- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Aren't all cards the same?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Aren't all cards the same?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

@driftless wrote:

@Themanwhocan wrote:

@Anonymous wrote:

@Anonymous wrote:

Hello. Not sure if this should be posted here or in the rebuild forum. Feel free to move.

And apologies if this is a dumb question...

I see a lot of people talking about the best cards to have while you rebuild your credit, but I don't know what this means. What are y'all looking at when you're looking to apply? Is it just about rewards?

I have a capital one platinum. Should I try for something else? I usually just go for the pretty cards...j/kCards are not all the same. For people rebuilding they want cards that are unsecured and have low or no fees. Rebuilders are also looking for cards that offer higher credit lines than their scores and past blemishes would normally allow them. Rewards are a nice cherry on top for rebuilders but it is mostly about getting cards with higher limits and that can grow with them. The reasons for wanting a higher limit are: 1) it is generally accepted that higher limits begit higher limits-meaning during and after the rebuild, banks may offer higher limits once they have seen that the applicant already had a higher limit and 2) for an optimal credit score, one does not want to have high balances in relation to their credit lines. Generally you shouldn't be over 30% utilization on any one or all cards at any time. For those that need to revolve balances, this can be troublesome when they do not have a lot of available credit. So, rebuilders here like to pad their available credit by going for cards known to give out higher limits.

I will let others guide you about which cards to go for next (it also depends on which creditors you may have burned in your bankruptcy). There are some great resources on the Rebuilding Your Credit section here. I would encourage you to post your question there as well as read through some of the sticky (posts at the very top of the page with a light blue-green highlight over them) for some great tips.

http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/bd-p/rebuildingcredit

Ideally you also want cards that you can request a credit limit increase with only a soft pull on your credit. And you eventually want high credit limits since one of the FICO reasons why your credit score is not higher, is "There are not enough premium bankcard accounts on your credit report", which in 1998 refered to bank cards with $10,000+ credit limit. We don't know how many is "enough", and we don't know if $10,000 is still the standard, since that was 19 years ago and the "premium" credit limit may be higher these days.

Ideally for most people, you want at least 3 credit cards eventually, you want all of them to report 0 usage except one that reports only a small amount of that cards limit (ideally just a few dollars), as this will maximize your FICO score from a utilization standpoint for most people. However, the higher your credit limits, the more you can use while still being considered to be using only a small amount of your card's limit.

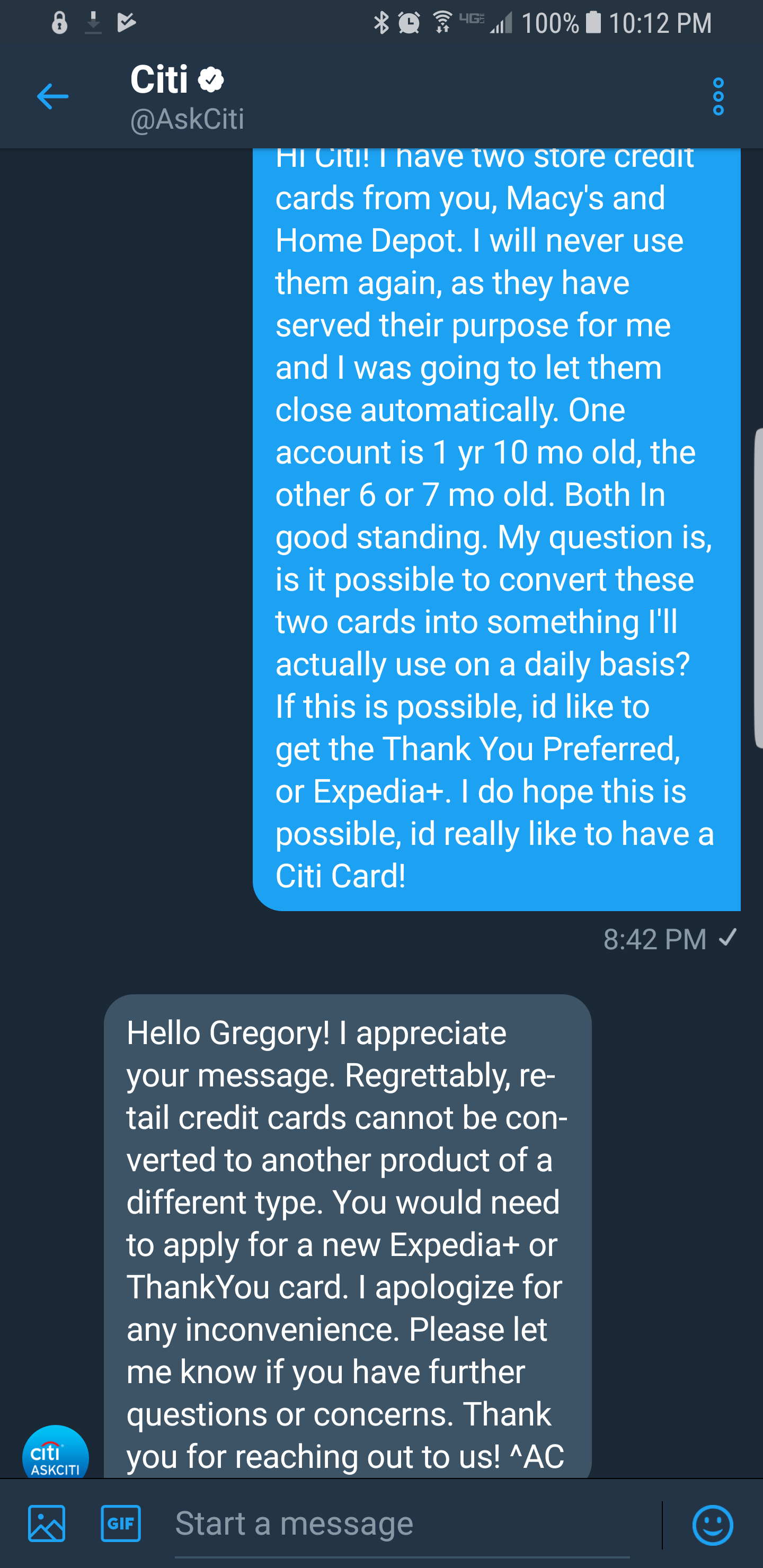

Other possible considerations might be 1) is this a card that you can keep for a long, long time? its best to keep your oldest cards, so that can be a concern [your oldest card is from Radio Shack? what were you thinking... NO, I don't want to hear about the Radio Shack battery of the month club]. 2) if not, then does that credit issuer have other good cards that you probably can't qualify for now, but that you might be able to Product Change your original cards to make them something you can keep open for the long haul, etc.

I believe that the current FICO standard is $50K TCL is now required for the highest score.

driftless, can you offer the link or the resource that taught you this? I am very interested to learn this. And just to clarify- you meant 50k total credit limit per card or 50k total credit limit accross different cards to achieve highest score?

@Anonymous wrote:Thank you. Great advice. I will keep this saved for when I'm ready for a big girl card. And how does one Product Change their card? Apply and balance transfer or just call and request it? Is this a HP?

If you just hang around here every couple days each week for years, you will learn a lot! That's how I learned as well.

Product change is different for different credit card companies, some will require a HP but some will not. If you specify your question a little bit, it will be easier to answer... This is because each credit card company has different rule on product change...

Easiest way to product change is to call the number on the back of your card and ask them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

For a product change, just call up the credit card issuer and ask. The Cap One Platinum is a solid starter card. It was my first card when I was rebuilding my credit and I still have it. Other cards for you to think about that do have decent rewards would be Cap One Quicksilver, Cap One Venture One (not to be confused with Cap One Venture), Barclays Rewards and Barclays Arrival (not to be confused with the Arrival+). I recommend these cards because there are no annual fees, they offer meaningful benefits and they are easier to get than many of the top-tier rewards cards. Those are also the cards I used during my rebuild, which has been quite successful. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

Yes, I am not sure where I saw that but I will look for it. I have a new 3B report due tomorrow maybe it was there.

Amex Blue Business Plus

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

Huh? Chase *was* my first. =/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

@Anonymous wrote:Huh? Chase *was* my first. =/

We've seen it happen, but it's unusual. Chase generally likes to see some history before approving a credit card account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

@Anonymous wrote:Thank you. Great advice. I will keep this saved for when I'm ready for a big girl card. And how does one Product Change their card? Apply and balance transfer or just call and request it? Is this a HP?

PCing that platinum will most likely be a breeze! They almost always have an offer for a QS (or QS1 if you have one with an AF). Just call or use their online chat and ask if they have any offers on your card. The terms generally stay exactly the same as your current card, but you now earn rewards. My DH was able to PC his even after he let it go 2 months late (bad DH!!!) and couldn't get a CLI for a year.

Is that your only card currently?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

Capital One - $4500

Synchrony/CareCredit - $2500

Barclay - $1500

Then I signed up for 3B and learned about credit mix and scoring, realized I had no revolving credit or utilization, so then I went on an app spree:

Denied by Wells Fargo.

Approved for Capital One $1000 CL, $3,500 less than the one I closed a month ago.

Signed on as AU on DH's Synchrony/Walmart, CL $1,800 (84% util).

Approved for VS ($250) and JCrew ($250).

Denied by Amazon.

May be another denial in there.

Then I learned about prequalifying tools. Smh.

Now I'm trying to come up with a plan and reading about how to choose the best credit cards for my needs and how/when to apply again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aren't all cards the same?

I looked at your card mix and that Walmart card with 84% UTL ...ouch. I honestly believe you should not AU to a high UTL card. You guys will need to do what you can to bring that down to 30% or below.

Also its probably time to garden, with the inquiries you now have and also the denials.

If you have a current BK, you also have to realize that there are some banks that are sensitive to it. I've been there so can only tell you to sit tight and make your payments on time, you need to let these accounts age some. Once the BK comes off, you will see a pretty significant bounce if you've done all the right things prior to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content