- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex Clearly Saying Soft Pull Pre-Qualify Now

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Clearly Saying Soft Pull Pre-Qualify Now

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex Clearly Saying Soft Pull Pre-Qualify Now

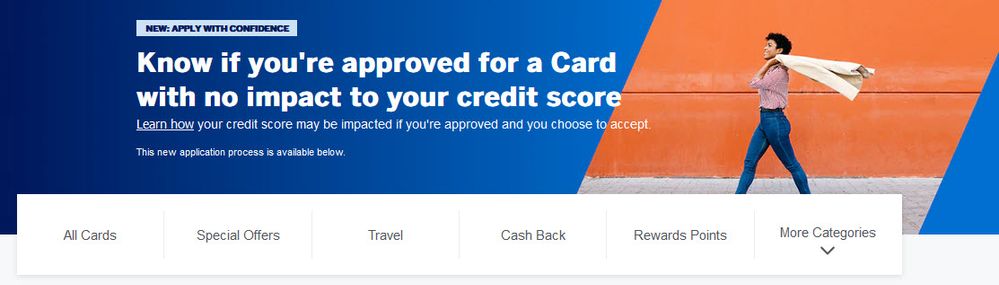

Not sure if this has been posted already, did not see it.

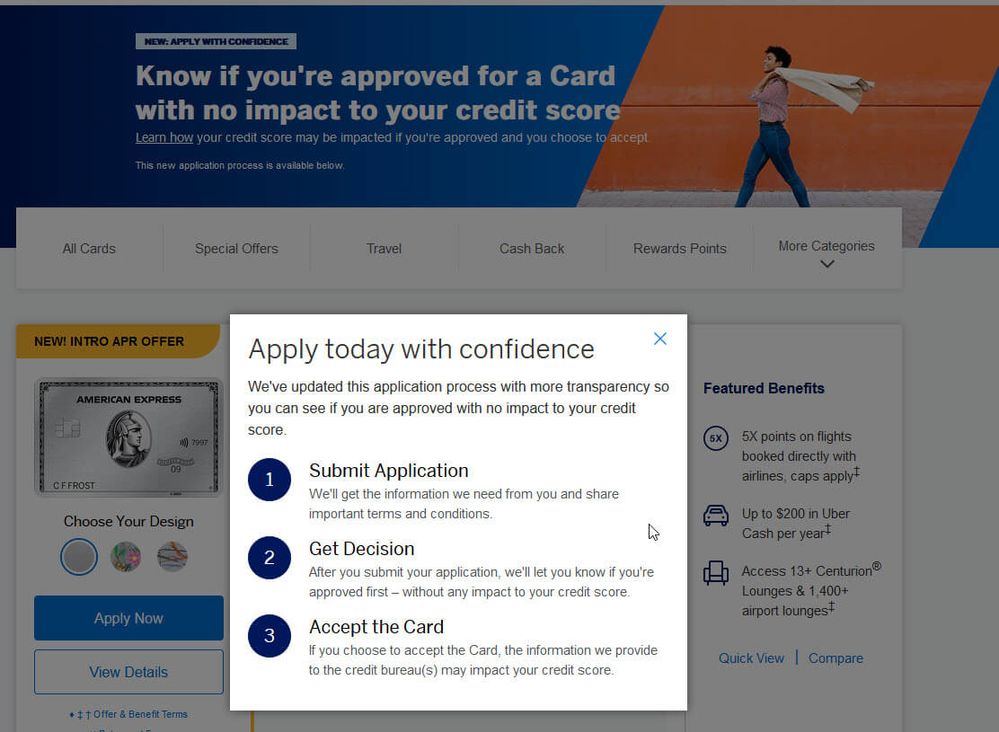

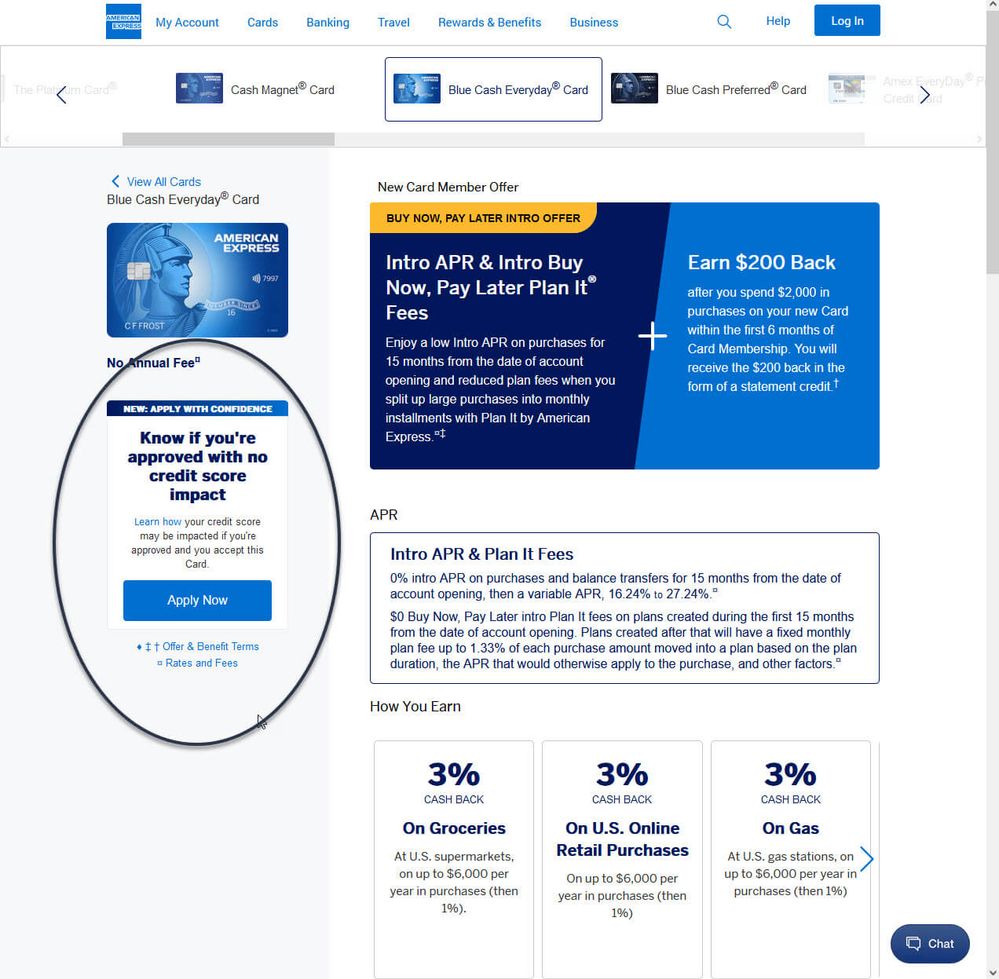

Seems AMEX is finally doing something that every credit card company should do. Allowing you to reliably take a shot at Any of their personal cards with a promised Soft Pull only.

The URL is here- https://www.americanexpress.com/us/credit-cards/?inav=menu_cards_prequal_offer

If you do not see the banner in the 1st image, then clear your cookies just for that site and refresh, then you will.

Of course should you accept the card you pre-qualify for, and if it's your 1st Amex, you likely would receive a hard pull after. However, I like the way they are making it perfectly clear and hand holding you the entire way now, not so Vague as the wording used to be. (Images Attached)

I am not sure if it works for business cards, but this is still agreat thing. I hate hearing people waste inquires over and over again, it's best to just know up front.

Happy Hunting!

Personal-

NFCU Platinum 50k | NFCU Flagship 20k | NFCU More Rewards 10k | NFCU NavChek PLOC 15k | PenFed Power Cash 25k | PenFed Gold 15k | PenFed Pathfinder 10k | PenFed OLOC 3K | GTE Financial CU 15k | VyStar CU Cash Back 25k | VyStar CU PLOC 15k | FNBO Evergreen 25k | FNBO 11.85K | BofA Cash Rewards 10.1k | Capital One Venture 13k | Capital One QS 7k | PNC Cash Rewards 15.5k | Citi Costco 8.5k | US Bank Cash+ 10k | Discover 14.8k | Discover 14.1k | Regions Cash 6k | Truist Enjoy Cash 9k | Truist Future 6.5k | Elan Max Cash 7k | Wells Fargo Reflect 20k | Fifth Third 7k | USAA PrefRew 15k | CFNA Tires Plus MC 8k | GM Rewards 3.5k | TD Bank Cash 3.5k | Amex BCP 3K | Lowes Store 30k | Sleep Number Store 13.5k | Home Depot Store 10k | Amazon Store 10k | Care Credit 15k | Walmart Store 6k | JCrew 25k | Jared 18.6k | HSN 4.1K | King Size 4k | Buckle 3.1k

Business-

Amex BBC 25k | Amex BBP 22k | Amex Business Platinum NPSL 30.4kPoT | Citizens Business Everyday 35k | Sams Club Business MC 25K | US Bank Business Plat 24k | Capital One Spark 2% 22k | Marcus GM Business 12.5k | Capital On Tap 2% 10k | Chase Ink 3k | Divvy 7k | PNC BLOC 50K | Citizens BLOC 50K | (Private) BLOC 75K | WEX Business Access Fuel 30k | Sams Bus Store 25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

But I want a Hard Pull (BL).🤪

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

For those who read this post and dont know where you stand with Amex due to past history- this link is a great tool to see if you are on the Amex Blacklist.

I had a family member try it with their information and the reason for denial was "ARE YOU CRAZY - YOU ARE ON THE BLACKLIST". Not in those words but something along the lines of "we cant approve you because we previously closed an account of yours" - Something along those lines.

Amex Business Plus: 6000 // Amex Business Hilton Honors: 3000 // Amex Delta Gold: 4900 // Amex Business Platinum NPSL POT 5000 // Amex Business Gold NPSL POT 15000

Personal Cards:

Discover It Cash Back: 8000 // Chase Saphire Preferred: 5000 // Truist Enjoy Beyond: 4500 // Amex Blue Cash Preferred: 1000 // Cap1SavorOne: 2000 // Cap1 Secured Platinum: 200 // Cap1 QuiksilverOne 2000 // Citi Double Cash: 5200 // Amex Platinum NPSL POT 4000 // Amex Gold NPSL POT 1750

GOAL SCORES 750 ACROSS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

Does it tell you anything when you do the soft pull approval as far as APR, limit, terms etc, like the Apple Card? That would be really cool if it did. You could try and see what you would get, and then accept if you want it and like the terms, or decline with no HP impact.

Last time I tried to prequal at Amex (for science), it said "we have nothing for you, but you can click this link to try for the Credit One Amex!" ![]() I'm almost certain this was because my reports are frozen, I can't qualify for anything without thawing them.

I'm almost certain this was because my reports are frozen, I can't qualify for anything without thawing them.

Open Tradelines: 4 Revolvers, 1 Mortgage / Garden Start Date: 10/1/2021 / Garden Goal: don't have one right now

TCL: $26,500 / AAoA: 8y6m / AoYA: 1y5m / Inqs: 1EX 0TU 1EQ / FICO8 Feb 2023: 848(TU) 843(EX)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

@CreditMarathoner wrote:Does it tell you anything when you do the soft pull approval as far as APR, limit, terms etc, like the Apple Card? That would be really cool if it did. You could try and see what you would get, and then accept if you want it and like the terms, or decline with no HP impact.

Last time I tried to prequal at Amex (for science), it said "we have nothing for you, but you can click this link to try for the Credit One Amex!"

I'm almost certain this was because my reports are frozen, I can't qualify for anything without thawing them.

No, it doesnt.. there's another thread about this as well

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

amex was included in my bk back in 2017. i went through with the soft pull app to see what they would say. hopefully to determine if was on their blacklist. i tried the skymiles card because ive read on here (years ago) that it was the easiest to qualify for does this mean im forever blacklisted? my 5yr mark will be this coming november. here is what they told me.....

"Thank you for applying for the Delta SkyMiles® Gold American Express Card. We're writing to let you know we cannot approve your application at this time because American Express cancelled your previous account(s).

If you have any questions, please call 1-800-222-8416 or write to us at the address above. You may qualify for a new Card in the future and are welcome to submit an application at a later date. You can also learn more about managing your credit at americanexpress.com/us/content/financial-education.

Thank you for your interest in American Express.

Sincerely,

American Express Customer Care

We've provided an important notice below concerning your rights. The creditor is American Express National Bank"

TU - 727 | EX - 732 | EQ - 736 |

TCL - 168K - UTIL - less than 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

@JcT21 wrote:amex was included in my bk back in 2017. i went through with the soft pull app to see what they would say. hopefully to determine if was on their blacklist. i tried the skymiles card because ive read on here (years ago) that it was the easiest to qualify for does this mean im forever blacklisted? my 5yr mark will be this coming november. here is what they told me.....

"Thank you for applying for the Delta SkyMiles® Gold American Express Card. We're writing to let you know we cannot approve your application at this time because American Express cancelled your previous account(s).

If you have any questions, please call 1-800-222-8416 or write to us at the address above. You may qualify for a new Card in the future and are welcome to submit an application at a later date. You can also learn more about managing your credit at americanexpress.com/us/content/financial-education.

Thank you for your interest in American Express.

Sincerely,

American Express Customer Care

We've provided an important notice below concerning your rights. The creditor is American Express National Bank"

I wouldnt say you are forever blacklisted but I think it is possible you may have to give it atleast 5 more years. I personally had to wait over 10 years to get off the blacklist. Seemed like forever - but they finally let me in this year. Low SL on the credit cards and low POT and internal limits on the charge cards but I am back in. Patience is key

Amex Business Plus: 6000 // Amex Business Hilton Honors: 3000 // Amex Delta Gold: 4900 // Amex Business Platinum NPSL POT 5000 // Amex Business Gold NPSL POT 15000

Personal Cards:

Discover It Cash Back: 8000 // Chase Saphire Preferred: 5000 // Truist Enjoy Beyond: 4500 // Amex Blue Cash Preferred: 1000 // Cap1SavorOne: 2000 // Cap1 Secured Platinum: 200 // Cap1 QuiksilverOne 2000 // Citi Double Cash: 5200 // Amex Platinum NPSL POT 4000 // Amex Gold NPSL POT 1750

GOAL SCORES 750 ACROSS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

About two years ago, Amex was including SL in pre-approved offers. This did not last very long, maybe a month or so, and it didn't work for everyone.

I personally like the idea of knowing as much as possible before applying. I don't see why we are expected to blindly accept whatever when it comes to credit cards.

If I wanted to buy a couch, I wouldn't like the process if it went something like "Here is a picture of a couch, yours might be same, similar, or nothing like it. Also, if we cannot give you a couch, we might give you a barstool, you don't have a say in that, either."

With other forms of lending such as auto, PLs, mortgages, you know terms and amounts ahead of accepting, and based on that, one can make (un)informed decisions.

Credit cards, cloak and dagger for so many.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Clearly Saying Soft Pull Pre-Qualify Now

@Remedios wrote:About two years ago, Amex was including SL in pre-approved offers. This did not last very long, maybe a month or so, and it didn't work for everyone.

I personally like the idea of knowing as much as possible before applying. I don't see why we are expected to blindly accept whatever when it comes to credit cards.

If I wanted to buy a couch, I wouldn't like the process if it went something like "Here is a picture of a couch, yours might be same, similar, or nothing like it. Also, if we cannot give you a couch, we might give you a barstool, you don't have a say in that, either."

With other forms of lending such as auto, PLs, mortgages, you know terms and amounts ahead of accepting, and based on that, one can make (un)informed decisions.

Credit cards, cloak and dagger for so many.

I wonder how much it would cost in order to for all lenders to go the Apple Card route and be able to provide a firm offer w/SP prior to acceptance.

Would rewards have to go down, interest have to go up, the economy have to get better?

I see no reason why it couldn't be done, but it doesn't seem there really isn't much pressure for it to happen. Perhaps law could mandate it.

3/6, 5/12, 14/24