- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex Pay Over Time eligibility?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Pay Over Time eligibility?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

@Anonymous wrote:I opened my PRG account in Aug 2016. That was my first ever Amex card. Got the POT offer in october 2016. Enrolled on 5th october tobe exact. 2 months after being approved for their card ( my first Amex) .i think they might be checking the overall credit profile & payment history

I was never really interested in AMEX charge cards but after seeing this thread and realizing they give the best of both worlds in a sense with a nice POT limit, I'm really thinking of getting a PRG now. AMEX has been bombarding me with mailers for the Gold and Platinum. May think it over...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

@GetTheFico wrote:

You may get lucky and get a bonus to add the pay over time feature.

They offered me 10,000 MR points to add it, which I did. I believe I had the card for over a year at the time though.

I'm hoping I get so lucky once my one year anniversary comes around in July 2017. (Fingers crossed). I don't need to use it but would love to get the MR points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

Amex PRG NPSL | Amex Delta $1K | Aviator Red $2.5K | Best Buy $3K | Amazon $4K | Chase $5K | BBVA $5K | UFCU $7.5K | NFCU $15K

AMEX doesn't trust you yet or your income is pretty low. Give them time, AMEX can be picky about things and PoT is controlled by underwriting department and not new cards department, these two departments have different goals in the corporation.

underwriting department is there to protect AMEX from loss, where the new cards department wants to get as many cards with the highest limit possible in to as many customers as they can and to make those customers happy. After a month of the card in the user hands, the card is passed off to the underwriting department where they get to make discussions on what happens to the card, and since you recieved a 1k limit card its pretty much a sign that yes the new cards group deciced to give you a chance, but your internal score is pretty low, so the underwriting department tollerates you, which is why you probably don't have the PoT option yet.

At this point, use your cards, pay your bills on time, don't max out your cards or let them report them that way. Don't let any other cards get maxed out or any other baddies on your report.

I got on AMEX bad list for a while, but after about 5 years now I have the option to get PoT, on the Zync card that is discontinued but AMEX still allows me to use, Which is possibly onr of the reason it took this long.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

On average, how much would a person have to spend monthly to qualify for the P.O.T. option?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

@Anonymous wrote:On average, how much would a person have to spend monthly to qualify for the P.O.T. option?

I am not sure there is any set amounts.... I was offered POT at activation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

@Anonymous wrote:On average, how much would a person have to spend monthly to qualify for the P.O.T. option?

I was offered mine shortly after activation, minimal spend!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

It could be more a question of creditworthiness, rather than spend.

I wonder how many customers use a charge card, have good enough credit for Amex to offer POT, and yet can't get a better APR or BT offer elsewhere...

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Pay Over Time eligibility?

You have show spend pattern on it first. No late payments, etc.

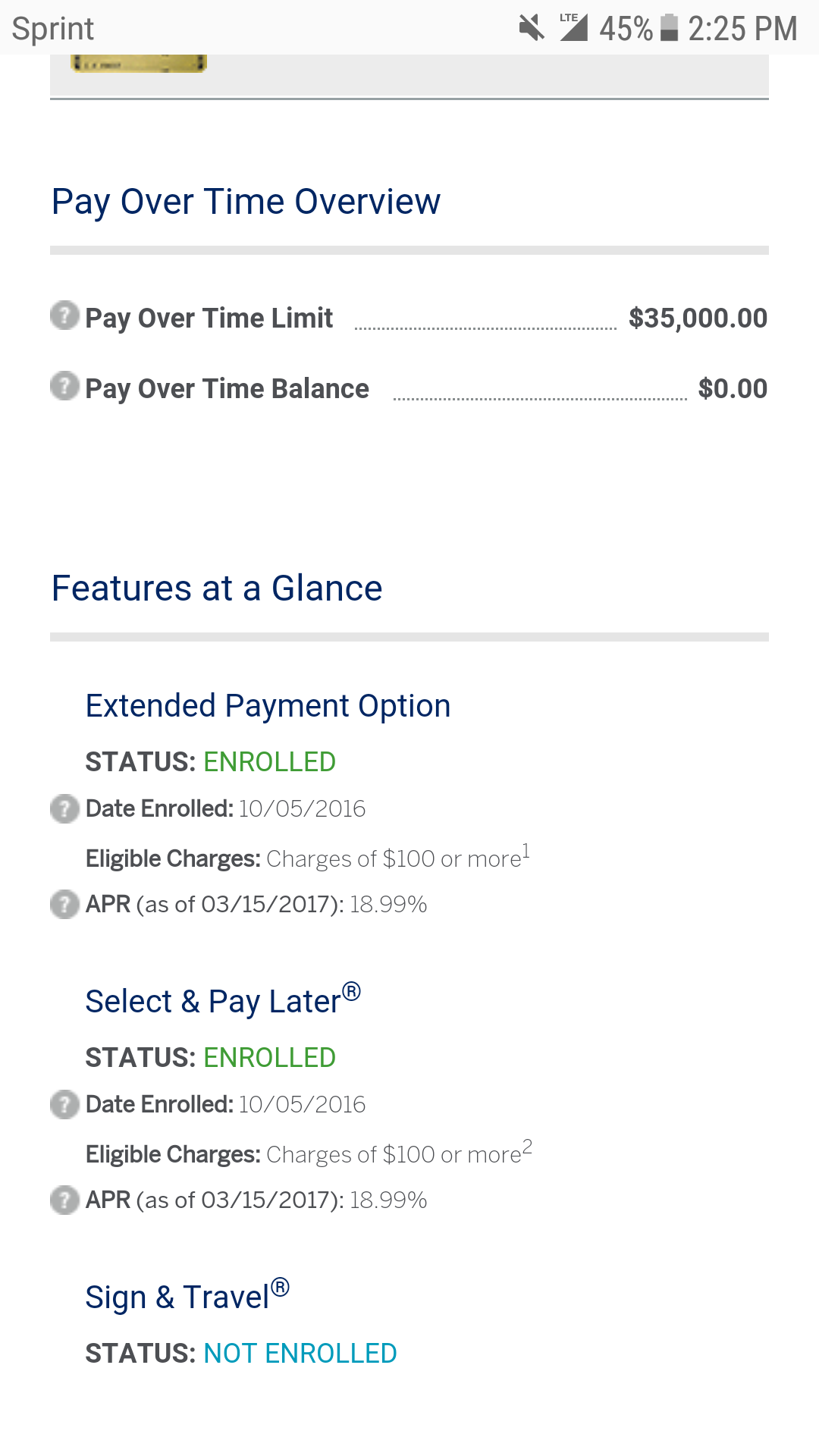

That's not always the case. I was approved for an Amex Platinum and got PoT enrolled and approved immediately, for a $35k limit.