- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex - Raises Minimum payment due

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

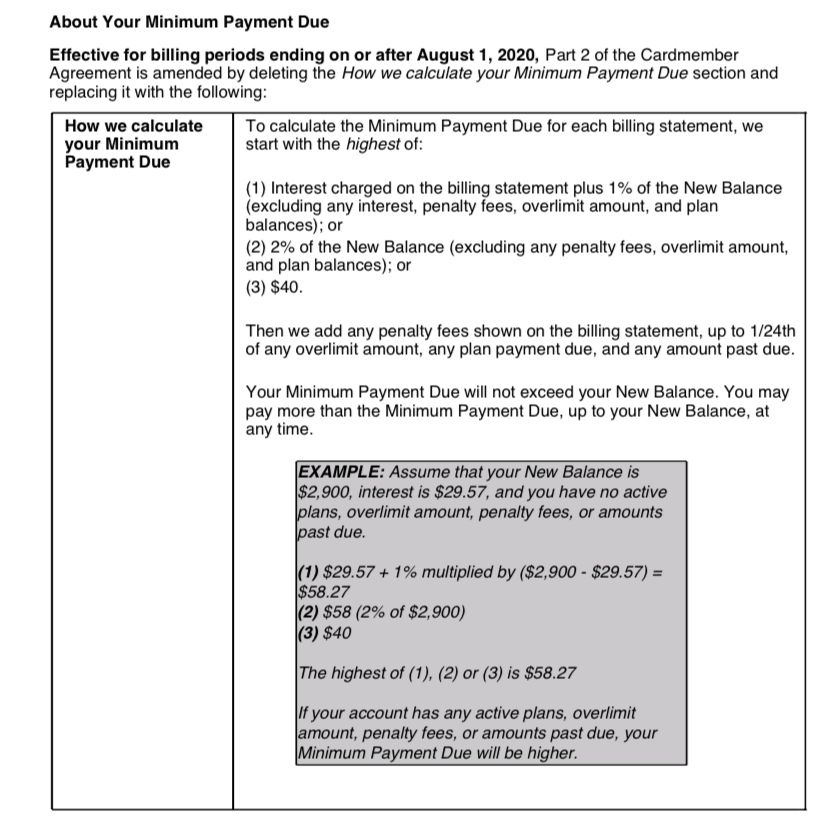

Amex - Raises Minimum payment due

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

@Anonymous wrote:

@Anonymous wrote:I took advantage of some plan it pay over time offers and that increased my minimum payment significantly. Used to be $30 now it's $166! But it's on a 0% interest card (Amex Everyday) so I will be carrying a 19% balance on that for the next yr...slowly paying it down while on my other cards I PIF.

Do you mean to say that you utilized Plan it on an existing 0% rate? If so, why? In my mind if your current rate is already 0% then there wouldn't really be a reason for Plan it.

The Plan It is helpful as it distinguishes the amount you want to "carry" for a balance, during a defined term. The Plan payments pay off that amount during the number of Plan payments. Everything else on the card can be Paid In Full as you go.

With a 0% offer, while it is nice to allow you to carry a balance, one does not want to run up the full CL then pay only minimum payment through the 12 month 0% period, only to find a large open payable balance at the end.

The basic Minimum payment calculations in the opening post are no different from other banks. Paying 1% vs 2% is the difference between paying it off in 100 months vs 50 months. Still a lot of interest in those 4+ years, as long as you aren't charging anything new to the card, which is not the case with the typical balance-carrying cardholder. That interest cost tends to be perpetual as they cycle a payment and new charges.

The difference with other banks is the Plan It amount. Other banks do not offer it, so don't put it in their Minimum Payment language. But you signed up for the Plan with the understanding it would be a required payment each month. So it should not be a surprise, or interpreted as "they raised my minimum payment amount" when a Plan is utilized.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

I guess it can be helful to those who only pay minimums, that way it right there in bacl and whie what to pay each month for it to be paid off by set date. Being one who does not pay minimum payments anyway, i know what amount needs to be paid over the course of teh 0% promo rate.

This way all my minimums remian the same not affecting DTI as much. Altough i know this is only a concern when actually apping for something, i still like to keep it and UT as low as possible at any given moment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

Yea @NRB525 I understand the calculations and I agree with what you wrote...I put a few big ticket items on my card taking advantage of the 0%...the plan it option allows me to divide up the payments over a set amount of time instead of me scrambling towards the end of the 0% interest time to make one big payment to pay everything off. I never pay just the minimum ever but it's good to know the plan it items are accounted for each mth and I can see in my account the progress I have made on the payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

@Remedios wrote:Minimum payments are not assigned on individual basis.

The amount may differ based on the balance, but calculations are identical across the board.

Thanks for the clarification. In that case they are either not changing all of the cards at once, or the OP just noticed a change that was made back around October 2019 because my ED min changed to 2% then.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

I only noticed this on my current statement. It appeared as a “change” to be reviewed. Not sure how they do it. I always PIF and have never carried a balance in this particular card. Maybe they realized I hadn’t been notified. Who knows. ETA...I just looked back on my statements- nothing there. My 5/24 statement says refer to important notices section for changes to your account terms. That is where is listed the minimum due info.

@FlaDude wrote:

@Remedios wrote:Minimum payments are not assigned on individual basis.

The amount may differ based on the balance, but calculations are identical across the board.

Thanks for the clarification. In that case they are either not changing all of the cards at once, or the OP just noticed a change that was made back around October 2019 because my ED min changed to 2% then.

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

Looks like it's on all revolvers as of August 2020. Just checked my statements for my 3 AMEX revolvers and they all had the same message.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

That makes sense. I have 2 revolvers with them. It’s on the current statement and effective in August.

@Anonymous wrote:Looks like it's on all revolvers as of August 2020. Just checked my statements for my 3 AMEX revolvers and they all had the same message.

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

There are a few advantages of using a Plan it on a 0% offer.. yes the payments are larger but you can make sure to pay down the plan it before the offer is up, and you can actually still use the card and have an ongoing plan it easier...(its easier to differentiate between the card balance and the plan its) Also for some reason i was able to make plan its that ended past the 0% period at 0% (YMMV)....

Still havent gotten the math to compare a plan it fee to roughly the apr equivalent..

If you have a plan it with X fee for 3 months or 6 months, what would be the equivalent APR

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Raises Minimum payment due

Apparently this happened on my Amex BCE last year but I never noticed until I carried a small balance last month.

It looks like they're going to keep gradually increasing the minimum payment for a while. Directly from their site:

https://www.americanexpress.com/ca/en/customer-service/faq.minimum-payment-due.html

The Minimum Payment is the lesser of (1) or (2), calculated as follows:

(1) the total of: (a) any previously billed minimum payment that remains unpaid on the Closing Date of the statement + (b) if applicable, installment amounts (including installment fees) charged on the billing statement PLUS

(for non-Quebec residents): (c) $10 + (d) Interest, Overlimit fees and Dishonoured Payment fees; or

(for Quebec residents whose accounts were opened on or after August 1, 2019): (c) 5% of the remaining balance owing that month.

(for Quebec residents whose accounts were opened prior to August 1, 2019): (c) 2% for statements dated on or after April 1, 2020, and the following percentages apply for statements dated on or after the following dates:

- August 1, 2020 – 2.5%;

- August 1, 2021 – 3%;

- August 1, 2022 – 3.5%;

- August 1, 2023 – 4%;

- August 1, 2024 – 4.5%;

- August 1, 2025 – 5%.

OR (2) the entire new balance of the billing statement.