- myFICO® Forums

- Types of Credit

- Credit Cards

- BABY BOY'S NEXT CREDIT STEPS

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BABY BOY'S NEXT CREDIT STEPS

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BABY BOY'S NEXT CREDIT STEPS

Happy Sunday,

My youngest son, is a Freshman in college. I had him app for the Discover Card and he was approved with a $500.00 SL. The card arrived, I put the Netflix subscription on it, put it on autopay to my CK account and promptly SDd it for 6 mos.

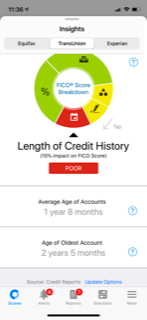

He also has a small Pell Grant loan, and this is his new FICO score from Discover.

I just opened NFCU CK+SV accounts for him to establish a relationship and I have the debit card for it, into which I will now begin to deposit funds monthly, that will also remain untouched.

a) Do we just keep him in the Garden for the remainder of this first year and then apply for a NAVY CC at 13 mos?

b) Are there any other suggested next milestones and targets for him, now or in 3, 6, 9 mos ?

Always appreciative of your collective thoughts...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

Don't see the FICO score.

Make sure he makes his payments on time. Allow the accounts to age.

If he's been earning a salary for a year, he could certainly apply for another card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

Sorry @donkort,

I thought it was in the picture, 714 is his FICO.

He has work study and he will also have a summer job, but I don't want either of us to get over extended, since I pay for everything that his Financial Aid doesn't cover.

I wanted him to have a solid credit foundation, understand how credit works and hopefully have a few decent CCs by his Junior year, when he can study abroad for a semester or get an internship in another city.

Long game, IMHO, when he graduates, he will also have decent CRA scores to buy or lease his first car or apartment without starting from scratch or needing a co-signor.

I just wasn't sure if 6 Mos. was enough or he needed the whole year under his belt before next steps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

When you say study abroad, do you mean overseas or elsewhere in the states? If he is going overseas, you need to focus on cards that offer no FTF.

I'm not a NFCU member but according to all the reading I see on here, that's a good one to start him with, as the 2nd card evidently offers excellent CL's. Another thought may be to get him in the door with AMEX, as well. The 3xCLI is a giant boost to anyone's credit portfolio. I'm actually about to add my first AMEX for exactly that reason.

Wish my mom had been this proactive with my credit while I was in school. No telling where my credit would be by now. Good for you.....I hope they appreciate your effort down the road!

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

I'd have him to go ahead and grab two or three tradelines now.

Then he can garden for a couple of years.

Or if you have a CC that reports AUs with long perfect history. Add him, and then after it reports, have him grab his own.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

There are "student cards."

But I would assess how he spends his money before getting one.

Students, even smart students, screw up all the time, maxing their cards, hoping the parents help them out of that jam....or they just ignore the cards so they go to collections or are charged off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

Thanks @Gmood1,

I have been reading the forums and trying to have my kids benefit as well. Mapping out a "plan" for which cards, when, is certainly more strategic. We will work on it so that his can grow together.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

Peer pressure is a bitch. They'll see other students using their cards, looking all hip and smart. They want to appear hip and smart, too.

This, and (for example) spring break temptations, leads to lots of card usage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BABY BOY'S NEXT CREDIT STEPS

@donkort, THAT is exactly what I do NOT want to happen. I am trying to have him learn about budgeting and managing his credit first, BEFORE he jumps off a cliff with a bunch of credit and no way to pay it back and I am left holding the bag. He has been fine with the new CC being SDd here at home with me, as he can see that his score went from non-existent to above 700 in 6 mos. Much like a GPA, everyone starts out with a 4.0 and he knows it doesn't take much to tank it.

I think I am going to give him a preset "money" card through TD this summer and see how he does. If he is approved for a higher limit card, then I will let him take the lower $500.00 Discover back to school with him in the Fall.

He does pretty well now with his allowance, so I am cautiously optimistic, the third time is the charm ![]() , he is the baby afterall.

, he is the baby afterall.