- myFICO® Forums

- Types of Credit

- Credit Cards

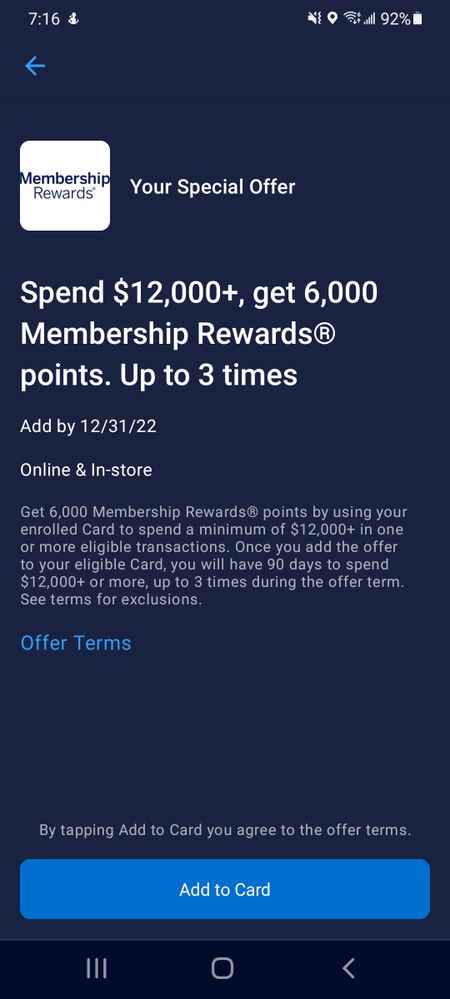

- Amex MR offer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex MR offer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

You think that's bad...

The offer I got on my Blue Business was to spend $13,500 and earn 3500 MR points... up to three times!

So not even 0.5x. I don't put that much spend on the card anyway, but this offer isn't exactly making me want to rearrange my spend

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@micvite wrote:This has got to be the WORST offer I've ever seen... 0.5 points per dollar spent. I guess this is what happens when you put 25k on the card in the first month they just expect you're gonna keep doing it and they throw you a few crumbs to thank you lol.

I'm struggling to understand what's "worst" about this.

It's not something you have to accept, and it's not something Amex had to do.

It's simply added incentive, nothing more nothing less.

And to put it in perspective, not even a couple of months ago threads were all "they won't let me spend money on Gold without paying constantly"

Now they loosened reigns, approved you for couple of additional cards, suddenly they "worst" . What's even weirder, you just got approved for this card, so one would think you would be in honeymoon approval/spending phase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@MrDisco99 wrote:You think that's bad...

The offer I got on my Blue Business was to spend $13,500 and earn 3500 MR points... up to three times!

So not even 0.5x. I don't put that much spend on the card anyway, but this offer isn't exactly making me want to rearrange my spend

Do you have a better off-category card? Or is there some SUB you're meeting?

If not, it makes an already great off-category card even better.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@micvite wrote:It's on the platinum and I don't see myself spending nearly that much in airfare this year (just bought a car and signed on a house which will eliminate all of my cash savings) and the Amex travel portal is significantly more expensive for hotels than just booking directly half the time. Had this come out before I maxed the 10x on restaurants sign up bonus it wiuldbe been useful, I would've gotten am extra 12k points, but other than that I just use the citi DC to get 2typ on daily purchases. Maybe towards the end of the year I'll activate it in case I decide to buy a vacation for 2023 lol

While there are certainly cases where it's better to book direct (generally for elite loyalty benefits and earnings which are very rarely honored when booking through an OTA), Amex Travel prices (with some exceptions noted later) will usually be the same as through any other OTA and those will also generally be the same as booking direct except for specific sales. Typically when one sees pricing discrepencies between OTAs (and direct airline or hotel purchases), it is because some front-ends will display all-in pricing (with taxes and any fees) and others will display subtotal pricing. With Hotel Collection, FHR, Insider Fares, and International Airline Program bookings, Amex will actually often have lower pricing than booking direct, however.

A 50% bonus on earnings is far from a "worst" offer. Keep in mind that 1.5x on purchases of $5000 or more is actually a key selling point of the Business Platinum Card. I often get offers such as "3000 bonus MRs for $13,500+ spend (up to 5 times, offer expires in 21 days)," and while that's not lucrative enough to make me switch spending from other cards, it's still free additional points if I were going to make the spend anyway. Amex Offers should be icing on the cake, not justification alone for holding a card. As for the Double Cash card, with a strategic redemption, 1.5 MR points can be far more valuable than 2 TYP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@K-in-Boston wrote:

@micvite wrote:It's on the platinum and I don't see myself spending nearly that much in airfare this year (just bought a car and signed on a house which will eliminate all of my cash savings) and the Amex travel portal is significantly more expensive for hotels than just booking directly half the time. Had this come out before I maxed the 10x on restaurants sign up bonus it wiuldbe been useful, I would've gotten am extra 12k points, but other than that I just use the citi DC to get 2typ on daily purchases. Maybe towards the end of the year I'll activate it in case I decide to buy a vacation for 2023 lol

While there are certainly cases where it's better to book direct (generally for elite loyalty benefits and earnings which are very rarely honored when booking through an OTA), Amex Travel prices (with some exceptions noted later) will usually be the same as through any other OTA and those will also generally be the same as booking direct except for specific sales. Typically when one sees pricing discrepencies between OTAs (and direct airline or hotel purchases), it is because some front-ends will display all-in pricing (with taxes and any fees) and others will display subtotal pricing. With Hotel Collection, FHR, Insider Fares, and International Airline Program bookings, Amex will actually often have lower pricing than booking direct, however.

A 50% bonus on earnings is far from a "worst" offer. Keep in mind that 1.5x on purchases of $5000 or more is actually a key selling point of the Business Platinum Card. I often get offers such as "3000 bonus MRs for $13,500+ spend (up to 5 times, offer expires in 21 days)," and while that's not lucrative enough to make me switch spending from other cards, it's still free additional points if I were going to make the spend anyway. Amex Offers should be icing on the cake, not justification alone for holding a card. As for the Double Cash card, with a strategic redemption, 1.5 MR points can be far more valuable than 2 TYP.

Perhaps. But as you know, since you are in my estimation a super expert on travel cards, there are also strategic redemptions where TYP can be more valuable than MR points, depending on specific travel partners and modes of travel.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@K-in-Boston wrote:

@micvite wrote:It's on the platinum and I don't see myself spending nearly that much in airfare this year (just bought a car and signed on a house which will eliminate all of my cash savings) and the Amex travel portal is significantly more expensive for hotels than just booking directly half the time. Had this come out before I maxed the 10x on restaurants sign up bonus it wiuldbe been useful, I would've gotten am extra 12k points, but other than that I just use the citi DC to get 2typ on daily purchases. Maybe towards the end of the year I'll activate it in case I decide to buy a vacation for 2023 lol

While there are certainly cases where it's better to book direct (generally for elite loyalty benefits and earnings which are very rarely honored when booking through an OTA), Amex Travel prices (with some exceptions noted later) will usually be the same as through any other OTA and those will also generally be the same as booking direct except for specific sales. Typically when one sees pricing discrepencies between OTAs (and direct airline or hotel purchases), it is because some front-ends will display all-in pricing (with taxes and any fees) and others will display subtotal pricing. With Hotel Collection, FHR, Insider Fares, and International Airline Program bookings, Amex will actually often have lower pricing than booking direct, however.

A 50% bonus on earnings is far from a "worst" offer. Keep in mind that 1.5x on purchases of $5000 or more is actually a key selling point of the Business Platinum Card. I often get offers such as "3000 bonus MRs for $13,500+ spend (up to 5 times, offer expires in 21 days)," and while that's not lucrative enough to make me switch spending from other cards, it's still free additional points if I were going to make the spend anyway. Amex Offers should be icing on the cake, not justification alone for holding a card. As for the Double Cash card, with a strategic redemption, 1.5 MR points can be far more valuable than 2 TYP.

Fair enough, I'm not complaining about the fact that they gave me an offer, just saying it's a pretty bad offer compared to what I've seen in travel groups and in the past on my gold card for example. I guess I should't have said anything since the AMEX gods were listening and now i have NO offers lol.

EDIT: as far as the booking, it's not a significant difference I'm seeing, but for example hilton offers a slight discount for booking through their app as a member and amex doesn't show that discount, so while it's only a few tens of dollars here and there it can add up.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR offer

@wasCB14 wrote:

@MrDisco99 wrote:You think that's bad...

The offer I got on my Blue Business was to spend $13,500 and earn 3500 MR points... up to three times!

So not even 0.5x. I don't put that much spend on the card anyway, but this offer isn't exactly making me want to rearrange my spend

Do you have a better off-category card? Or is there some SUB you're meeting?

If not, it makes an already great off-category card even better.

Yes it is my default "miscellaneous" card... but I just don't put that kind of churn through it. My point was that bumping it from 2x to 2.26x won't pull spend away from my other cards.

As it stands I won't hit $13,500 at all during the offer period, so even though I added the offer it didn't do anything for me.