- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex - Shifting Credit Limits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

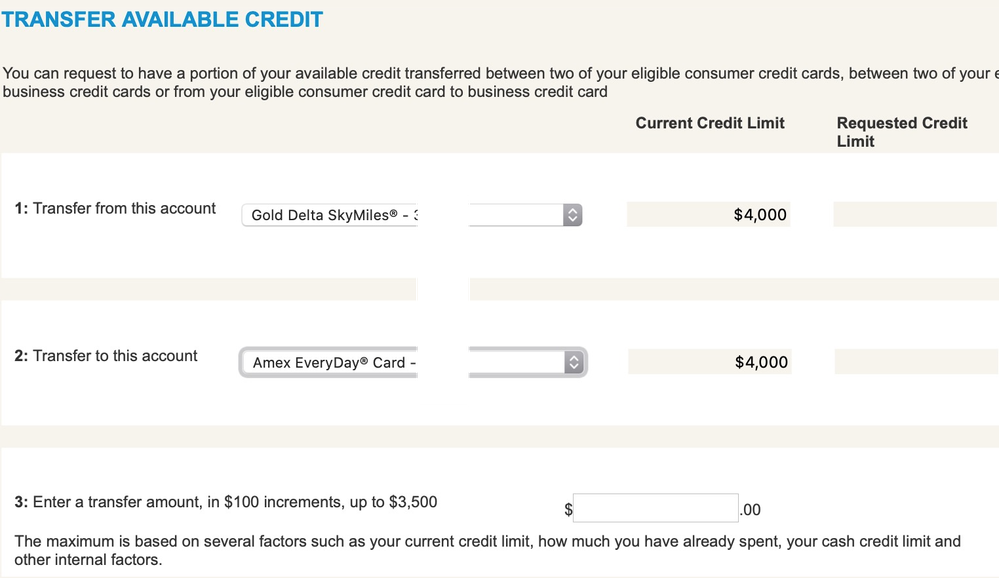

Amex - Shifting Credit Limits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@simplynoir wrote:

@FinStar wrote:

@CreditCuriosity wrote:Very easy to move limits with amex must leave 500 as stated on donor card use to be once ever months, but believe that restriction has also been removed if i recall correctly.. I moved most of my limits to business credit from personal with them once that is done you cant move back to personal though which kinda stinks, but all good overall

It's been a while since I did this, but I recall the process was seamless. Now, if a CL is reallocated, does that impact the 3x CLI schedule on either card whether it's the recipient or the donor? My memory is a bit foggy on that piece 😛🤔.

Only CLI initiated by the customer resets the clock, everything else from new apps, reallocation, or auto CLIs don't reset the clock

That's good to know @simplynoir 😁...thank you! 👍 I haven't had the need to reallocate CLs, but since I'm considering the consolidation of some existing revolvers, I couldn't remember the guidelines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

As FinStar stated "seamless" to re-allocate CL's .. and usually takes effect within 5 minutes or sooner.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

I also moved limit to a brand new card the day after it was opened (it took that long for the card to show up in my online account).

I know there’s a lot on the google machine talking about how cards have to be a year old to be involved in this process, but that doesn’t appear to be the case anymore.

You can’t move business lines to personal (you can go the other way), you have to leave the minimum CL on the donor card, and I’ve been limited to 30 days between requests.

All of which is mentioned above but just adding my experience for confirmation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@Anonymous wrote:I know that American Express will sometimes decrease the credit limit on one card when you're approved for a new card. I've also heard that we can move credit limits around some. Could you do that right after approval?

Yes you can - I did so and now my Everday Cash with 15 months (or is it 18) 0% interest has an $11,000 CL instead of the $3,000 at approval. As soon as I've done my Delta Gold SUB I'll move $3500 more over to the interest free card.

However, keep in mind that a new Amex card won't report for a couple of months, so your total CL shrinks as far as your scores are concerned. I basically have only 75% of my actual CL reporting right now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

For many the minimum you have to leave on the donor card is $500, but for both my Delta Gold and BCP it was $1k. (This was lousy for my Delta, since the credit line was only $1k to begin with so I couldn't reallocate at all.)

I think (???) I've seen reports of people only leaving $500 on those two in particular so it might be profile specific rather than product specific.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@CreditCuriosity wrote:Very easy to move limits with amex must leave 500 as stated on donor card use to be once ever months, but believe that restriction has also been removed if i recall correctly.. I moved most of my limits to business credit from personal with them once that is done you cant move back to personal though which kinda stinks, but all good overall

I wasnt aware you could allocate between business and personal....good info for those who may want this as an option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@Anonymous wrote:

@CreditCuriosity wrote:Very easy to move limits with amex must leave 500 as stated on donor card use to be once ever months, but believe that restriction has also been removed if i recall correctly.. I moved most of my limits to business credit from personal with them once that is done you cant move back to personal though which kinda stinks, but all good overall

I wasnt aware you could allocate between business and personal....good info for those who may want this as an option.

It's a one-way trip from personal -> business. You cannot do business -> personal so loses some of its appeal to me there but still helpful if you a daily driver like the Blue Business Plus/Cash cards that require a bigger limit to use

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@UncleB wrote:For many the minimum you have to leave on the donor card is $500, but for both my Delta Gold and BCP it was $1k. (This was lousy for my Delta, since the credit line was only $1k to begin with so I couldn't reallocate at all.)

I think (???) I've seen reports of people only leaving $500 on those two in particular so it might be profile specific rather than product specific.

It's definitely related to balance, for one thing. I can leave only 500 on Delta if I want to, but my Everyday rewards, that's carrying about 3600 on 0%, can't go below a $4000 limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex - Shifting Credit Limits

@Anonymous wrote:

@UncleB wrote:For many the minimum you have to leave on the donor card is $500, but for both my Delta Gold and BCP it was $1k. (This was lousy for my Delta, since the credit line was only $1k to begin with so I couldn't reallocate at all.)

I think (???) I've seen reports of people only leaving $500 on those two in particular so it might be profile specific rather than product specific.

It's definitely related to balance, for one thing. I can leave only 500 on Delta if I want to, but my Everyday rewards, that's carrying about 3600 on 0%, can't go below a $4000 limit.

I don't doubt that at all, but in my case the balance on all cards was -0- so it was something about my profile that required me to leave $1k on each card. ¯\_(ツ)_/¯

Also, you can't tell what they would let you leave by looking at that screen... that's exactly what I saw as well, but when I tried to do the reallocation it failed and I was told I would get a letter. On my BCP I immediately tried again (leaving $1k) and it worked.