- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex Plan It Experiences

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Plan It Experiences

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@NRB525 wrote:I have an SPG Lux with purchse APR of 12.24%. I am running a $4,000 purchase on Plan It, took the 3 months option though 6 and 9 were available. Total fee for the 3 payments will be $55.17 for an annualized rate of 5.5%.

So if you want a better Plan It rate, my guess is ask to get the APR on regular purchases reduced. The challenge with that request is, on other AMEX cards I've been offered a 1% reduction for a year, from a 19.99% rate. Not a classy offer.

That would be an interesting data point. I would assume APR plays a role. Hopefully more people add data to see if history carries any weight.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@Brian_Earl_Spilner wrote:

@NRB525 wrote:I have an SPG Lux with purchse APR of 12.24%. I am running a $4,000 purchase on Plan It, took the 3 months option though 6 and 9 were available. Total fee for the 3 payments will be $55.17 for an annualized rate of 5.5%.

So if you want a better Plan It rate, my guess is ask to get the APR on regular purchases reduced. The challenge with that request is, on other AMEX cards I've been offered a 1% reduction for a year, from a 19.99% rate. Not a classy offer.

That would be an interesting data point. I would assume APR plays a role. Hopefully more people add data to see if history carries any weight.

What's your SPG Lux CL? I wonder if utilization plays a role in the plans Amex offers.

Perhaps Amex wants an account's utilization under a certain level within a few months...hence why my 35% and 50% util purchases ($3.5k and $5k on a $10k account) only got the 3 and 6 month options?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@wasCB14 wrote:

@Brian_Earl_Spilner wrote:

@NRB525 wrote:I have an SPG Lux with purchse APR of 12.24%. I am running a $4,000 purchase on Plan It, took the 3 months option though 6 and 9 were available. Total fee for the 3 payments will be $55.17 for an annualized rate of 5.5%.

So if you want a better Plan It rate, my guess is ask to get the APR on regular purchases reduced. The challenge with that request is, on other AMEX cards I've been offered a 1% reduction for a year, from a 19.99% rate. Not a classy offer.

That would be an interesting data point. I would assume APR plays a role. Hopefully more people add data to see if history carries any weight.

What's your SPG Lux CL? I wonder if utilization plays a role in the plans Amex offers.

Perhaps Amex wants an account's utilization under a certain level within a few months...hence why my 35% and 50% util purchases ($3.5k and $5k on a $10k account) only got the 3 and 6 month options?

$15k limit.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

Re: $15k CL

There may possibly be something to the role of utilization. ~27% gave you exactly one more option (not zero, not several) than 35% and 50% gave me.

Obviously not enough data to guess at the detailed criteria they use, or even if it does play a role.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@wasCB14 wrote:Re: $15k CL

There may possibly be something to the role of utilization. ~27% gave you exactly one more option (not zero, not several) than 35% and 50% gave me.

Obviously not enough data to guess at the detailed criteria they use, or even if it does play a role.

Well, total limits on open AMEX revolvers is $53k, 4 revolvers and a charger, and I suspect AMEX has an overall profile view. That is what leads to SP new accounts.

If anyone has seen more than a 9-month offer term that would be interesting.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

Fascinating!

I just found "plan it" the other day, and was playing with the options this morning. We're planning to PIF anyway, but it's a nice option to see!

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@NRB525 wrote:

@wasCB14 wrote:Re: $15k CL

There may possibly be something to the role of utilization. ~27% gave you exactly one more option (not zero, not several) than 35% and 50% gave me.

Obviously not enough data to guess at the detailed criteria they use, or even if it does play a role.

Well, total limits on open AMEX revolvers is $53k, 4 revolvers and a charger, and I suspect AMEX has an overall profile view. That is what leads to SP new accounts.

If anyone has seen more than a 9-month offer term that would be interesting.

The longest plan that I'm aware of is 24 mos, but I haven't seen more than 9.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

@Brian_Earl_Spilner wrote:It sounds like a win/win, but in the end, Amex would make less money than if someone carried the balance. I don't think they care as long as they get paid back sooner.

While it would be less revenue than when carrying a balance I think the overall result may be more revenue for them. A lot of Amex customers (myself included) PiF each month to avoid interest. They make no money on that other than swipe fees. I look at this as a way to entice people to actually carry a balance over time. For me it makes it much more appealing to carry a balance with a Plan considering the lower fees, and it not triggering interest on the regular spending on my card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

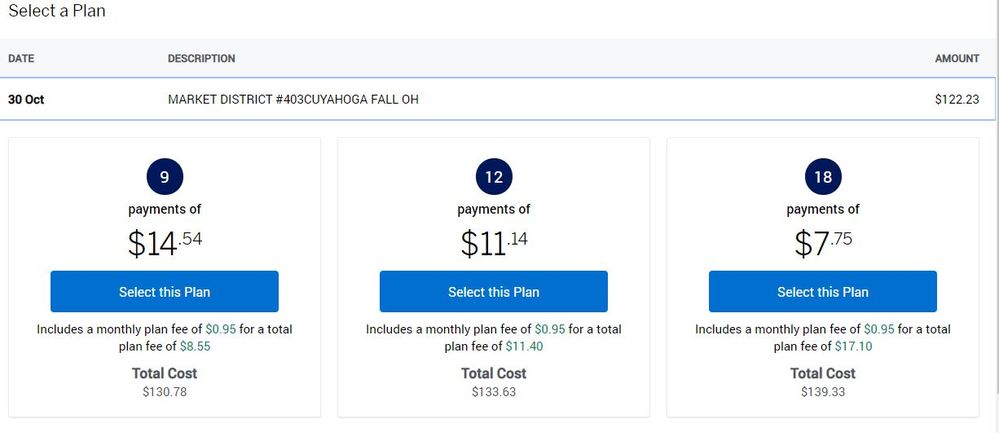

A simple grocery store charge allows me up to 18 months. Why? I don't know. For data points, if anybody has any questions then feel free to ask.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Plan It Experiences

Oh my goodness. If I need 18 months to pay off $122, just shoot me now ![]()

![]()

![]()

Oh by the way, I love those FICO 8s across the board. Congrats.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K