- myFICO® Forums

- Types of Credit

- Credit Cards

- Another Amex Upgrade Offer (Everyday to EDP)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Another Amex Upgrade Offer (Everyday to EDP)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Another Amex Upgrade Offer (Everyday to EDP)

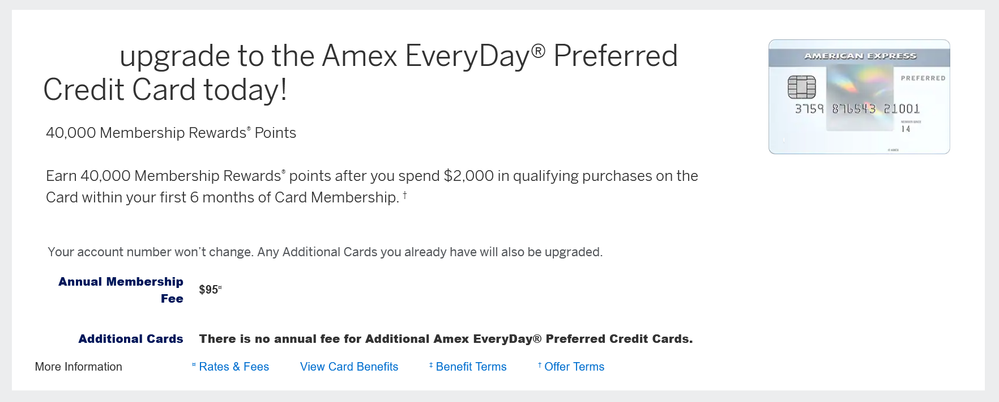

I just downgraded my EDP to an ED back in February, and now here they offering a bonus to go back to the EDP:

It's not a bad offer - I actually accepted a 25k MR offer nearly exactly two years ago - but I'm just not sure if it's worth the hassle. After a prorated fee for 2022 plus the fee for 2023 (can't upset the RAT) and opportunity cost the actual 'effective' bonus wouldn't be all that much.

Keeping in mind that I also have the Gold there's not much use for an EDP outside of the bonus... speaking of which, I took them up on an upgrade from Green to Gold just last summer. I have no plans to immediately downgrade the gold (again, gotta keep the RAT happy) so I'm not too worried about their 'gaming' clause, but it just seems like I'm spinning my wheels.

Short of them offering me the 'mother of all retention offers' (not likely) I'll be closing my Schwab Platinum in July, and I suspect once that happens all my upgrade offers will come to a halt. This sorta makes me wish I still had my Blue Cash Preferred card, or had downgraded it rather than closing it... that one would be much easier to make a case for keeping.

Really just sharing a data point here... hopefully someone will find it useful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

I accepted this same offer last year and recently paid the 2nd annual fee to stay clear of RAT. I will downgrade next year. I don't regret going through this process. It's not a huge bonus after paying the two annual fees, but it's still worth over $200 and it didn't cost me an inquiry or a new account.

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

@UncleB wrote:I just downgraded my EDP to an ED back in February, and now here they offering a bonus to go back to the EDP:

It's not a bad offer - I actually accepted a 25k MR offer nearly exactly two years ago - but I'm just not sure if it's worth the hassle. After a prorated fee for 2022 plus the fee for 2023 (can't upset the RAT) and opportunity cost the actual 'effective' bonus wouldn't be all that much.

Keeping in mind that I also have the Gold there's not much use for an EDP outside of the bonus... speaking of which, I took them up on an upgrade from Green to Gold just last summer. I have no plans to immediately downgrade the gold (again, gotta keep the RAT happy) so I'm not too worried about their 'gaming' clause, but it just seems like I'm spinning my wheels.

Short of them offering me the 'mother of all retention offers' (not likely) I'll be closing my Schwab Platinum in July, and I suspect once that happens all my upgrade offers will come to a halt. This sorta makes me wish I still had my Blue Cash Preferred card, or had downgraded it rather than closing it... that one would be much easier to make a case for keeping.

Really just sharing a data point here... hopefully someone will find it useful.

That's strong compared to the new customer offer of 15k mr points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

Thank you for the info!

Just curious, was there any other reason for the EDP ---> ED, other than the AF?

"When prosperity comes, do not use all of it"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

I took the same 40k/$2k offer a few months ago.

I redeem for travel, but even with Schwab 1.1 cpp cash redemptions:

40k SUB + 2k (or more) points earned = 42k+ MRs

42k * 1.1 cpp = $462 at Schwab

Less $80 of opportunity cost ($2k at 4% cash back)

Less maybe $120 of annual fees (I've downgraded midway through year 2...but after 12 full months...without clawbacks)

That's still $262 or so net. Not bad for an existing account.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

@SDMarik wrote:Thank you for the info!

Just curious, was there any other reason for the EDP ---> ED, other than the AF?

I can only answer for myself. The $95 annual fee isn't worthwhile for me. I am AU on spouse's "old" Blue Cash card, so all our grocery/gas/drugstore spend goes on that card. I don't really have a reason to use Everyday or Everyday Preferred these days except for FICO scoring purposes (age and credit limit).

FICO8:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 36 yrs | AoYRA: 12 mos | New Accounts: 0/6, 0/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

As a general comment, it seems to me that these up & down moves between like accounts would be something Amex would frown upon. Yet, here they are. How long did they let the MS go on before they stopped it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

@W261w261 wrote:As a general comment, it seems to me that these up & down moves between like accounts would be something Amex would frown upon. Yet, here they are. How long did they let the MS go on before they stopped it?

@W261w261, so far no issues on my end. They can always decline any upgrade and/or SUB (as per their T&C) if it's programmed within the RAT periodic reviews or audits. I have duplicates (i.e. BCE/BCP, ED/EDP, Delta + HHonors flavors, etc -- not including the charge cards). However, my strategy may not be the same as others and the up/down movements have posed no issues in the past 5+ years on some of these particular cards. IME, they're no only used for the incentive/SUB since I have plenty of organic + periodic spend (no MS) to pass through all of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

@SDMarik wrote:Thank you for the info!

Just curious, was there any other reason for the EDP ---> ED, other than the AF?

Yeah, with the Gold the EDP was redundant.

It started out life as an ED, and if not for the upgrade offers it would have never been changed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Another Amex Upgrade Offer (Everyday to EDP)

@wasCB14 wrote:I took the same 40k/$2k offer a few months ago.

I redeem for travel, but even with Schwab 1.1 cpp cash redemptions:

40k SUB + 2k (or more) points earned = 42k+ MRs

42k * 1.1 cpp = $462 at Schwab

Less $80 of opportunity cost ($2k at 4% cash back)

Less maybe $120 of annual fees (I've downgraded midway through year 2...but after 12 full months...without clawbacks)

That's still $262 or so net. Not bad for an existing account.

The math is almost exactly the same for me, only the opportunity cost would be 5% rather than 4% and my first-year prorate would be a little more (nine months)... my back-of-the-envelope math indicates I'd net around $135. Still not bad for an existing account.

I also have a Schwab Plat I could use to cash-out if I move quickly... the Schwab will be gone by late July/August. Ironically my offer allows for six months, so if I didn't have cashing-out in mind I could take my time with non-category spend, but of course then I'd be "stuck" with MRs, which aren't that useful to me.

I guess I need to think about it a bit more.

(To those wondering, I got the ED years ago as a way to play around with MRs and take advantage of the Amazon specials. Turns out I'm not a great fit for the program, yet I found myself accumulating more and more MRs anyway, thus the Schwab.)