradeline?

From what I gather from previous posts, the secured card does indeed do a hard pull?

I was hoping to avoid adding another hard pull by going the secured route.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

Can anyone vouch for how the unsecured card reports? If it shows as a retail card or regular tradeline?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

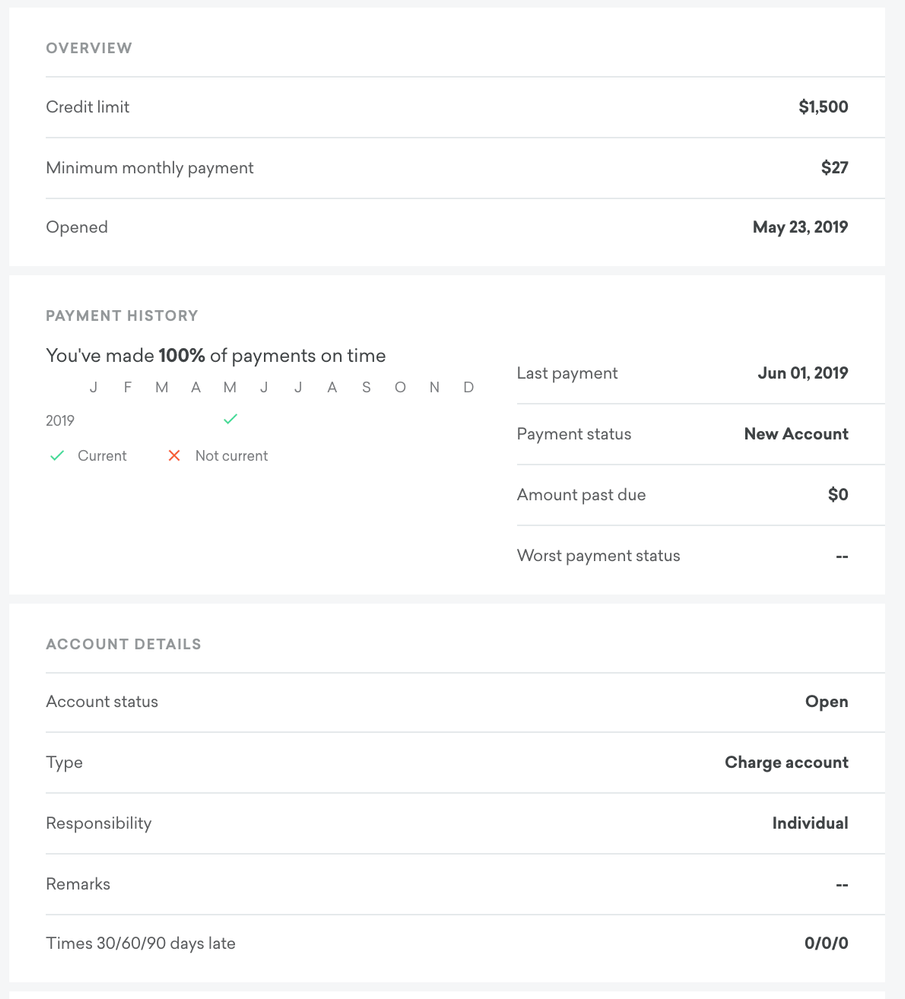

Here is what I see in CK.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

What's the point? 2 1/2 years after bk, there's NO Reason to consider secured cards of ANY type!

Jm2¢...

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

A curious question, does the Amazon Prime Store Card (non chase version) allow you to pay your prime subscription using the card itself? I like to have at least 1 reoccuring monthly charge on every card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Prime Store Card Credit Builder

yes, you can and make sure update which payment method. I did it and it works