- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex CLI without tax forms

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex CLI without tax forms

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex CLI without tax forms

Hi,

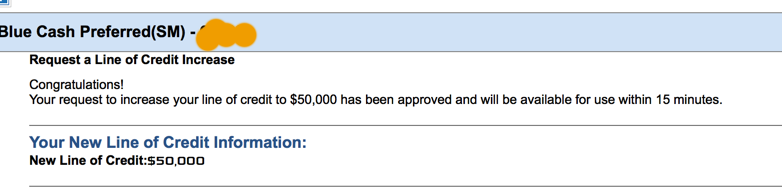

I just increased my wifes credit limit on her BCP from 20K to 50K. They approved it right away without any income verification, financial review or a request to fill out the 4506-T tax form. I requested 50K instead of 60K because I thought it's too much. Now I think that was stupid adn I should have gone for the 60K.

There are three possibilities why it went through like that:

1. good customer, always paid in full, member since 2013, high (self-) reported income

2. they changed their rules

3. they used the 4506-T they got from me last year when they raised my BCP limit from 22K to 65K

What do you think it was ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI without tax forms

@Ammer wrote:Hi,

I just increased my wifes credit limit on her BCP from 20K to 50K. They approved it right away without any income verification, financial review or a request to fill out the 4506-T tax form. I requested 50K instead of 60K because I thought it's too much. Now I think that was stupid adn I should have gone for the 60K.

There are three possibilities why it went through like that:

1. good customer, always paid in full, member since 2013, high (self-) reported income

2. they changed their rules

3. they used the 4506-T they got from me last year when they raised my BCP limit from 22K to 65K

What do you think it was ?

If your wife is on the tax forms you sumitted last year, then they most likely used that as a basis for approving the $50K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI without tax forms

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI without tax forms

There are no hard rules about CL caps with AmEx that I am aware of. There are obviously the rumors of a $25k or $35k cap, but it definitely doesn't apply to everyone.

And yes, if you and your wife file jointly I am sure they have everything they need from the 4506t request and tax transcripts they received from it. If you file separately, they must just really like her. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI without tax forms

Reason #3 makes the most sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex CLI without tax forms

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k